Namespace: |

|

Content: |

|

Defined: |

globally in fpml-option-shared-5-3.xsd; see XML source |

Includes: |

|

Used: |

at 3 locations |

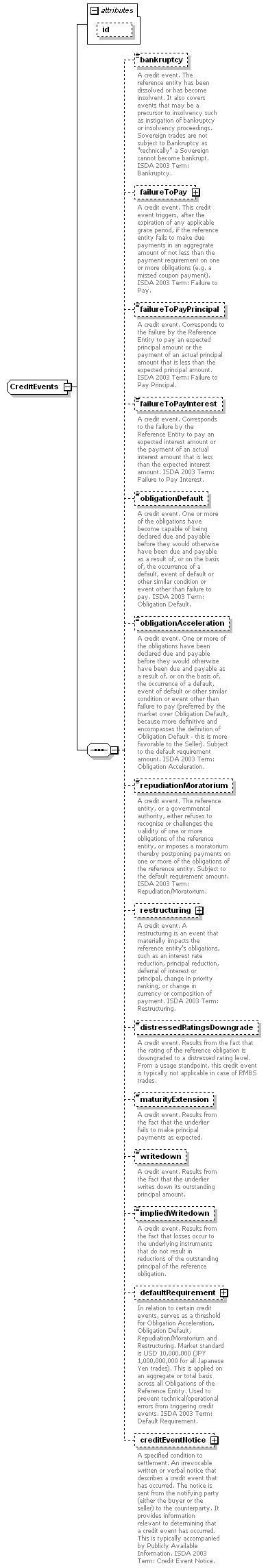

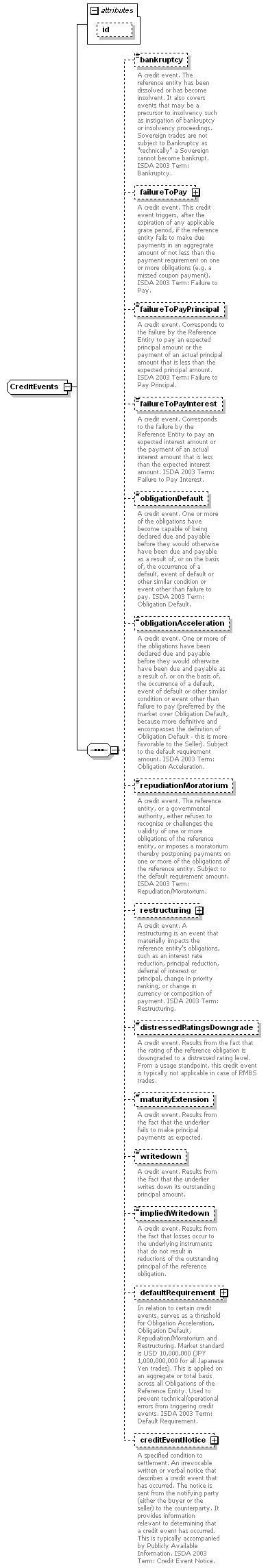

XML Representation Summary |

||||||

| <... | ||||||

|

||||||

| > | ||||||

| </...> | ||||||

| <xsd:complexType name="CreditEvents"> <xsd:sequence> </xsd:sequence> </xsd:complexType> |

Type: |

xsd:ID, predefined |

Use: |

optional |

| <xsd:attribute name="id" type="xsd:ID" use="optional"/> |

Type: |

xsd:boolean, predefined, simple content |

| <xsd:element minOccurs="0" name="bankruptcy" type="xsd:boolean"/> |

Type: |

CreditEventNotice, complex content |

| <xsd:element minOccurs="0" name="creditEventNotice" type="CreditEventNotice"/> |

Type: |

Money, complex content |

| <xsd:element minOccurs="0" name="defaultRequirement" type="Money"/> |

Type: |

xsd:boolean, predefined, simple content |

| <xsd:element minOccurs="0" name="distressedRatingsDowngrade" type="xsd:boolean"/> |

Type: |

FailureToPay, complex content |

| <xsd:element minOccurs="0" name="failureToPay" type="FailureToPay"/> |

Type: |

xsd:boolean, predefined, simple content |

| <xsd:element minOccurs="0" name="failureToPayInterest" type="xsd:boolean"/> |

Type: |

xsd:boolean, predefined, simple content |

| <xsd:element minOccurs="0" name="failureToPayPrincipal" type="xsd:boolean"/> |

Type: |

xsd:boolean, predefined, simple content |

| <xsd:element minOccurs="0" name="impliedWritedown" type="xsd:boolean"/> |

Type: |

xsd:boolean, predefined, simple content |

| <xsd:element minOccurs="0" name="maturityExtension" type="xsd:boolean"/> |

Type: |

xsd:boolean, predefined, simple content |

| <xsd:element minOccurs="0" name="obligationAcceleration" type="xsd:boolean"/> |

Type: |

xsd:boolean, predefined, simple content |

| <xsd:element minOccurs="0" name="obligationDefault" type="xsd:boolean"/> |

Type: |

xsd:boolean, predefined, simple content |

| <xsd:element minOccurs="0" name="repudiationMoratorium" type="xsd:boolean"/> |

Type: |

Restructuring, complex content |

| <xsd:element minOccurs="0" name="restructuring" type="Restructuring"/> |

Type: |

xsd:boolean, predefined, simple content |

| <xsd:element minOccurs="0" name="writedown" type="xsd:boolean"/> |

| XML schema documentation generated with DocFlex/XML 1.8.6b2 using DocFlex/XML XSDDoc 2.5.1 template set. All content model diagrams generated by Altova XMLSpy via DocFlex/XML XMLSpy Integration. |