|

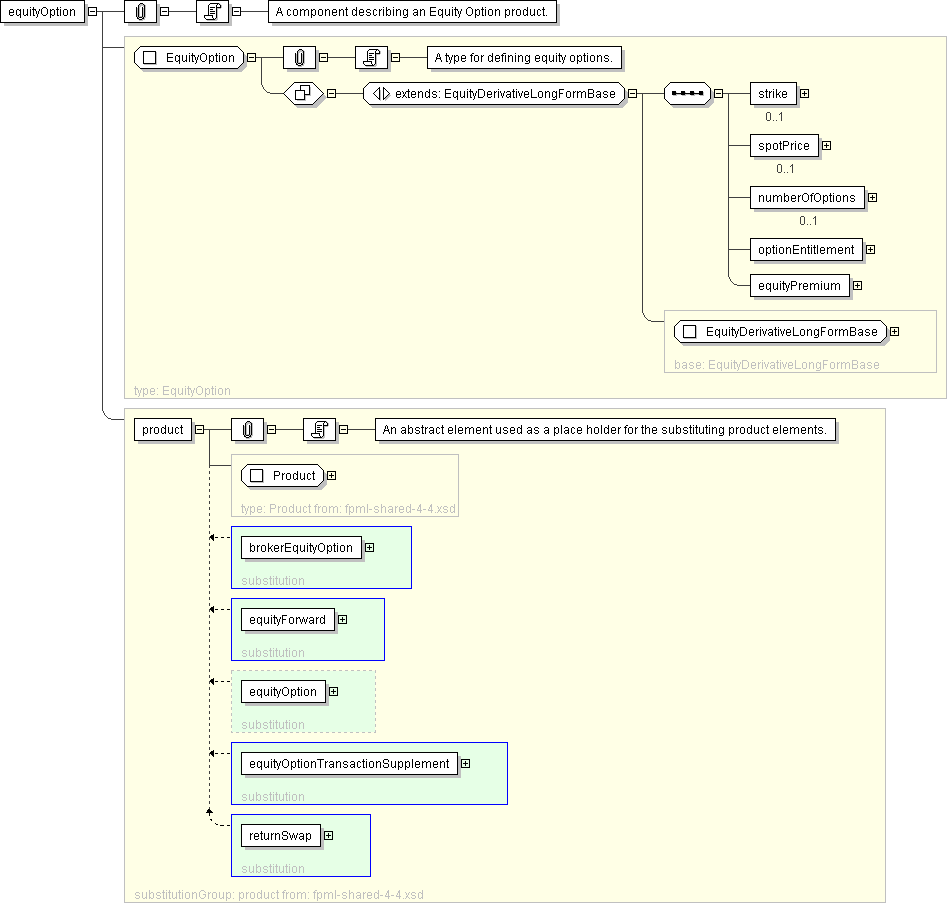

| Name | equityOption |

|---|---|

| Type | EquityOption |

| Nillable | no |

| Abstract | no |

| Documentation | A component describing an Equity Option product. |

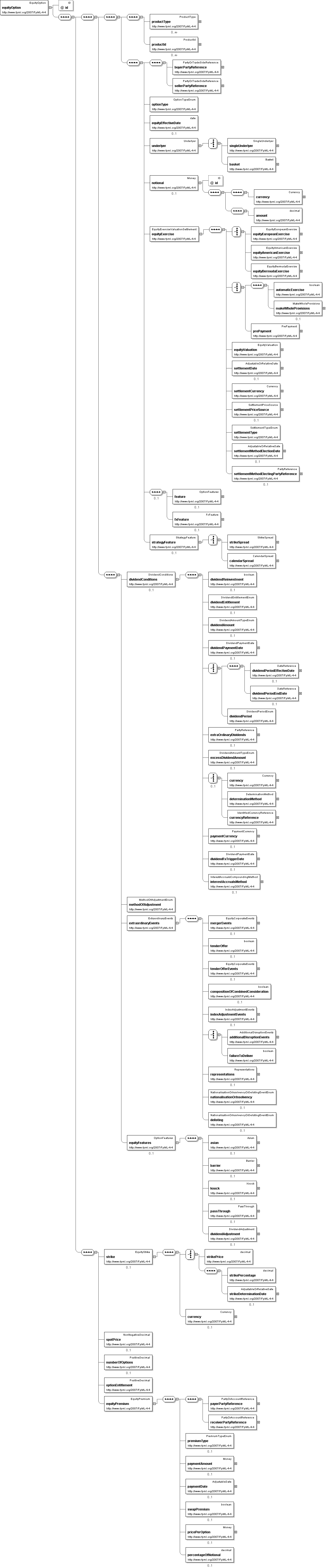

'A classification of the type of product. FpML defines a simple product categorization using a coding scheme.'

'A product reference identifier allocated by a party. FpML does not define the domain values associated with this element. Note that the domain values for this element are not strictly an enumerated list.'

'A reference to the party that buys this instrument, ie. pays for this instrument and receives the rights defined by it. See 2000 ISDA definitions Article 11.1 (b). In the case of FRAs this the fixed rate payer.'

'A reference to the party that sells (\"writes\") this instrument, i.e. that grants the rights defined by this instrument and in return receives a payment for it. See 2000 ISDA definitions Article 11.1 (a). In the case of FRAs this is the floating rate payer.'

'Effective date for a forward starting option'

'Specifies the underlying component, which can be either one or many and consists in either equity, index or convertible bond component, or a combination of these.'

'The parameters for defining how the equity option can be exercised, how it is valued and how it is settled.'

'A equity option simple strategy feature'

'Defines how adjustments will be made to the contract should one or more of the extraordinary events occur.'

'Where the underlying is shares, specifies events affecting the issuer of those shares that may require the terms of the transaction to be adjusted.'

'DEPRECATED This element will be removed in the next FpML major version. Use the \"feature\" element for option features such as asian, barrier, knock.'

'Defines whether it is a price or level at which the option has been, or will be, struck.'

'The price per share, index or basket observed on the trade or effective date.'

'The number of options comprised in the option transaction.'

'The number of shares per option comprised in the option transaction.'

'The equity option premium payable by the buyer to the seller.'