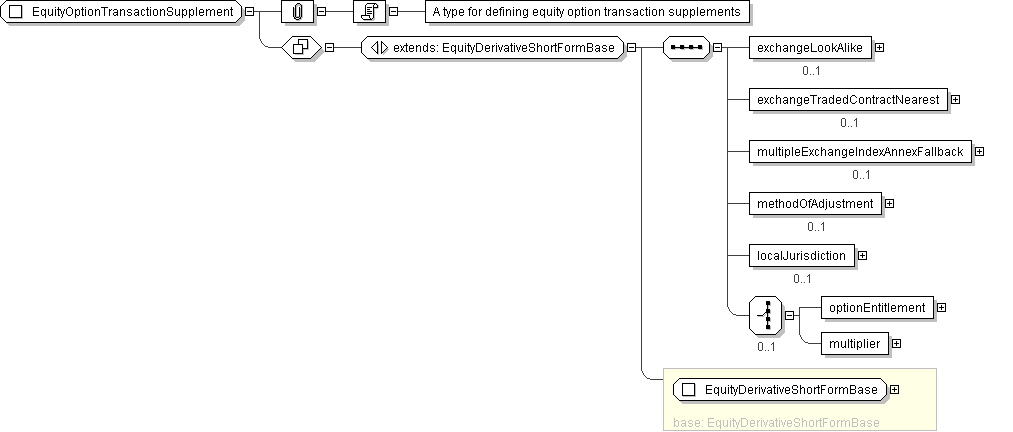

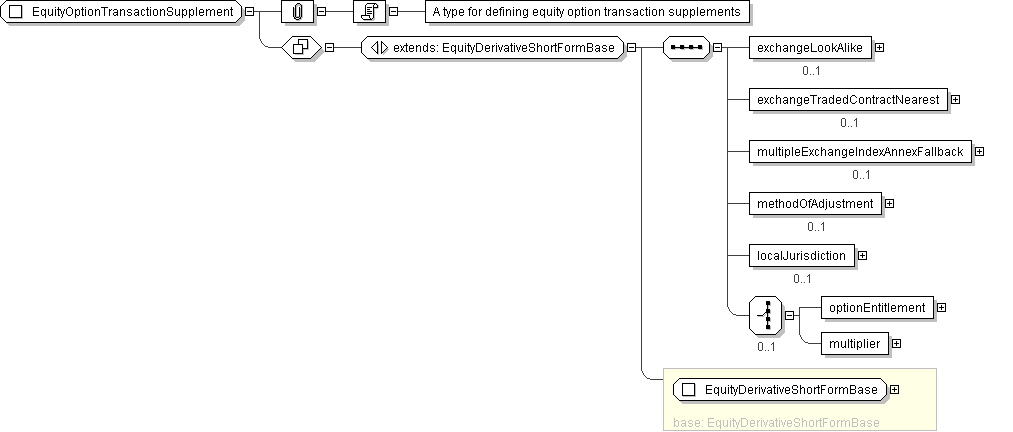

| Super-types: | Product < EquityDerivativeBase (by extension) < EquityDerivativeShortFormBase (by extension) < EquityOptionTransactionSupplement (by extension) |

|---|---|

| Sub-types: | None |

| Name | EquityOptionTransactionSupplement |

|---|---|

| Used by (from the same schema document) | Element equityOptionTransactionSupplement |

| Abstract | no |

| Documentation | A type for defining equity option transaction supplements |

'A classification of the type of product. FpML defines a simple product categorization using a coding scheme.'

'A product reference identifier allocated by a party. FpML does not define the domain values associated with this element. Note that the domain values for this element are not strictly an enumerated list.'

'A reference to the party that buys this instrument, ie. pays for this instrument and receives the rights defined by it. See 2000 ISDA definitions Article 11.1 (b). In the case of FRAs this the fixed rate payer.'

'A reference to the party that sells (\"writes\") this instrument, i.e. that grants the rights defined by this instrument and in return receives a payment for it. See 2000 ISDA definitions Article 11.1 (a). In the case of FRAs this is the floating rate payer.'

'Effective date for a forward starting option'

'Specifies the underlying component, which can be either one or many and consists in either equity, index or convertible bond component, or a combination of these.'

'The parameters for defining how the equity option can be exercised, how it is valued and how it is settled.'

'A equity option simple strategy feature'

'For a share option transaction, a flag used to indicate whether the transaction is to be treated as an \'exchange look-alike\'. This designation has significance for how share adjustments (arising from corporate actions) will be determined for the transaction. For an \'exchange look-alike\' transaction the relevant share adjustments will follow that for a corresponding designated contract listed on the related exchange (referred to as Options Exchange Adjustment (ISDA defined term), otherwise the share adjustments will be determined by the calculation agent (referred to as Calculation Agent Adjustment (ISDA defined term)).'

'For an index option transaction, a flag used in conjuction with Futures Price Valuation (ISDA defined term) to indicate whether the Nearest Index Contract provision is applicable. The Nearest Index Contract provision is a rule for determining the Exchange-traded Contract (ISDA defined term) without having to explicitly state the actual contract, delivery month and exchange on which it is traded.'

'For an index option transaction, a flag to indicate whether a relevant Multiple Exchange Index Annex is applicable to the transaction. This annex defines additional provisions which are applicable where an index is comprised of component securities that are traded on multiple exchanges.'

'Local Jurisdiction is a term used in the AEJ Master Confirmation, which is used to determine local taxes, which shall mean taxes, duties, and similar charges imposed by the taxing authority of the Local Jurisdiction If this element is not present Local Jurisdiction is Not Applicable.'

'The number of shares per option comprised in the option transaction supplement.'

'Specifies the contract multiplier that can be associated with an index option.'