FpML Financial product Markup Language

Last Call Working Draft 14 Oct 2003

Version:

4.0

This version:

http://www.fpml.org/spec/2003/lcwd-fpml-4-0-2003-10-14

Copyright 1999 - 2003. All rights reserved.

Financial Products Markup Language is subject to the FpML Public License.

A copy of this license is available at http://www.fpml.org/documents/license

The FpML specifications provided are without warranty of any kind, either expressed or implied, including, without limitation, warranties that FpML, or the FpML specifications are free of defects, merchantable, fit for a particular purpose or non-infringing. The entire risk as to the quality and performance of the specifications is with you. Should any of the FpML specifications prove defective in any respect, you assume the cost of any necessary servicing or repair. Under no circumstances and under no legal theory, whether tort (including negligence), contract, or otherwise, shall ISDA, any of its members, or any distributor of documents or software containing any of the FpML specifications, or any supplier of any of such parties, be liable to you or any other person for any indirect, special, incidental, or consequential damages of any character including, without limitation, damages for loss of goodwill, work stoppage, computer failure or malfunction, or any and all other commercial damages or losses, even if such party shall have been informed of the possibility of such damages.

This is the FpML 4.0 Last Call Working Draft for review by the public and by FpML members and working groups. It is a draft document and may be updated, replaced or obsoleted by other documents at any time. It is inappropriate to use FpML Working Drafts as reference material or to cite them as other than "work in progress". This is work in progress and does not imply endorsement by ISDA.

The FpML Working Groups encourage reviewing organizations to provide feedback as early as possible. Comments on this document should be sent by filling in the form at the following link: http://www.fpml.org/issues. An archive of the comments is available at http://www.fpml.org/issues/archive.asp

Public discussion of FpML takes place on the FpML Discussion List: discuss@fpml.org which you can join at the following link:

http://www.fpml.org/mailing-lists/join-discuss.asp

There are also asset class-specific mailing lists; you can join them at the following link:

http://www.fpml.org/mailing-lists/join-discuss.asp

A list of current FpML Recommendations and other technical documents can be found at

http://www.fpml.org/spec

While implementation experience reports are welcomed, the FpML Standards Committee will not allow early implementation to constrain its ability to make changes to this specification prior to final release.

This document has been produced as part of the FpML 4.0 activity and is part of the Standards Approval Process.

The FpML documentation is organized into a number of subsections.

This document, "FpML-4-0-intro", provides overviews of the specification.

These are automatically generated reference documents detailing the contents of the various sections in the FpML schema.

- Examples - Provides sample FpML for each section.

- Scheme Definitions - Describes standard FpML schemes, and the values that they can take.

The Financial Products Markup Language (FpML) is a protocol enabling e-commerce activities in the field of financial derivatives. The development of the standard, controlled by ISDA (the International Swaps and Derivatives Association), will ultimately allow the electronic integration of a range of services, from electronic trading and confirmations to portfolio specification for risk analysis. All types of over-the-counter (OTC) derivatives will, over time, be incorporated into the standard. FpML 4.0 covers FX and Interest Rate, Equity, and Credit Derivatives.

FpML is an application of XML, an internet standard language for describing data shared between computer applications.

In WD#2 we changed the schema to make most element definitions local to a global type, rather than global. This was done to minimize cross-asset class name clashes. We received some feedback from implementers that they had been using global elements to define client-specific products, and thus that they did not agree with the change. The FpML Coordination Committee is currently investigating alternatives for achieving the goals of the change while meeting the needs of firms to customize products based on FpML. The FpML Standards Committee invites more comment on this topic.

The FpML Coordination committee has been considering some proposed extensions to the FpML trade header. These proposals include items such as trader and source system identification, status reporting, textual descriptions, etc. Some of these extensions may be incorporated in the FpML 4.0 Trial Recommendation as optional elements. The FpML Standards Committee invites comments on what extensions if any to the trade header should be supported by FpML.

In WD#2 we changed the schema to eliminate scheme default attributes. This was done for several reasons, including schema maintenance and document processing. We received some feedback from implementers that they had were using non-standard scheme defaults for frequently used elements and that this change would result in much larger and more difficult to read instance documents. The FpML Standards Committee invites more comment on this topic, particularly on the specific schemes that result in the greatest increase in document size/complexity. The FpML Coordination Committee is investigating alternatives for addressing this issue; some changes may be incorporated in to the Trial Recommendation or the upcoming Architecture guidelines to address this topic.

Following is a brief list of the changes to be found in this working draft compared to working draft #1.

- Many "schemes" have been replaced by enumerations, in cases where the domain was judged to be relatively stable. In addition, all scheme default attributes have been removed from the FpML root element. Schemes that have been converted to enumerations no longer require a scheme default. Other schemes are now defaulted, where possible, as default attribute values in the schema. This change was made to improve the maintainability and readability of the FpML root element, and to make it clearer when non-default schemes are used.

- Most global element definitions have been turned into local element definitions. This change was made to reduce cross-asset name clashes and improve flexibility going forward. It also had the side benefit of reducing the documentation size by approximately 400-500 pages. This change has significantly changed the schema files, but not changed the instance documents.

- There have been a few small changes to Credit Derivative definitions (e.g. addition of new scheme values) to address the ISDA 2003 credit derivatives supplement.

- Enhancements to IRD cashflows recently incorporated into versions 2.0 and 3.0 have also been included in version 4.0.

- There have been a few changes to message headers and reject messages to address recommendations by the Validation working group.

- Most diagrams have been redone to improve quality.

- Example files have been renamed for clarity and consistency

The following changes have been introduced in FpML 4.0 which are incompatible with FpML 3.0

FpML type definitions are now expressed using XML Schema. This replaces the document type reference (DOCTYPE directive) in each FpML document with new attributes for specifying namespaces and schema locations on the "FpML" root element. In addition the correct document content model must be selected by setting the type of the root element. The main body of the document is unaffected by the transition to XML schema.

With the conversion of many schemes to enumerations, we have chosen to eliminate all scheme defaults from the FpML root element and replace them in some cases with default attribute values in the schema. To convert instance documents from version 3.0, you will need to remove scheme default attributes from the root element. In cases where a scheme has been converted to an enumeration, it will no longer be possible to use a proprietary set of domain values.

dateRelativeTo now uses only the href attribute. This will affect instance documents and processors using this element. This change was made to eliminate redundancy, which will simplify maintenance of the schema, generation of FpML documents, and validation .

Intra-document references (using the "href" attribute) now no longer have a "#" prefix, due to the change to id/idref semantics from the xlink referencing style. This change is also planned to be made to FpML 3.0, but is incompatible with instance documents developed to date. To change instance documents to accommodate the change it will be necessary to remove the "#" prefix from href attribute values.

In FpML 3.0 an entry was added to the trade header to specify a calculation agent. With FpML 4.0 this has been rationalized with an entry in the trade element which specifies the calculation agent(s). Documents using the calculationAgentReference in the tradeHeader will need to be changed to use the calculationAgent element in the "trade" element.

The masterConfirmation element now appears before the contractualDefinitions element in the definition of the Documentation type. Furthermore, in FpML 4.0 the masterConfirmation element is no longer simply a date. In 4.0 it consists of a masterConfirmationType, masterConfirmationDate and an optional masterConfirmationAnnexDate.

All FpML 3.0 documents that contain a masterConfirmation element are incompatible with FpML 4.0. Do the following in order to upgrade your 3.0 documents to 4.0:

- If the document contains both a masterConfirmation and a contractualDefinitions element(s), reverse the order of these elements.

- Move the date value that appears in the masterConfirmation element to the element masterConfirmation.masterConfirmationDate.

- Add the element masterConfirmation.masterConfirmationType with the appropriate value.

Messages constructed using FpML 4.0 should make use of the new message framework to express the reason for the exchange of information, to identify the parties involved in the exchange and to describe the actual information itself.

A number of standard messages have been provided for trade affirmation and confirmation along with error reporting and trade status enquiry. FpML users can derive additional message types from the framework to meet specific messaging requirements currently outside FpML's scope.

To allow backwards compatibility with existing pre-FpML 4.0 documents a 'DataDocument' type has been provided which does not include message elements.

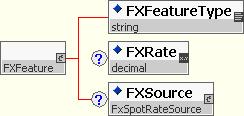

Because we rationalized some FX rate definition structures, there have been small changes (elements renamed or moved) in a few places, including FX linked notionals in IRD, and non-deliverable forwards and options in FX.

Following is a list of changes that are anticipated to be made by the time the document reaches Last Call Working Draft:

- A number of definitions that are used in several places in the document are likely to be moved to the "shared" subschema.

- In a number of places where the localization of global elements has created repeated definitions of the same basic type, we plan to create global types. Examples include intra-document references such as party references, invocations of schemes, etc.

- A number of global types are likely to be renamed to improve clarity of scope/purpose.

- We will attempt to rationalize/consolidate a number of definitions across asset classes.

- There have been several comments proposing localized enhancements, to areas including the tradeHeader and the party element, that are likely to be addressed.

The scope of FpML 4.0 includes all of the FpML 3.0 scope plus significantly broadened Equity Derivative product coverage, new Credit Derivative product coverage, and support for an FpML Messaging framework.

The various Working Groups have developed FpML 4.0 within an architecture framework updated from the FpML Architecture Version 1.0 framework defined by the Architecture Working Group. The original FpML 1.0 Architecture framework recommendations covered:

- XML tools for editing and parsing

- XML namespace usage within FpML

- FpML versioning methodology

- FpML content model - a new style for representing the FpML Document Type Definition (DTD)

- FpML referencing methodology, including guidelines for referencing coding schemes.

The principal changes from the original FpML 1.0 architecture framework include:

- Replacement of XML DTDs (Document Type Definitions) by XML Schemas, as described in a technical note published in 2002 by the FpML Architecture WG.

- Elimination of xlink-style referencing and its replacment with id/idref-style referencing (this change is also being adopted for FpML 3.0).

The Architecture Working Group intends to publish a new architecture framework incorporating the above changes, and some others, including, among other topics:

- Proprietary extensions to FpML

- Enhanced versioning support

- Digital signature support

This updated architecture framework is likely to be published as separate document during the working draft stage of FpML 4.0.

An FpML messaging working group has been formed to define a messaging framework and sample messages for selected business processes. FpML 4.0 Last Call Working Draft includes a preliminary version of this working group's output; it is expected to evolve somewhat in future drafts of FpML 4.0. Business processes currently addressed by this Working Group include:

- Trade Affirmation

- Trade Confirmation

To support these business processes, a number of messages have been defined. Please see the "Message Architecture" section for more informtion.

The Validation Working Group was set up to provide semantic, or business-level

validation rules for FpML 4.0. These validation rules, which are

aimed at normalizing the use of elements within FpML, are issued

separately from the main working draft document at a URL defined in the validation

section of this document.

The validation working group publishes with its releases:

- A set of rules described in English

- Positive and negative test case documents for each rule

- Non-normative reference implementations

The current working draft includes a set of rules for Interest Rate Derivatives. The working

group intends to continue its work to publish rules for shared component definitions,

additional rules for IRD, rules for credit derivatives and thereafter rules for the other

product types. It is expected that some of these rule sets will become available between

the publication of this draft and the Trial Recommendation.

In FpML 4.0 Last Call Working Draft the following FX products are covered:

- FX Spot

- FX Forward (including non-deliverable forwards, or NDFs)

- FX Swap

- FX Options (European and American; barriers, digitals, binaries, average rates; cash and physical settlement)

- Option Strategies (multiple simple options)

In addition, support for the following money market instrument is also provided:

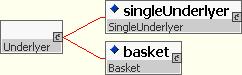

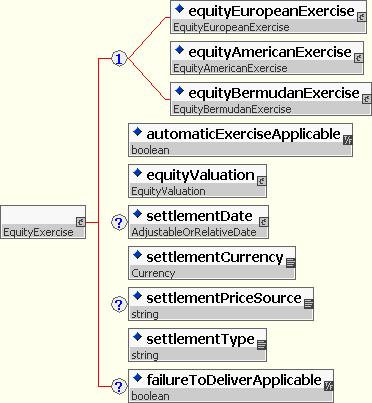

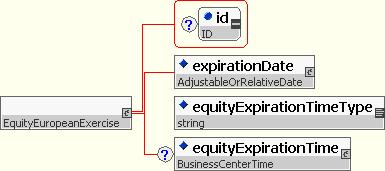

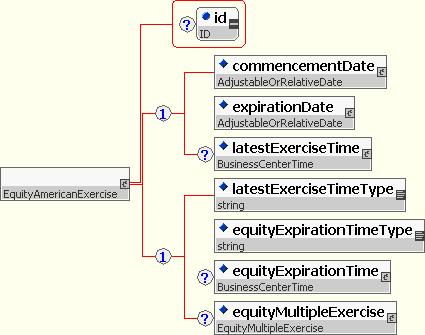

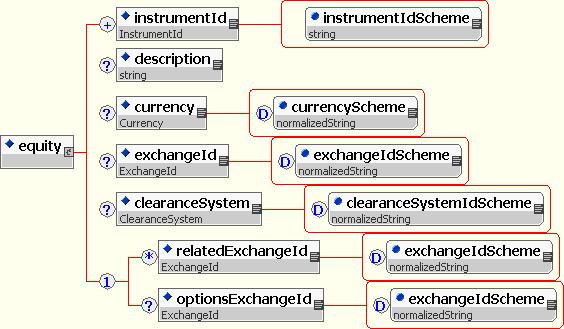

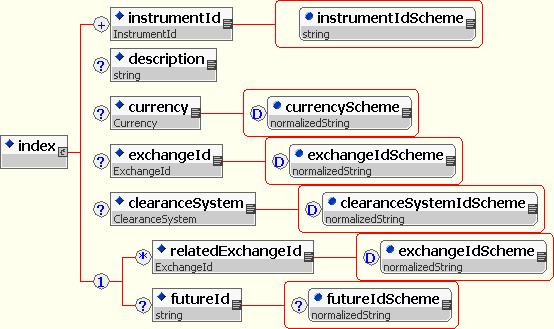

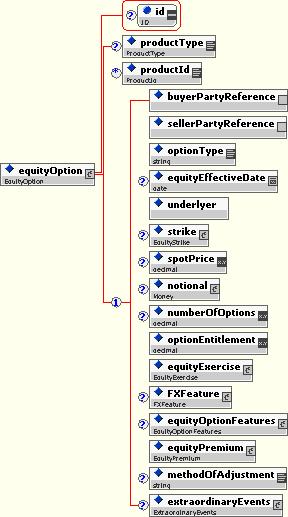

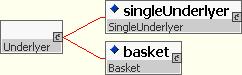

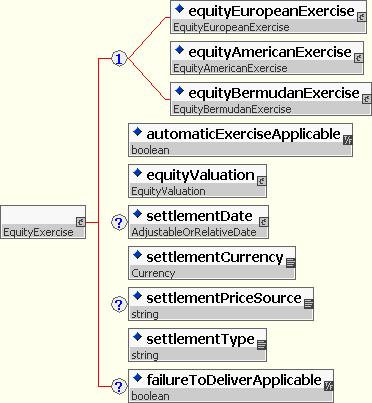

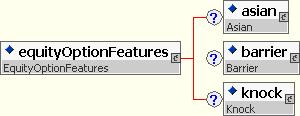

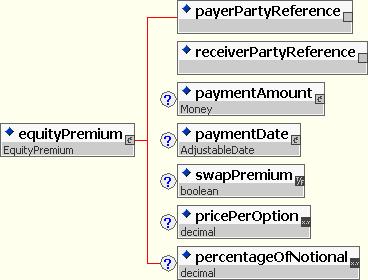

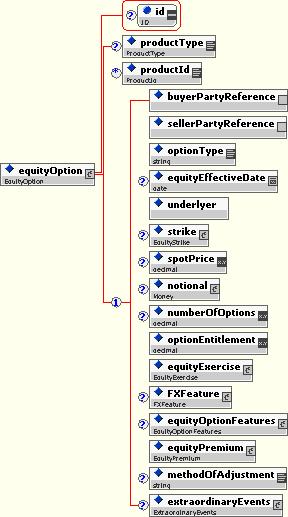

The EQD Products Working Group has extended the FpML 3.0 standard to cover the following Equity Derivative Products:

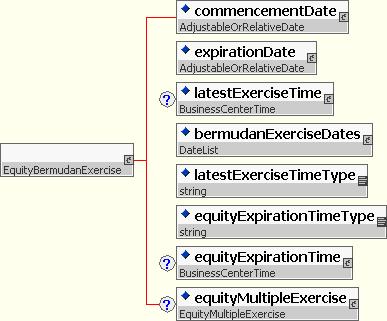

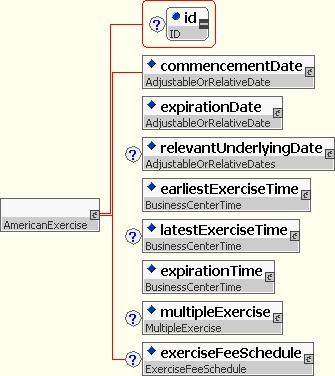

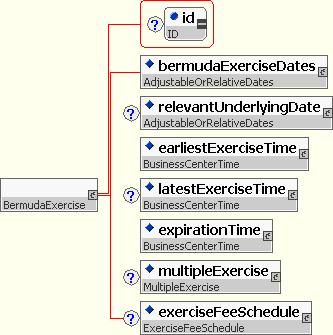

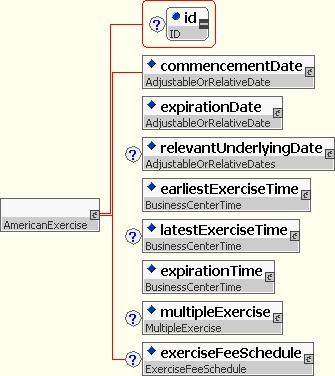

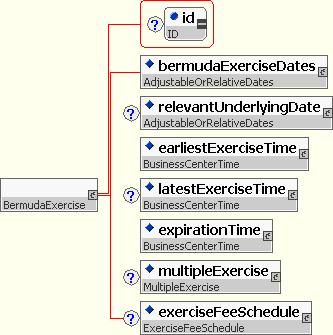

- Bermudan exercise style

- Basket underlyings

- Forward starts

- Cash or Physical Settlement

- Quantos and Composites

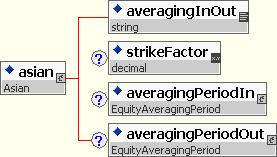

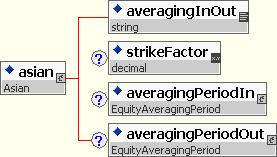

- Averaging

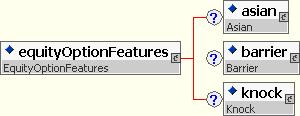

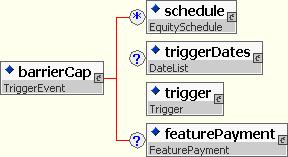

- Barriers, Knock-Ins, Knock-Outs and Binary (Digital) Options

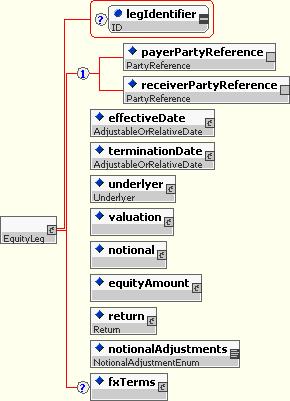

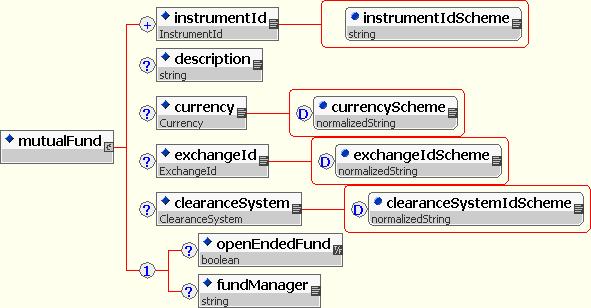

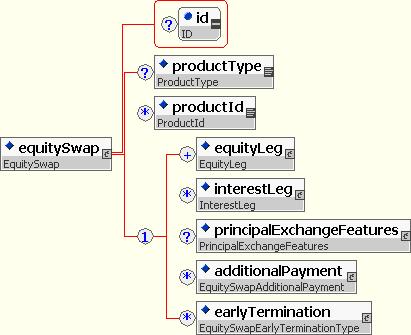

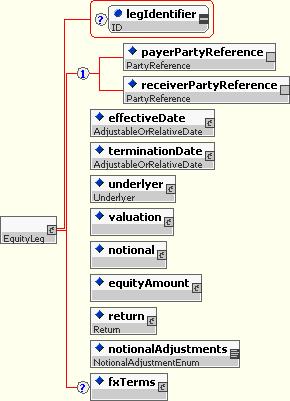

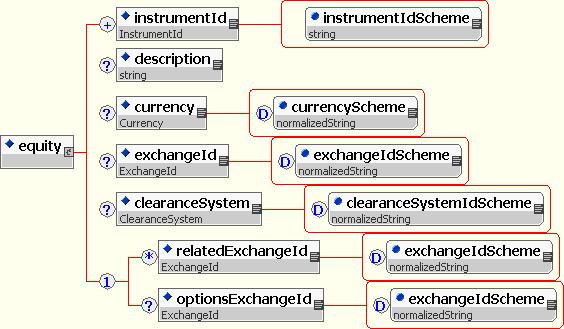

We have included support for various types of Equity Swaps, without any specific limitation. Those identified so far include:

- Single stock swaps as well as basket swaps

- Swaps that have an equity, index or a convertible bond underlyers, or a combination of these

- 2-legged swaps with a combination of an equity leg and a funding leg, as well as swaps that either have only one leg (e.g. fully funded swap) or multiple equity legs

- Swaps that have specific adjustment conditions, such as execution swaps or portfolio rebalancing swaps

- Zero-strike swaps, which do not have an interest rate component but rather involve the exchange of principal cashflows

The FpML representation of the equity swap is focused on representing the economic

description of the swap. The expectation is that the reference terms of the swap will

be defined either through the ISDA definitions or, when exceptions apply, through

master bilateral agreements that will be agreed between the parties to the trade

In order to support the above scope for both Equity Derivative and Equity Swap products we support operational features, such as contact information and governing documentation which are present in current documents defined by ISDA standards

In FpML 4.0 Last Call Working Draft no Energy Derivative products are covered. However, a working group is currently active in this area and is expected to provide support for the following products in the next version of FpML:

- Financial Gas swaps, caps/floors, and swaptions

- Financial Power swaps, caps/floors, and swaptions

- Financial Oil swaps, caps/floors, and swaptions

It is anticipated that support for physically-settled products will be incorporated in future versions of FpML.

Producers of FpML documents intended for interchange with other parties must encode such documents using either UTF-8 or UTF-16. Consumers of FpML documents must be able to process documents encoded using UTF-8, as well as documents encoded using UTF-16. For more information, see

http://www.w3.org/TR/REC-xml#charencoding

Unrestricted FpML elements may use any valid XML characters. For more information, see

http://www.w3.org/TR/REC-xml#charsets

Certain elements and attributes (such as scheme URIs) are defined with more restrictive types, such as xsd:normalizedString, xsd:token, or xsd:anyURI. For these types, please see the relevant data type definition in the XML Schema datatypes specification:

http://www.w3.org/TR/xmlschema-2/

FpML is designed based on a number of key principles and conventions. Some of these include:

- Use XML's structuring ability to create reusable building blocks.

- Follow naming and structuring conventions to create a more consistent XML appearance.

- Where possible, share definitions across products and asset classes.

- Minimize evolution in instance documents from version to version.

Although these basic principles have consistently been observed, over the lift of the specification there has been some evolution in the details, and as a result there have been some changes in the appearance of FpML. A number of these changes have been introduced to take advantage of the power created by XML schemes. The original version of the FpML Architecture is located at http://www.fpml.org/spec/2001/rec-fpml-1-0-2001-05-14/index.asp. The latest version of the FpML architecture principles is described in detail in the FpML Architecture 2.0 document, to be released shortly. That document discusses how to create and extend FpML definitions.

The remainder of this section is intended to describe how the architecture principles were applied in developing FpML, and how to use the resulting spec. Please see the end of this section for a fuller explanation of the motivation for the FpML design approach.

FpML is divided into several schema files, which organize the definitions into samller and more maintainable building blocks. These building blocks incude:

- fpml-main-4-0.xsd - root definitions, plus definitions related to trades.

- fpml-shared-4-0.xsd - shared definitions used widely throughout the specification. These include items such as base types, shared financial structures, etc.

- fpml-enum-4-0.xsd - shared enumeration definitions. These definitions list the values that enumerated types may take.

- fpml-msg-4-0.xsd - definitions related to messaging and workflow.

- fpml-ird-4-0.xsd - Interest rate derivative product definitions.

- fpml-fx-4-0.xsd - Foreign exchange product definitions.

- fpml-cd-4-0.xsd - Credit derivative product definitions.

- fpml-eqd-4-0.xsd - Equity derivative option product definitions.

- fpml-eqs-4-0.xsd - Equity derivative swap product definitions.

This organization may be refined in the future. In particular, it is possible that the trade-related definitions in fpml-main will be moved out to their own subschema in a future version of FpML, and it is likely that fpml-shared will be split into smaller pieces.

Before beginning to use FpML 4.0, an architect must answer several questions:

- How will the FpML be used? Is it primarily a messaging application, or primarily a data storage and retrieval application?

- If it is a messaging application, is there an existing workflow format that is used to coordinate interactions between the entities exchanging messages, or is a new one required?

- Will the FpML be used within a single institution, or across a number of institutions?

- What asset classes of products will be required?

- Will there need to be local data or product extensions?

- Are there any other XML schemas or DTDs the FpML needs to interact with?

If the application requires a new messaging layer, particularly if it will be used between institutions, you should consider using (and extending) FpML messaging. If the application is primarily a data storage and retrieval application, you should consider using the DataDocument type, and avoiding FpML messaging. For example, to store trades in an XML trade archive, and then retrieve them for a display or to generate, say, a confirmation, the DataDocument format will likely be sufficient. To implement a trade matching service between institutions, you should consider using the messaging layer. It's worth pointing out that if you base your definitions on the DataDocument type, you can completely ignore FpML messaging, as none of the messaging definitions will be used.

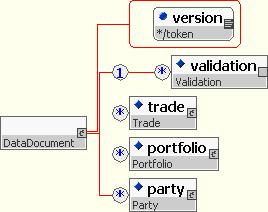

The FpML element forms the root for an FpML instance document. The structure of the FpML document depends on the "xsi:type" attribute. The simplest FpML document is a "DataDocument" (xsi:type='DataDocument'). This is similar to an FpML 3.0 document, and is described in the next section.

The FpML root element contains attributes that specify the FpML version ('4-0' for FpML 4.0), the schema name and location, the name space, and related properties, as well as the xsi:type. See the upcoming Architecure 2.0 specification for more details on this.

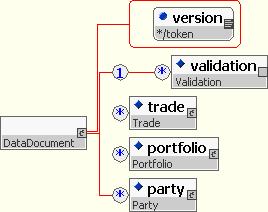

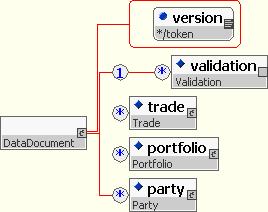

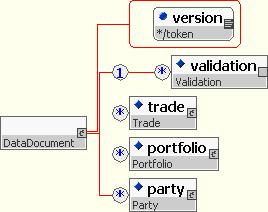

The DataDocument type contains three elements, trades, portfolios and parties. Portfolios contain only trade references, if the trades themselves need to be included in the document then the trades can be included within the root element.

As mentioned above, the structure of the FpML document depends on the "type" attribute. The simplest FpML document is a "DataDocument", which is similar to an FpML 3.0 document. A DataDocument looks like this:

It contains:

- A trade or trades

- A portfolio or portfolios

- A party or parties

In addition, the FpML root element includes attributes for:

- Specifying the FpML version and related schemas and namespaces.

- Specifying the message type.

Each FpML document contains a message header, which provides a context for the document. The header includes information about the sender and recipient of the message and the purpose of the message. See the section on "Messaging Architecture" for more information.

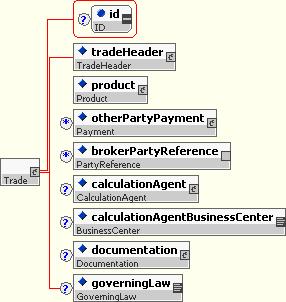

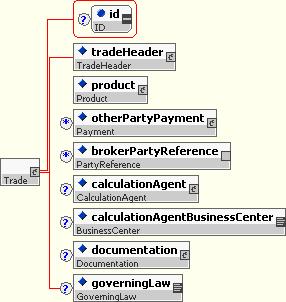

The trade is the top-level component within the root element FpML. A trade is an agreement between two parties to enter into a financial contract and the trade component in FpML contains the information necessary to execute and confirm that trade.

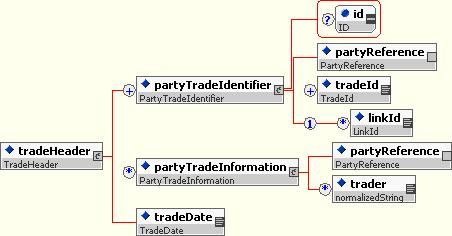

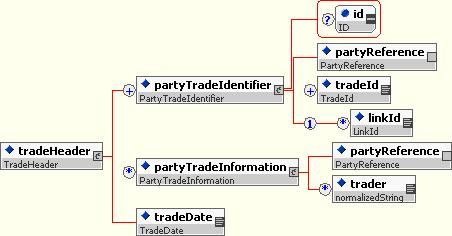

The information within tradeHeader is common across all types of trade regardless of product. In FpML 4.0 this element contains the trade date and party trade identifiers.

Product is an abstract concept in FpML and an actual product element is not used. Instead, one of the FpML products will appear directly under trade.

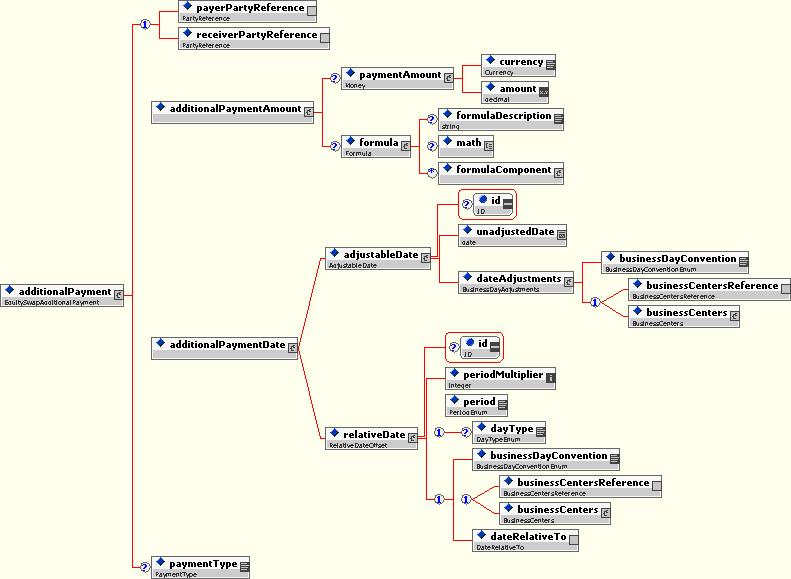

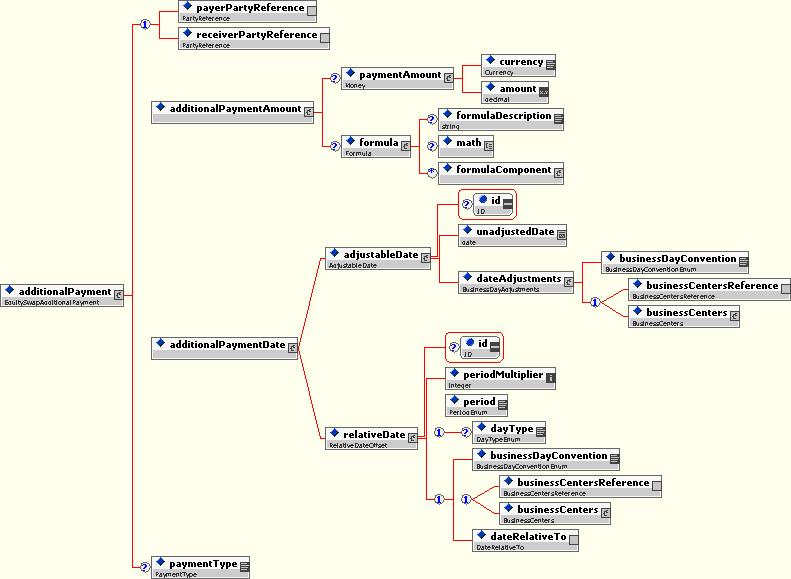

This component contains additional payments such as brokerage paid to third parties which are not part of the economics of a trade itself.

The calculation agent identifies the party or parties responsible for performing calculation duties, such as cash settlement calculations.

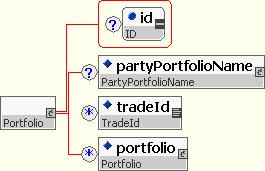

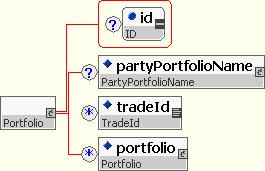

The portfolio component specifies a set of trades as a list of tradeIds and a list of sub portfolios. Portfolios can be composed of other portfolios using a composition pattern. By using the tradeId to identify the trade the standard allows for portfolios to be sent around without the full trade record.

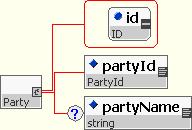

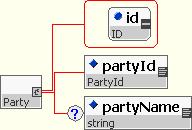

The party component holds information about a party in involved any of the trades or portfolios included in the document. The parties involved will be the principals to a trade and potentially additional third parties such as a broker. For this release, this component is restricted to party identification.

It should be noted that an FpML document is not 'written' from the perspective of one particular party, i.e. it is symmetrical with respect to the principal parties. The particular role that a party plays in the trade, e.g. buyer, seller, stream payer/receiver, fee payer/receiver, is modeled via the use of references from the component where the role is identified to the party component.

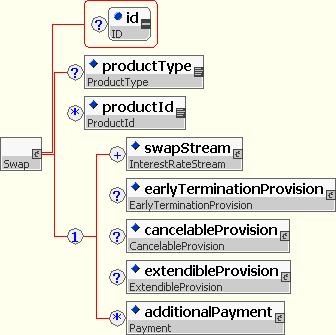

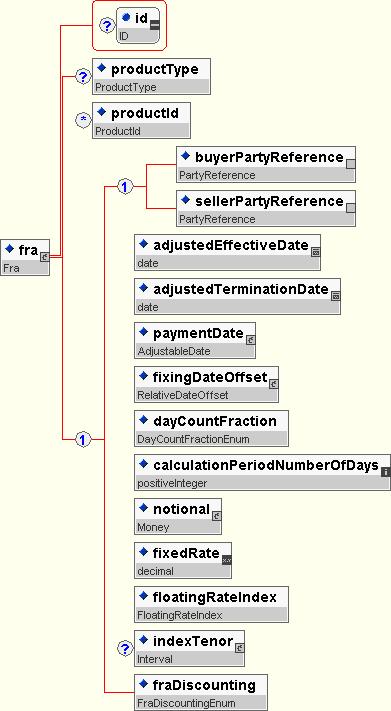

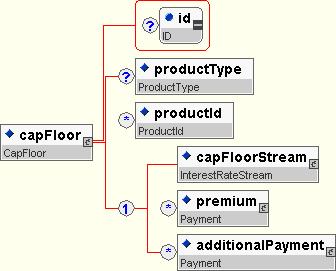

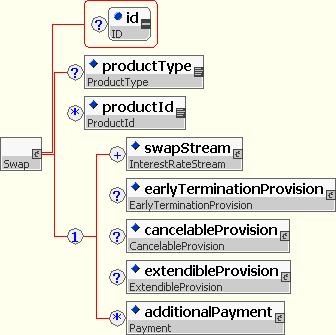

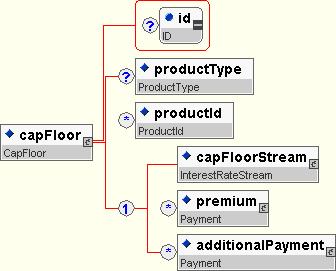

The product component specifies the financial instrument being traded. This component captures the economic details of the trade. It is modeled as a substitution group; each asset class may create one or more product definitions. Some examples of products that different working groups have defined include:

- Interest rate swaps

- FRAs

- caps/floors

- swaptions

- FX spot/forwards

- FX swaps

- FX options

- Equity options

- Equity swaps

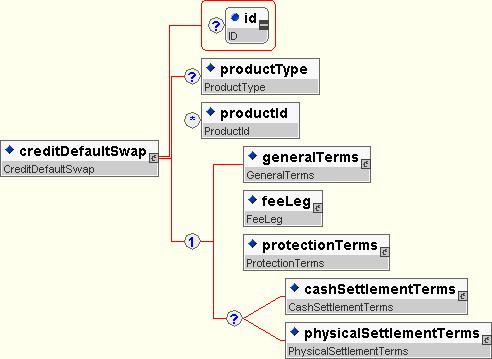

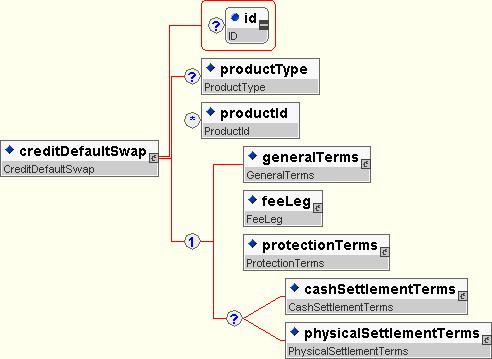

- Credit default swaps

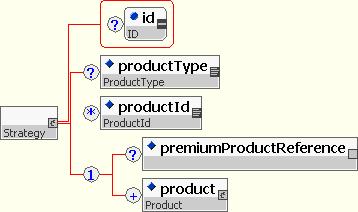

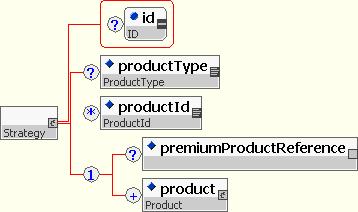

This component defines a special kind of product that allows the structuring of trade by combining any number of products within a strategy. A trade can be of a strategy rather than of a base product; this strategy can then in turn contain other products, such as multiple options. For example, you could define a strategy consisting of an FX call and an FX put to create a straddle or strangle, and then create a trade of that strategy.

The Strategy component makes use of a composition pattern since strategy itself is a product. This means that strategies can themselves contain strategies.

This section provides some additional background on the design of FpML.

FpML incorporates a significant level of structure, rather than being a 'flat' representation of data. This structuring is achieved through the grouping of related elements describing particular features of a trade into components. Components can both contain, and be contained by, other components.

An alternative approach would have been to collect all the required elements in a single large component representing a product or trade. A flat structure of this kind would capture all the relevant information concisely but would also constrain the model in two important respects, namely, ease of implementation and extensibility.

Grouping related elements into components makes it easier to validate that the model is correct, that it is complete and that it doesn't contain redundancy. This is true, both from the perspective of readability to the human eye, and also from the perspective of processing services. Processing services that do not need all the information in a trade definition can isolate components and be sure that the complete set of elements required, and only the elements required, is available for the particular process in hand.

Components additionally serve as the building blocks for a flexible and extensible model. Generally speaking, the complexity of financial products is a result of combining a few simple ideas in a variety of different ways. The component structure supports a trade content definition that is flexible enough to represent the wide variation of features found in traded financial instruments.

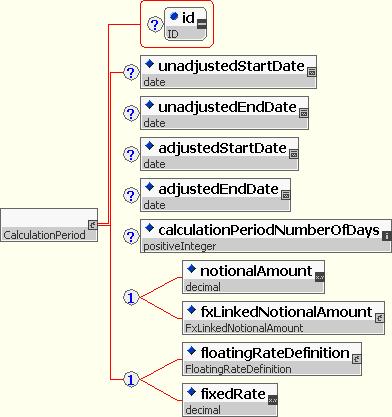

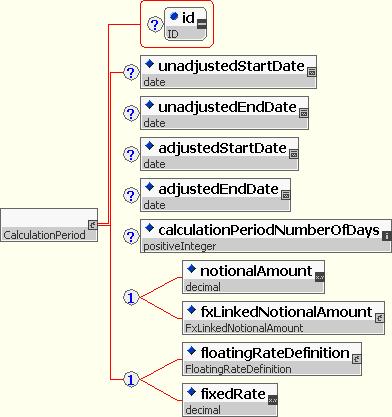

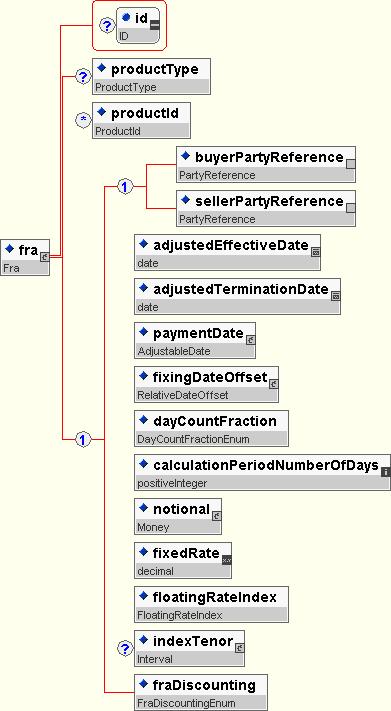

It should be noted that the application of the guiding principles of extensibility and ease of use has resulted in a different approach with regard to the forward rate agreement. Because this product is straightforward, commoditized and unlikely to develop further, the advantage to be gained from the extensive use of components is outweighed by the concision of a single component.

The optimum level of granularity is important to FpML. FpML separates the elements which collectively describe a feature of a product or trade into a separate component with each component serving a particular semantic purpose. Every grouping of elements in FpML is regarded as a component and each component is regarded as a container for the elements that describe that component. In the majority of cases each component will contain a mixture of other components and primitive elements, e.g. a date or string, that collectively describe the features of the component. Components are typically represented in the FpML schema as Complex Types.

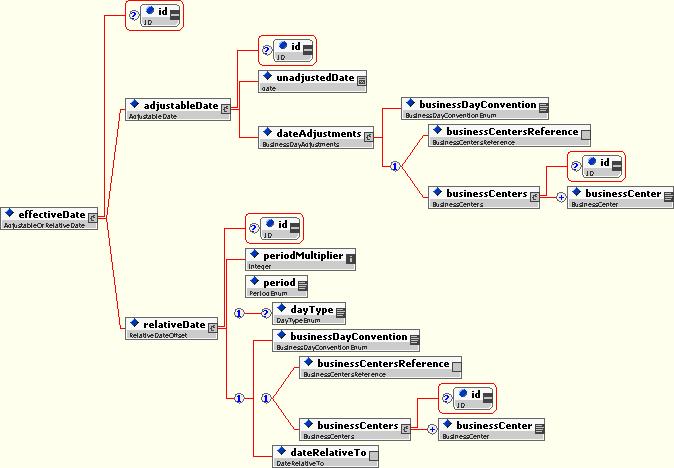

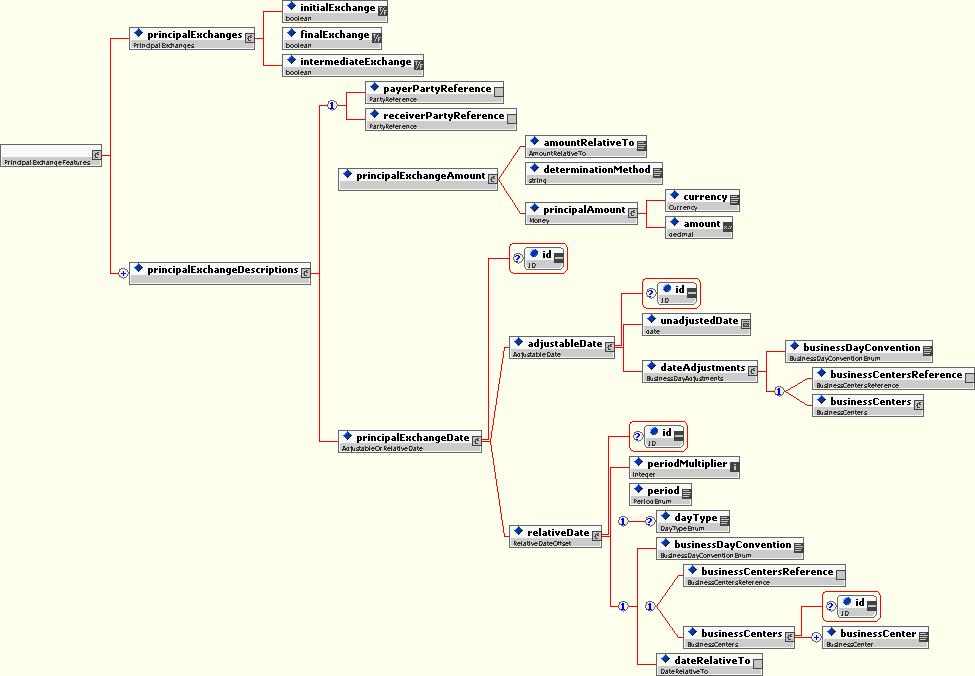

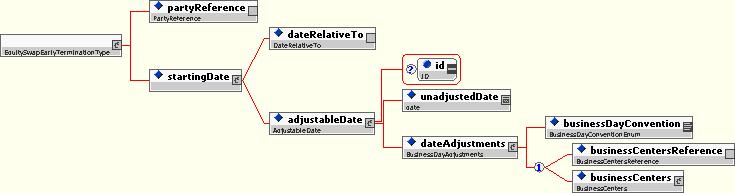

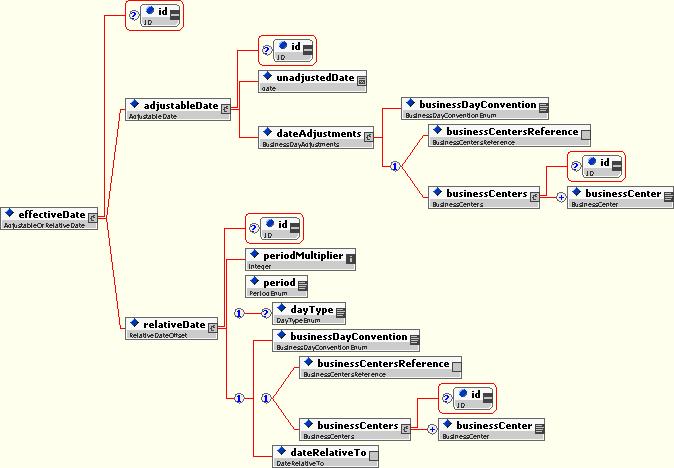

Generally speaking, the lower level a component is, the more re-usable it will be. FpML makes use of a number of primitive entity components that describe the basic building blocks of financial products, for example, FpML_Money, FpML_AdjustableDate, FpML_BusinessCenters, FpML_Interval, FpML_BusinessDayAdjustments etc. These primitive components are re-used in different business contexts.

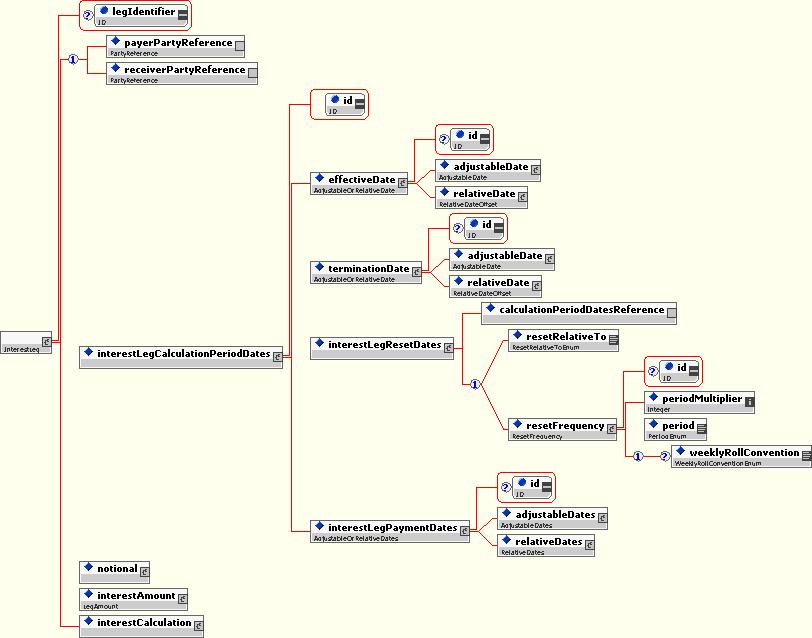

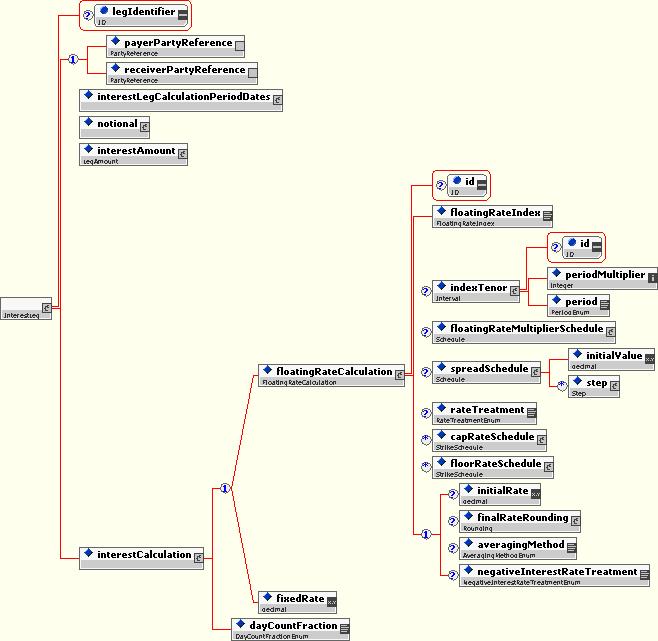

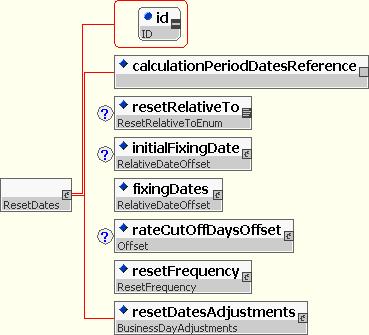

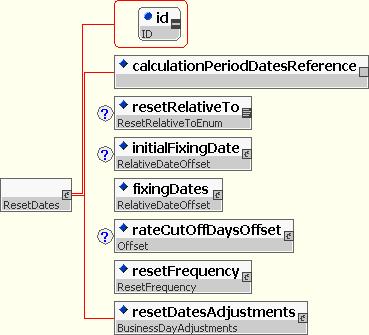

Primitive components are contained in higher level components that describe the features of particular products. For this reason these higher level components will tend not to be re-usable to the same extent. Examples within the definition of swapStream are the components required to construct schedules of dates such as calculationPeriodDates, resetDates and paymentDates. However, it should not be inferred from this that any fundamental distinction is drawn between components in usage or structure.

A necessary feature of a portable data standard is both an agreed set of elements and an agreed set of permissible values (the value domain) for those elements. An FpML document exchanged between two parties would not be mutually understandable if either or both of the parties used internal or proprietary coding schemes to populate elements. For FpML 4.0 LCWD the handling of coding schemes has changed from previous versions of FpML, with the introduction of the use of enumerations and the elimination of scheme default attributes from the FpML root element. The following description refers to the updated approach.

One possible means of identifying value domains is to include the domain of permitted values within the schema, using an XML Schema enumeration structure. This mechanism has been adopted in the LCWD for element values that satisfy the following criteria:

- The list of allowable values is relatively short.

- The list of allowable values is not expected to change during the lifetime of the specification

- It's not possible to change the list of allowable values without affecting the meaning of the specification.

This leave a number of lists of values not meeting the above criteria that are represented by "schemes". "Schemes" are lists of values that can be changed dynamically without affecting the schema. They include items such as currency codes, party identifiers, business centers, floating rate indexes, etc. For these data elements, the "scheme" is a URI, as identified in an FpML attribute, that designates the universe of acceptable values the element may take. This scheme definition list is typically encoded as an XML document, but does not in general need to be. In cases where the ISDA wishes to designate a default scheme, this is recorded as a default attribute value in the schema. In other cases, the scheme attribute is required.

For further details on the architectural framework behind Schemes, refer to the FpML Architecture Version 1.0 document.

The FpML 4.0 Schema is the first release of the specification to place a messaging framework around the product descriptions to describe the context and use to which the information is expected to be put. This section describes a small set of complex types and elements that comprise a simple message framework that is used as the basis for defining business messages suitable for use in a 'Business-to-Business' (B2B) or 'Application-to-Application' (A2A) communications process.

These definitions introduce a new set of ideas that previously could not be used in FpML because of its reliance on DTDs as the formal specification of the grammar. The following sections describe the reasoning behind the features used in the framework.

In general computer systems commonly use two styles of messaging to exchange information between each other, namely:

-

Request/Response

A style of exchange in which one system sends a message to the other to asking it to perform some function, the result of which is encapsulated in an appropriate response and returned.

-

Notification

A style of exchange in which a system sends a message describing a business event that has occurred and may be of interest to others.

The receipt of either kind of message may cause additional messages to be generated and sent as part of the processing to obtain information from other systems or to inform them of the business event underway.

The FpML 4.0 schema explicitly models 'delivery' related information as part of the message itself. Some transports (i.e. SOAP, ebXML, etc.) allow such information to be placed in the 'envelope' that surrounds the message during delivery whilst others (e.g. message based middleware, files, etc.) do not.

Including a standard header within FpML messages increases consistency by providing a single format for delivering information regardless of the physical transport, ensures that it will be persisted if the message is archived, and allows more flexible use of features such as digital signatures.

The design of a grammar must strike a balance between the degree of flexibility it allows and the complexity of its validation. An overly lax grammar allows the construction of documents that, whilst syntactically correct, may have no valid business interpretation. On the other hand a very rigid grammar may require many more grammatical productions in order to enumerate only the valid combinations.

In general it makes sense for a grammar to be strict when it can be achieved easily and without too much additional definition, and lax where flexibility is required (e.g. for proprietary extensions, etc.). In the case of the message framework the grammar provides a mechanism for ensuring that messages have the correct content that applies to them.

The receiver of a message needs to be able to determine the function that the message is invoking. In XML there are three different techniques that can be used for indicating the purpose of a message.

The FpML message framework is based on type substitution as it gives the greatest control over validation whilst allowing easy extension of the message elements.

The receiver can look at the namespace from which the element definitions have been drawn and determine from it the function requested.

<?xml version="1.0"?>

<FpML version="4-0"

xmlns="http://www.fpml.org/2002/FpML-4-0-TradeConfirmationRequest">

<header>

... Message header

</header>

... Business data

</FpML>

Using namespaces it would be possible to create a highly extendable framework for FpML but it could lead to documents having to have every FpML element prefixed with a suitable namespace abbreviation although it may be possible to mitigate this by having the 'core' sub-schemas use no namespaces in their definition and take on the namespace of the one they are including into.

There may be further issues with related XML standards such as XPath as the namespace of the same included elements may not be consistent between documents.

The receiver can look at the name associated with an element within the message (either the root or one of the first level children) to determine the function requested.

<?xml version="1.0"?>

<FpML version="4-0" xmlns="http://www.fpml.org/2002/FpML-4-0">

<header>

... Message header

</header>

<tradeConfirmationRequest>

... Business data

</tradeConfirmationRequest>

</FpML>

To ensure that the content of the FpML element is always a valid message element the grammar would have to use either a choice group (which would limit extensibility) or a substitution group (which is extensible) to define the acceptable elements.

Whilst the root element could be used to indicate the function it is more likely that a child would be used so that all FpML documents would still have the FpML element as the root.

In this model the message header must be generic, that is suitable for any kind of message. There is no way in XML to validate that the content is suitable for the type of message content that follows.

The receiver can look at the type associated with an element within the message (e.g. the root or a child).

<?xml version="1.0"?>

<FpML version="4-0" xmlns="http://www.fpml.org/2002/FpML-4-0"

xsi:type="TradeConfirmationRequest">

<header>

... Message header

</header>

... Business data

</FpML>

An XML schema based instance may use type substitution to replace the content model of any element with another providing that the replacement is derived from the original. Given a framework that provides the appropriate extension points any number of new types can be derived within the name or different namespaces as necessary.

In addition through inheritance the message types can be associated with an appropriate message header content model.

The focus of FpML to date has been on the focus description of trades for B2B purposes. At the same time many of the existing implementations have been for internal trade exchanges between systems.

Extending FpML to handle internal trade information entails adding additional elements to the current schema to hold the values needed to categorise a trade for internal purposes. There are several ways this information could be added to the schema (e.g. optional elements, alternative inheritance structures, inheritance by restriction) each with its own properties in terms of ease of validation or affects on document style.

In this document optional elements have been used to illustrate the changes but such definitions could be used in external messages and would pass basic XML schema validation. Their use could only be prevented through the use of additional validation rules applied post XML parsing.

The representation of a trade within a trading system may change many times during its lifetime as business processes, both internal (e.g. trade creation, amendment, authorisation, etc.) and external (e.g. matching, confirmation, settlement, exercise, etc.), are applied to it.

Systems that maintain local copies of trade descriptions need to be able to determine the state of a trade contained within a message with respect to their own copy. The trade identifier by itself is not enough to determine if one trade description is more recent than another. Some other piece of data that changes in a consistent manner is needed to determine the ordering between the two descriptions, such as either a timestamp or an incrementing version number.

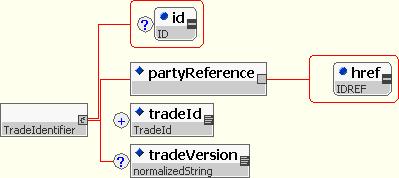

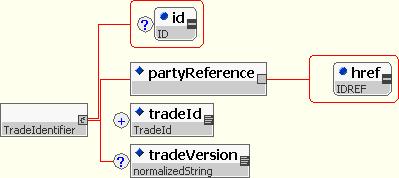

To add a version number to FpML the 'TradeIdentifier' type could be extended as shown below.

The 'tradeVersion' value could be defined as either a simple incrementing integer value or as a more structured string value (e.g. 1.0, 2.4.2, etc.).

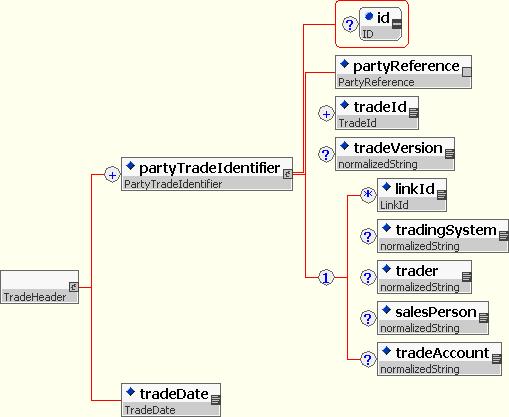

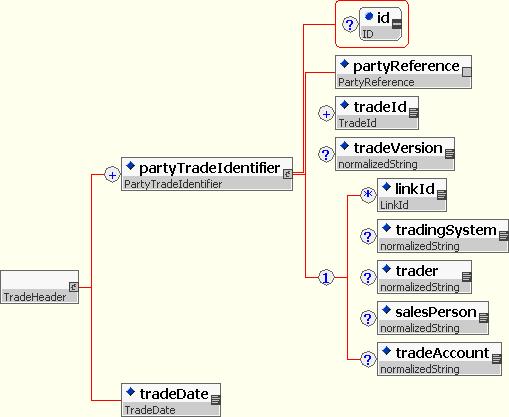

The current FpML 'TradeHeader' type records the minimum content required for trade identification. Normally an internal trade is stored along with more information used for internal accounting and reporting purposes.

The following diagram shows an enhanced 'TradeHeader' structure that can contain information describing the origination of the trade, the individuals responsible for its creation and the internal 'account'.

Combining these two changes would allow the creation of FpML documents with the following structure:

<FpML>

...

<trade>

<tradeHeader>

<partyTradeIdentifier>

<partyReference href="UBSW"/>

<tradeId>1234</tradeId>

<tradeVersion>1</tradeVersion>

<tradingSystem>London/FX/WallSt</tradingSystem>

<trader>Andrew Jacobs</trader>

<salesPerson>Karel Engelen</salesPerson>

<tradeAccount>LON/FX/PROP. TRADING</tradeAccount>

</partyTradeIdentifier

<tradeDate>2003-04-17</tradeDate>

</tradeHeader>

<tradeHeader>

<fxLeg>

...

</fxLeg>

...

</FpML>

Versions of FpML prior to 4.0 have allowed the construction of documents which contain only product definitions. The original proposal for FpML 4.0 was to force a transistion directly to messages by making some message elements mandatory in every document. However after further consideration it was decided to restructure the framework to allow both styles of definition giving FpML backwards compatibility with exisiting solutions and the scope to expand into new B2B (or A2A) messaging applications.

The XML schema for FpML 4.0 defines the type of the root FpML element to be 'Document', an abstract type with an empty content model save only for the standard FpML version.

The Document type serves as the base type in an inheritance scheme that provides the content model definitions for actual message types.

The DataDocument type provides the same content model as the pre XML schema version of FpML allowing the construction of documents that contain only product definitions.

To make an FpML 3.0 DTD based document compatible with the FpML 4.0 schema as a DataDocument a number of changes are required to the instance document, namely:

- The <!DOCTYPE> reference must be removed from the document.

- Where the <FpML> element defines a non-standard or institution specifi default scheme attribute value it must be proprogated the scheme attribute on all the appropriate elements.

- A reference to the FpML schema as the default namespace must be added.

- A reference to the W3C XML schema instance schema must be added and assigned to a namespace (e.g. 'xs' or 'xsi').

- A reference to the W3C XML Digital Signature schema must be added and assigned to a namespace (e.g. 'dsig').

- The type of the <FpML> element must be set to 'DataDocument'.

- A schemaLocation attribute may be added to the <FpML> element to hint at the location of the schema for XML tools that do not perform full 'entity resolving'.

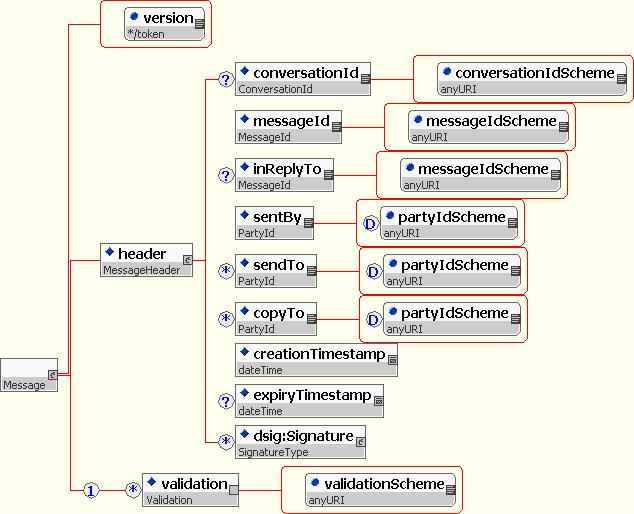

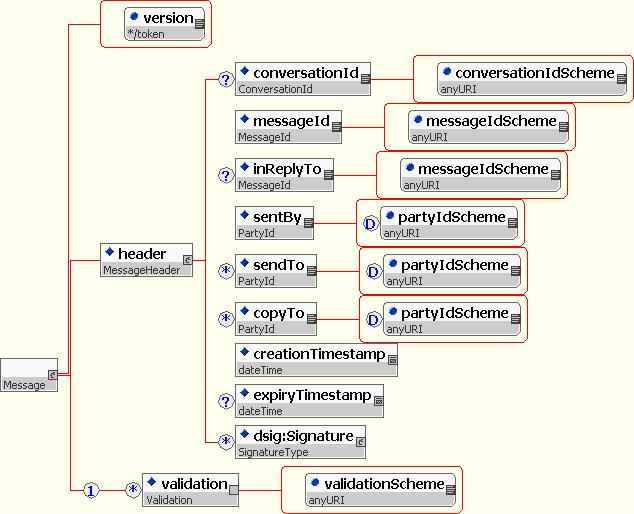

The two core definitions within the schema establish two abstract base classes, 'Message' and 'MessageHeader' from which all the other definitions are derived.

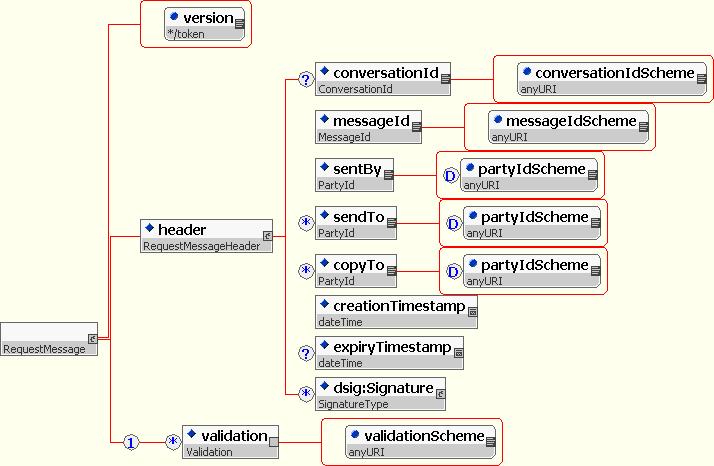

The 'Message' type contains a single element 'header' that holds the message identification and delivery data defined by the 'MessageHeader' type. The Message type inherits the set of attributes used to identify the FpML coding schemes by extending the Document type. The elements that comprise a 'MessageHeader' are the superset of elements required for both request/response and notification messaging styles.

The following XML schema fragment shows how these types are defined.

<xsd:complexType name = "Message" abstract = "true">

<xsd:complexContent>

<xsd:extension base = "Document">

<xsd:sequence>

<xsd:element name = "header" type = "MessageHeader"/>

<xsd:group ref = "Validation.model"/>

</xsd:sequence>

</xsd:extension>

</xsd:complexContent>

</xsd:complexType>

<xsd:complexType name = "MessageHeader">

<xsd:sequence>

<xsd:element name = "conversationId" type = "ConversationId" minOccurs = "0"/>

<xsd:element name = "messageId" type = "MessageId"/>

<xsd:element name = "inReplyTo" type = "MessageId" minOccurs = "0"/>

<xsd:element name = "sentBy" type = "PartyId"/>

<xsd:element name = "sendTo" type = "PartyId" minOccurs = "0" maxOccurs = "unbounded"/>

<xsd:element name = "copyTo" type = "PartyId" minOccurs = "0" maxOccurs = "unbounded"/>

<xsd:element name = "creationTimestamp" type = "xsd:dateTime"/>

<xsd:element name = "expiryTimestamp" type = "xsd:dateTime" minOccurs = "0"/>

<xsd:element ref = "dsig:Signature" minOccurs = "0" maxOccurs = "unbounded"/>

</xsd:sequence>

</xsd:complexType>

Not all of the elements of 'MessageHeader' are relevant to all messaging styles and its content is restricted by subsequent definitions, The role of each element is given below.

- conversationId allows a message sender to create a common context for a number of separate message exchanges.

- messageId contains the senders unique identifier for a message.

- inReplyTo contains the unique identifier for the request message that is being responded to.

- sentBy identifies the party sending a message.

- sendTo identifies the parties who will receive a message and should act upon it.

- copyTo identities other parties who will receive a message but who do not have to act upon it.

- creationTimestamp describes the time when the sender created the message.

- expiryTimestamp defines a time after which the sender will consider the message expired.

- dsig:Signature allows the inclusion of W3C digital signatures within the message.

The validation element in the Message type contains the URI for a set of additional validation rules to be applied to the document during processing.

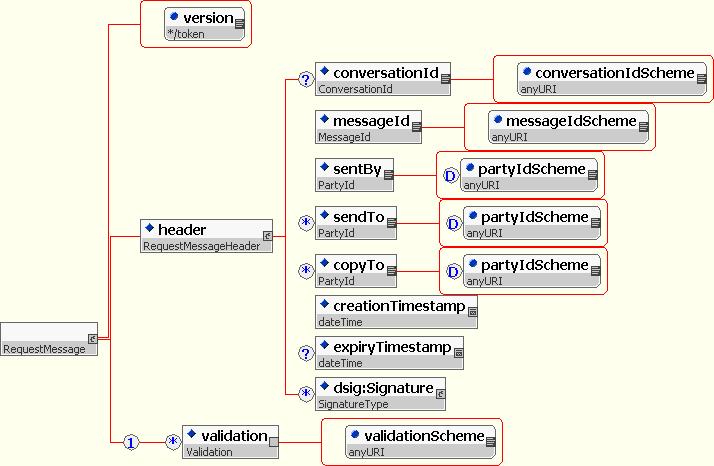

The schema derives three abstract message style types from the core messaging classes by restriction. For example a request message may not have an inReplyTo element where as it is made mandatory in a response.

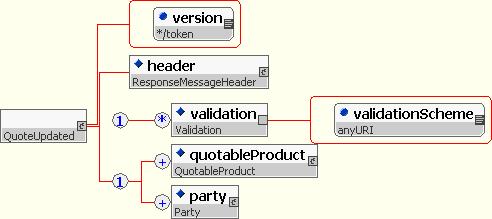

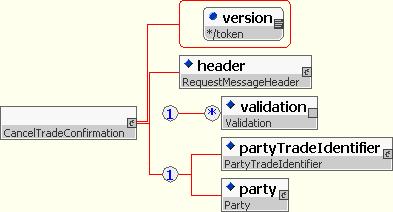

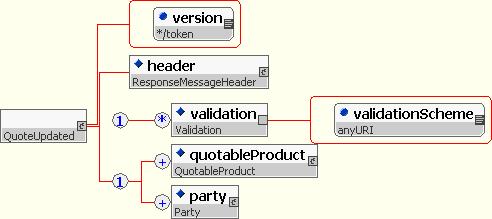

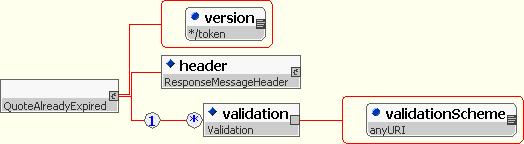

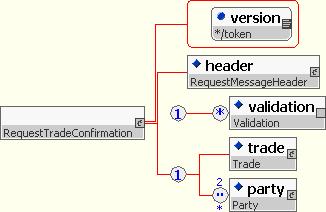

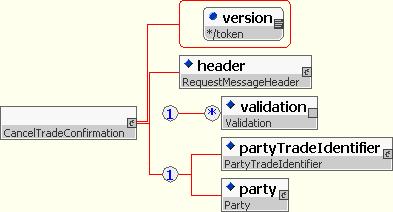

The following image shows the construction of just one message style type, as with in the exception of the type of the header element, they are all the same.

In each case inheritance is used to restrict the content model of the base 'Message' type and change the type of the 'header' element. Each of these types is in turn a restriction of the generic 'MessageHeader' type with some elements either excluded or made mandatory.

<xsd:complexType name = "RequestMessage" abstract = "true">

<xsd:complexContent>

<xsd:restriction base = "Message">

<xsd:sequence>

<xsd:element name = "header" type = "RequestMessageHeader"/>

<xsd:group ref = "Validation.model"/>

</xsd:sequence>

<xsd:attributeGroup ref = "StandardAttributes.atts"/>

</xsd:restriction>

</xsd:complexContent>

</xsd:complexType>

<xsd:complexType name = "RequestMessageHeader">

<xsd:complexContent>

<xsd:restriction base = "MessageHeader">

<xsd:sequence>

<xsd:element name = "conversationId" type = "ConversationId" minOccurs = "0"/>

<xsd:element name = "messageId" type = "MessageId"/>

<xsd:element name = "sentBy" type = "PartyId"/>

<xsd:element name = "sendTo" type = "PartyId" minOccurs = "0" maxOccurs = "unbounded"/>

<xsd:element name = "copyTo" type = "PartyId" minOccurs = "0" maxOccurs = "unbounded"/>

<xsd:element name = "creationTimestamp" type = "dateTime"/>

<xsd:element name = "expiryTimestamp" type = "dateTime" minOccurs = "0"/>

<xsd:element ref = "dsig:Signature" minOccurs = "0" maxOccurs = "unbounded"/>

</xsd:sequence>

</xsd:restriction>

</xsd:complexContent>

</xsd:complexType>

<xsd:complexType name = "ResponseMessage">

<xsd:complexContent>

<xsd:restriction base = "Message">

<xsd:sequence>

<xsd:element name = "header" type = "ResponseMessageHeader"/>

<xsd:group ref = "Validation.model"/>

</xsd:sequence>

<xsd:attributeGroup ref = "StandardAttributes.atts"/>

</xsd:restriction>

</xsd:complexContent>

</xsd:complexType>

<xsd:complexType name = "ResponseMessageHeader">

<xsd:complexContent>

<xsd:restriction base = "MessageHeader">

<xsd:sequence>

<xsd:element name = "conversationId" type = "ConversationId" minOccurs = "0"/>

<xsd:element name = "messageId" type = "MessageId"/>

<xsd:element name = "inReplyTo" type = "MessageId"/>

<xsd:element name = "sentBy" type = "PartyId"/>

<xsd:element name = "sendTo" type = "PartyId" minOccurs = "0" maxOccurs = "unbounded"/>

<xsd:element name = "copyTo" type = "PartyId" minOccurs = "0" maxOccurs = "unbounded"/>

<xsd:element name = "creationTimestamp" type = "dateTime"/>

<xsd:element name = "expiryTimestamp" type = "dateTime" minOccurs = "0"/>

<xsd:element ref = "dsig:Signature" minOccurs = "0" maxOccurs = "unbounded"/>

</xsd:sequence>

</xsd:restriction>

</xsd:complexContent>

</xsd:complexType>

<xsd:complexType name = "NotificationMessage">

<xsd:complexContent>

<xsd:restriction base = "Message">

<xsd:sequence>

<xsd:element name = "header" type = "NotificationMessageHeader"/>

<xsd:group ref = "Validation.model"/>

</xsd:sequence>

<xsd:attributeGroup ref = "StandardAttributes.atts"/>

</xsd:restriction>

</xsd:complexContent>

</xsd:complexType>

<xsd:complexType name = "NotificationMessageHeader">

<xsd:complexContent>

<xsd:restriction base = "MessageHeader">

<xsd:sequence>

<xsd:element name = "messageId" type = "MessageId"/>

<xsd:element name = "sentBy" type = "PartyId"/>

<xsd:element name = "sendTo" type = "PartyId" minOccurs = "0" maxOccurs = "unbounded"/>

<xsd:element name = "copyTo" type = "PartyId" minOccurs = "0" maxOccurs = "unbounded"/>

<xsd:element name = "creationTimestamp" type = "dateTime"/>

<xsd:element name = "expiryTimestamp" type = "dateTime" minOccurs = "0"/>

<xsd:element ref = "dsig:Signature" minOccurs = "0" maxOccurs = "unbounded"/>

</xsd:sequence>

</xsd:restriction>

</xsd:complexContent>

</xsd:complexType>

This document assumes throughout that the delivery of a message is guaranteed by the transport used to send it. If some communication error occurs that prevents delivery or causes the temporary loss of messages we shall assume that it is the transports responsibility to re-establish connection at a later time and resume communication from the point of failure.

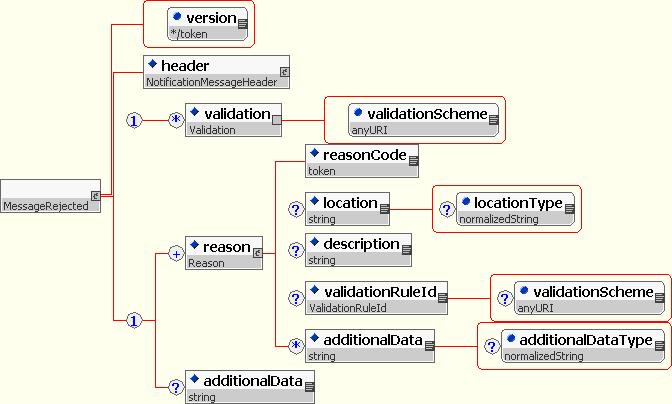

If the message cannot be processed for some technical reason such as: it has become corrupted, is not XML or is not a valid FpML message, then the receiver returns a 'MessageRejected' message to the sender. Usually the message will require manual intervention to diagnose and solve any problems. Such rejections will not be show on any of the diagrams in this paper.

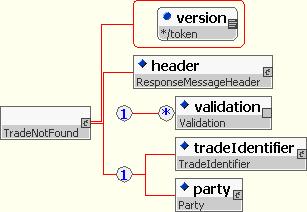

If the message cannot be processed because the request is invalid, given the state of the data to which it applies, then an appropriate business level notification is returned to the sender (e.g. 'TradeNotFound', 'TradeAlreadyMatched', etc.) which in turn could be used to invoke either an automatic recovery or a manual intervention.

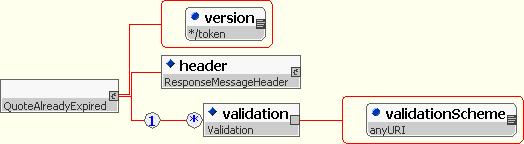

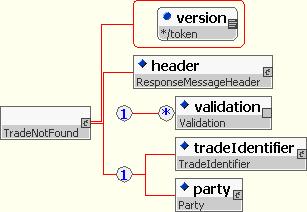

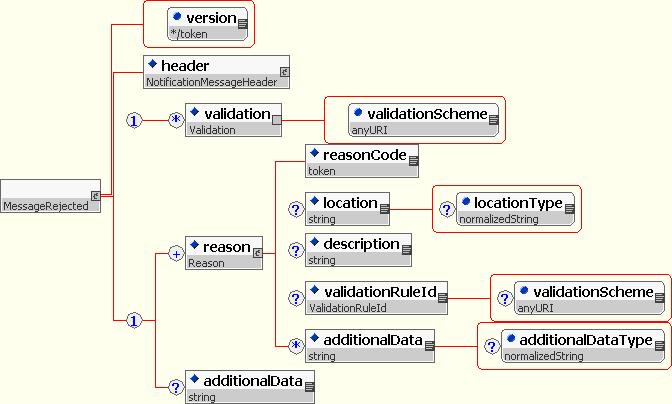

The design of the rejection message must allow for the inclusion of a computer readable error code (taken from a standard list), location information for the source of the error (e.g. a XPath expression or line/character position) and a copy of the failed message. In addition where the problem was identified by business validation rules it may provide information regarding the rule that was breached and any relevant data. The following diagram shows the proposed message design for this.

In order to encapsulate one XML message within another the addition data section would have to use an XML CDATA encoding to prevent the parser from attempting to process the contents.

Message rejections may use any of the following list of error codes to indicate the reason for failure. Institutions may define thier own additional error codes in the numeric range provided for user errors.

- Level 100: Message transport and delivery problems

- 100: Default transport error code

- 101: transport unavailable

- 102: unknown recipient/destination

- 103: delivered to wrong recipient

- 104: timeout - message delivered past expiration

- 105: this type of message not accepted on this transport

- 106: message generation problem (e.g. data conversion)

- 110: Message corrupted (e.g. CRC failure)

- 111: Message text doesn't match digital signature hash

- Level 200: Message Integrity and Processing problems

- 200: Default message processing error code

- 201: Lexical problem - not well-formed XML

- 202: Unsupported character set

- 203: Empty or missing content

- 204: Content too large

- 210: System unavailable

- 211: Message component text doesn't match digital signature hash

- Level 300: Message Validation Problems

- 300: Default validation error code

- 301: Unknown or unsupported DTD/Schema

- 302: Unsupported FpML version

- 303: Invalid FpML message - message doesn't validate w.r.t. specified DTD/schema

- 304: Validation failure - unsupported message type

- 305: Validation failure - mandatory FpML rule (a rule we say must always be followed)

- 306: Validation failure - master agreement rule (a rule 2 parties agree to follow)

- 307: Validation failure - business policy (a rule that only the recipient has)

- 308: Validation failure - unsupported product/asset

- 310: Signature required - message content must be signed

- 311: Signature not accepted - problem with message signer (cert revoked, unacceptable principal, etc.)

- Level 400: Business Process/Workflow Problems

- 400: Default business process error code

- 401: Don't know - unrecognized trade

- 402: Suitability - trade can't be done for client or dealer suitability reasons

- 403: Credit - trade can't be done for credit reasons

- 404: Not interested - recipient chooses not to respond

- 410: Message arrived too late - e.g. trade no longer exists

- 411: Message expired - message arrived on time, but a response was not generated in time

- Level 500: User Defined

FpML releases to date have concentrated on defining only product structure. These products are the key part of many messages but in order to have a meaningful 'conversation' additional information is required to express the action that the message sender believes the message receiver should perform upon receipt of the message. Usually a key data structure like a product and/or party is the main component of the data that accompanies the request but for some actions additional parameters may need to be included.

This section outlines a process for requesting and obtaining a quote for a trade prior to entering into a full contractual trade. The processes shown are based on those in use today in markets that already have an established electronic market.

Within this section well shall refer to two types of market participant, namely:

A request for quote process could be conducted directly between a market maker and a market taker (e.g. Citigroup''s ''CitiFx FX Benchmark'' service) or more commonly through an electronic exchange or trading portal where several market makers may quote on the same request.

The specification of products in request for quote messages is different than for those in post trade messages. The product may be more ambiguous (e.g. it may not specifiy whether it is a buy or sell) and irrelevant settlement specific data can be omitted.

The 'symetric' nature of FpML product specifications creates some additional problems when considering their generalisation into pre-trade messages. FpML avoids the use of simple 'buy' and 'sell' indicators by associating parties with components of a product and indicating thier obligation (i.e. payer or receiver). However this approach has three problems in the pre-trade space.

-

Anonymity

In some negotiations the identity of the market taker may not be known until an agreement has been reached. FpML requires party information within a product specification to identify obligations. An identity could only be hidden if a standard 'dummy' party was allowed in negotiation messages.

-

Multicasting

A market taker may request quotes on the same product from many market makers. Given the current definitions the product definition would need to be customized for each potential recipient. Alternatively another 'dummy' party could be used to represent any maker maker.

-

Two Way Quotes

In many negotiations the intent of the market taker is unclear and market maker provides both a buy and a sell price. The use of party to identify obligation in an FpML product means that can only have one interpretation (i.e. it is either a buy or a sale, it can never be both).

It is clear that if the current style of product definition is to be used for pre-trade then some additional conventions will need to be adopted.

Whilst it would be possible to generalise the current post trade definitions by making some of the current elements optional (so they could be excluded in RFQs) and the addition of extra optional elements of quote specific data this would lead to possiblity that RFQ products could appear in post trade messages (and vice versa). Syntactically such messages would be valid and extra validation rules could need to defined to detect this semantic error.

A simpler solution would be to define a new set of product definitions specifically for pre-trade messages based on a similiar framework as is used for the existing post-trade products. To implement this a new global element and base type are needed to serve as the attachment point for substituting definitions.

Given these definitions quotable versions of the existing products can be created, for example for FX:

Using this definition it is possible to express the intention of the transaction (e.g. the currencies, delivery date(s) and notional amount) whilst leaving other values (i.e. the exchange rate) out.

<quotableFxSingleLeg>

<exchangedCurrency>

<paymentAmount>

<currency>GBP</currency>

<amount>1000000</amount>

</paymentAmount>

<paymentDate>

<unadjustedDate>2003-07-25</unadjustedDate>

<dateAdjustments>

<businessDayConvention>FOLLOWING</businessDayConvention>

<businessCentersReference href="CENTERS"/>

</dateAdjustments>

</paymentDate>

</exchangedCurrency1>

<exchangeRate>

<quotedCurrencyPair>

<currency1>USD</currency1>

<currency2>GBP</currency2>

<quoteBasis>CCY1PERCCY2</quoteBasis>

</quotedCurrencyPair

</exchangRate>

</quotableFxSingleLeg>

By keeping the quotation product definition close to that of the post-trade product (e.g. using the same element names and ordering) a responding message can be constructed by copying sections of the input message (e.g. parts of the parsed DOM tree representation) and enriching it with any required data to form the full product definition.

In order to create the example definition for FX two other definitions had to be generalised, namely QuotablePayment (from Payment) and QuotableMoney (from Money). These definitions have no direct relationship with their fully formed partners, they are simply modified copies of the original XML schema definitions, although it would be possible to define them using 'inheritance by restriction' (e.g. Money could be inherited from QuotableMoney making the amount element mandatory, Payment and QuotablePayment could be derived from some generic common base class).

This section describes the follow of messages required in a bilateral exchange directly between a market maker and a market maker. It is assumed that market maker operates two systems to support his trading business: one to manage his communication with market takers (the quotation system) and one to record transactions (the trading system). The features of these two logical systems could reside in a single physical implementation.

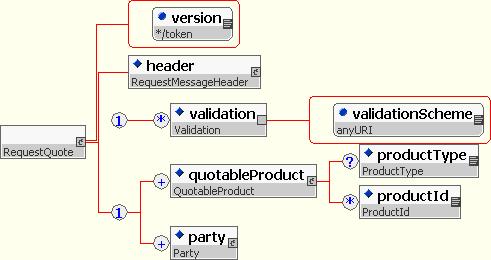

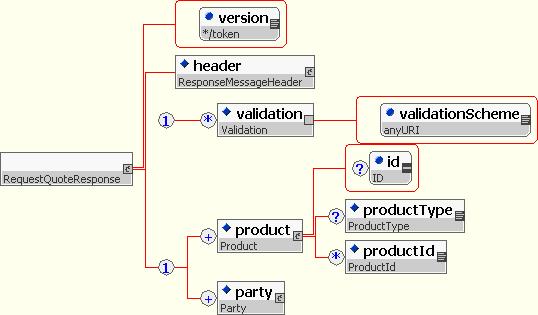

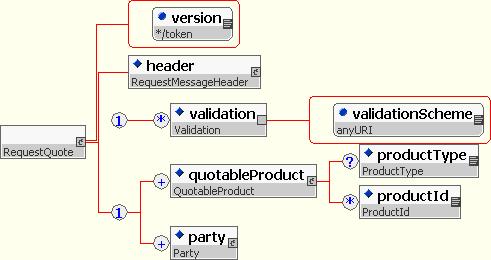

The following diagram shows the sequence of message exchanges (including an additional flow for a quote update) under normal operation.

The role of each of the messages is as follows:

-

The market taker sends the quotation system a RequestQuote message describing the properties of the transaction in which he is interested in. The quotation system forwards the message on to the market maker for attention. The RequestQuote message uses the QuotableProduct definition to allow the product to be loosely defined.

Note that the message allows more than one product be to included to allow a number of quotes to be request simultaneously.

-

The market market determines either a one-way or two-way price for the product and the left of time for which that quote will be honoured and returns it to the market taker via the quotation system. The market marker can quote for a subset of the requested products (or none of them by not responding at all).

-

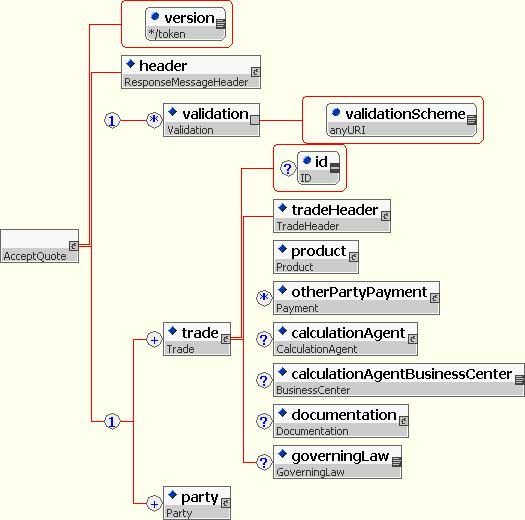

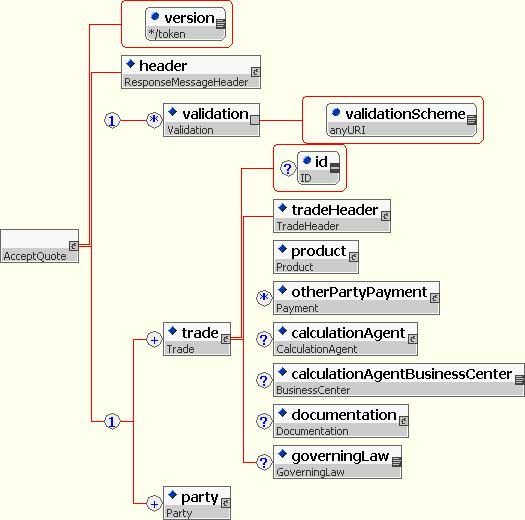

The market taker accepts the quote and informs the quotation system of which quote (if the price was two-way) was taken by returning a fully formed trade (possibly containing the market takers settlement information). The quotation system forwards the acceptance to the trading system.

The quotation system should ensure that details of the trade within the QuoteAcceptance match the quotation provided earlier and that the quote is still valid.

-

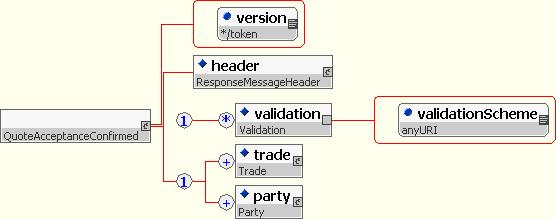

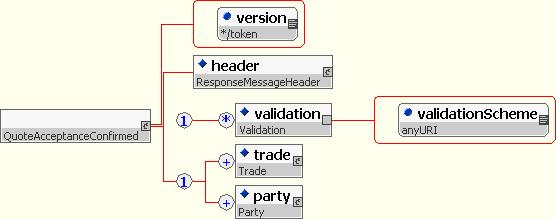

When the trading system confirms its acceptance of the transaction by returning it in a QuoteAcceptanceConfirmed message (possibly after adding its own settlement information) the quotation system can issue TradeAffirmations to inform each party that the trade is complete.

-

Finally both parties confirm their acceptance of the TradeAffirmation to the quotation system to allow it to record the successful end of the transaction. (The TradeAffirmation and TradeAffirmed messages are described later)

The role of the quotation system in the above processing is to ensure that both market makers and market takers are treated fairly during the quotation process, by maintaining an audit record of message from both parties in order of arrival.

In practice the negotiation of a rate or price for a transaction may require more message exchanges than shown in the last example and there are a number of different outcomes that can occur, namely:

-

The market taker may choose not to act on the quote, leaving it instead to expire at the time designated by the market maker.

There are no messages to inform parties of the expiration of a quote, rather it is discovered by exception when a stale quote is acted upon (shown later).

-

The market maker may choose to refine a previously made quote to reflect a change in market conditions. A marker taker may be tempted to trade on the new quote (as shown in the following diagram) or may leave it to expire or be cancelled.

-

The market taker may re-request a quote for the same product for which he requested an earlier quotation. If the earlier quotation is still active then the request could be ignored or an update sent to original request. If the quote has expired then the normal quotation process is repeated.

-

A market taker may attempt to take up a quotation after it has become expired. This could be accidental or caused through synchronisation issues between the systems (e.g. differences between system clocks, message delays or processing order).

Within the context of FpML, trade affirmation is considered to be a notification of trade execution. An affirmation message may be sent internally or externally after the trade negotiation has completed. At this point the trade may not have been legally confirmed between the two principal parties. Trade affirmations may also be sent by a third party, e.g. a broker, to the principal parties involved.

There are a few basic patterns that are used in the industry today for delivery of trade affirmation messages. In all cases the workflow is basically the same. That is, a notification message is sent from a trading system (either an internal/external system or broker) followed by an acknowledgement of receipt (response message) from the message receiver. Acknowledgement of receipt is used to complement the asynchronous nature of the affirmation message and to assure that the message is not deleted from the originating system prior to being persisted in the destination system.

The following sequence diagram illustrates the process for one side of a bilateral affirmation. Both parties to the trade may be executing this process to obtain an affirmation from each other.

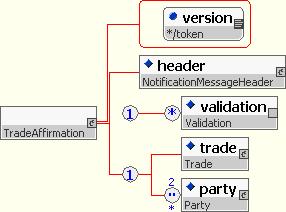

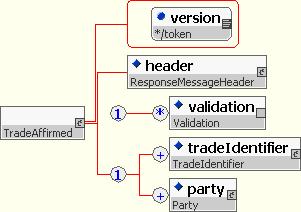

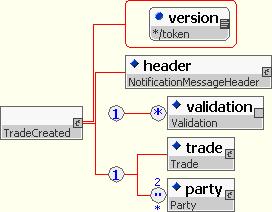

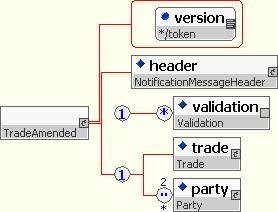

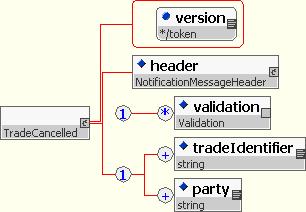

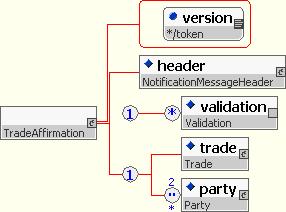

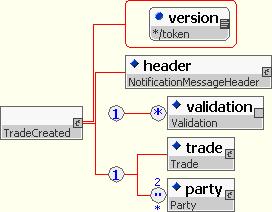

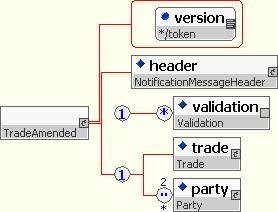

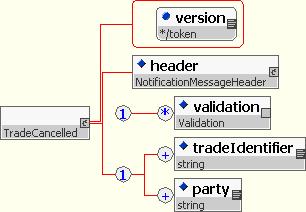

The affirmation message typically contains the same information that is contained in a trade confirmation message. Some details, such as settlement information, could be omitted if it is unknown to the affirmation sender. The following diagram shows the content model for a 'TradeAffirmation' message.

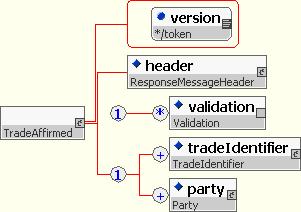

The response to the affirmation message indicates its acceptance and indicates the transaction to which it applies. The content model for it is as follows:

If the trade affirmation is being generated by a third party, such as a broker, then affirmation could be sought from one side and then the other, or from both simultaneously as shown in the following diagram.

The data content of the messages is the same as in the bilateral case.

Today the procedure for achieving trade confirmation is manual for most OTC derivative transactions. Principally this is because the information describing the economic and legal liabilities of the transaction are embedded within a native text document and set amongst legal wording. A skilled human reader is needed to extract and compare the relevant information to determine if it matches the bank's own definition of the same deal.

This section describes how the process of trade confirmation for OTC derivatives might be achieved electronically through the exchange of a sequence of 'messages' between the two parties' computer systems. This can only take place if the parties involved have identified and 'marked-up' the salient details of the transaction using a common vocabulary of terms and data structure, such as those provided by the FpML product definitions.

Matching and comparison are central to confirmation process. In basic terms the matching operation is carried out as follows.

Each new request to confirm a trade results in a search of the system's set of currently unmatched trades to determine if a viable match exists. A trade is comprised of a set of data items that describe its properties and each one of these in turn falls into one of following three categories:

- Identifying financial items that, if present, must exactly (or within tolerance) match (e.g. common trade identifier, trade date, maturity, product type, currencies, notional amounts, parties, etc.).

- Non-identifying items that should exactly (or within tolerance) match (e.g. business centers, date roll conventions, etc.).

- Items irrelevant to the matching process (e.g. comments).

As a result of the matching process a trade is said to be:

- Matched - If all identifying and non-identifying items agree.

- Mismatched - If all identifying items agree but the non-identifying items differ.

- Unmatched - No match on identifying items could be found.

If a trade is matched then both descriptions of a trade are fully reconciled and the parties can agree that it is confirmed. If the trades contain identification information that shows that they should have matched but other significant details differ then the trade is mismatched.

If no match was found then the system must assume that it is yet to receive a copy of the trade from the other party and should add it to the set of unmatched trades and wait for the next request.

Some additional actions are required to prevent trades remaining unmatched indefinitely. There are two cases that can give rise to this situation:

- The counterparty failed to enter and send his definition of the transaction (so no counter-trade exists in the system).

- The counterparty incorrectly identified the true party (in which case a counter-trade exists but will never match).

To attempt to recover from both cases after a trade has remained unmatched for a period of time, the system should send a message to the alleged counterparty in order to provoke them into investigating whether they need to send a new trade or correct an existing unmatched trade.

If after an additional time period the trade still remains unmatched, it should be returned as failed.

The following sections illustrate the end-to-end sequence of message exchanges required to confirm a transaction directly between two parties and the various outcomes that are possible.

Under normal operation we would expect a match to be found as soon as both the internally and externally generated copies of the trade are submitted to the confirmation engine.

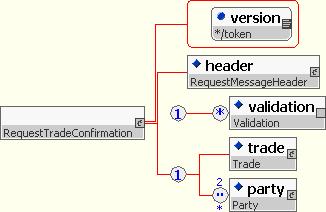

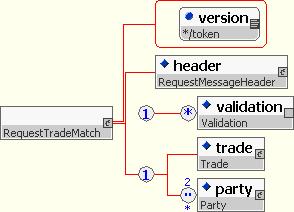

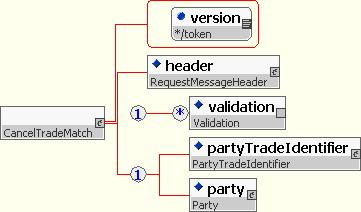

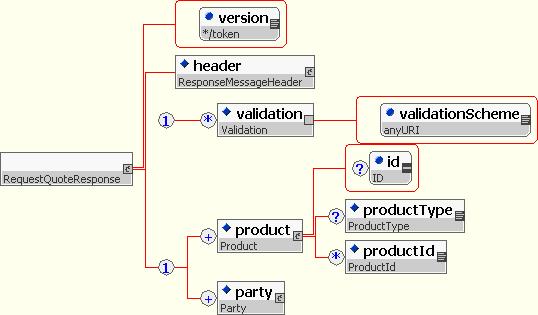

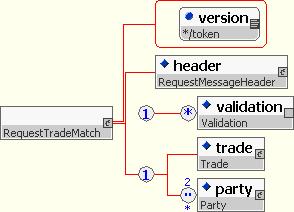

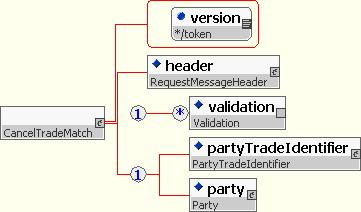

Following a trade negotiation each side generates a 'RequestTradeConfirmation' message which is sent to the confirmation provider's system. These requests are used to initiate a trade matching operation. The structure of the request message is shown below.

If the request is valid then the trade is passed to the matching engine for processing. The 'RequestTradeMatch' message needs the same basic data content as the confirmation request message.

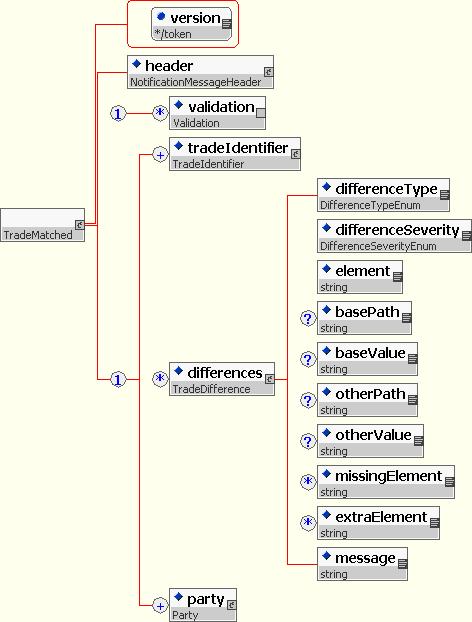

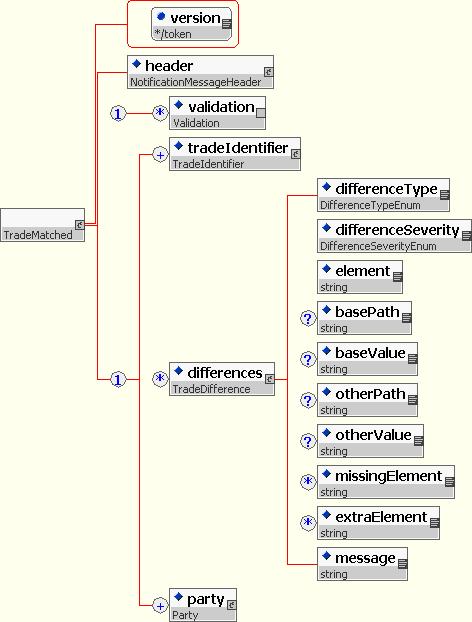

When a match is found the associated notification message needs to identify the two trades (via their identifiers) to the participants.

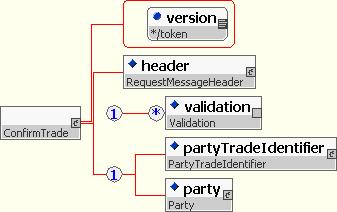

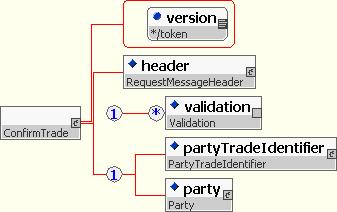

To finish the process the confirmation requestor confirms his acceptance of the match by issuing a 'ConfirmTrade' message that contains a reference to the matched trade.

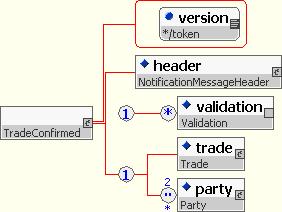

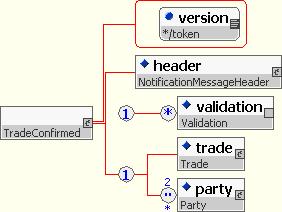

The final notification of the confirmation provider reiterates the legally binding definition of the trade.

If the request contains the details for a transaction which has already been processed by the confirmation service then a number of possible errors can result in response to the request:

-

If a request to confirm the same trade was made previously and the trade is currently unmatched or mismatched, then the service should reply with a 'TradeAlreadySubmitted' message.

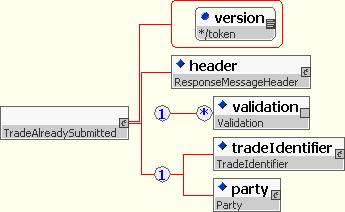

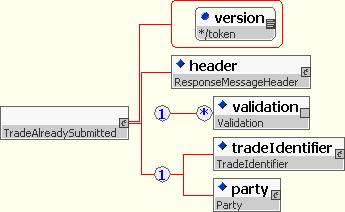

The 'TradeAlreadySubmitted' message has the following content model:

-

If a request to confirm the same trade was made previously and the trade was successfully matched, then the service should reply with a 'TradeAlreadyMatched' message.

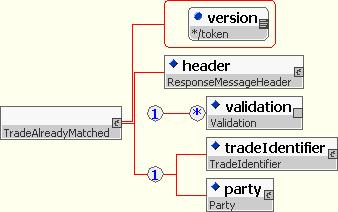

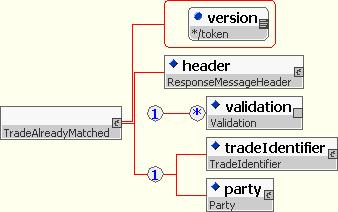

The 'TradeAlreadyMatched' message has the following content model:

If a mistake has occurred in the generation of one trade confirmation request it is possible that the system can detect that two trades should have matched (e.g. they contain a common unique trade identifier) but that they cannot due to significant differences.

The confirmation system keeps trades in its pool following the mismatch notification to allow a subsequent correction or cancellation to be applied to the trade.

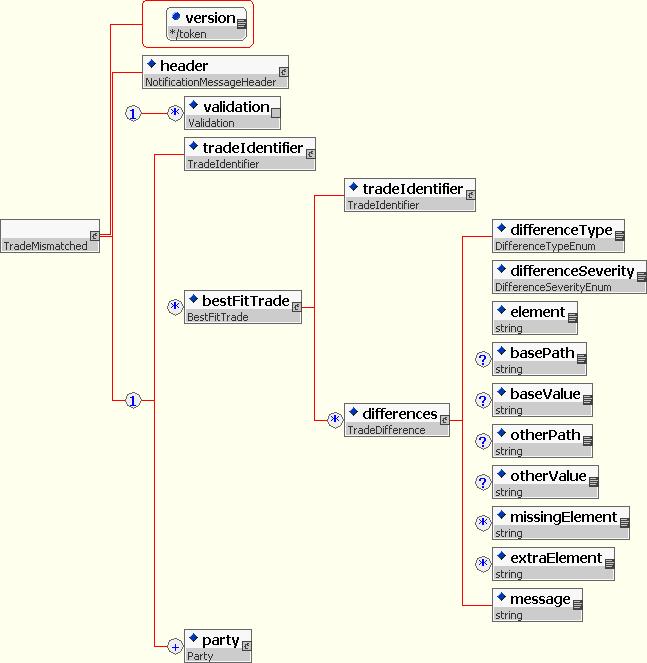

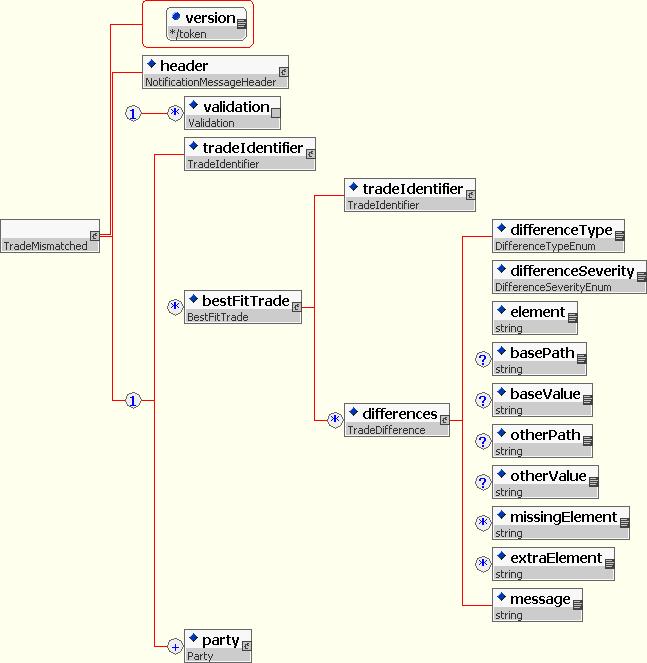

The 'TradeMismatched' notification must contain the participants trade identifier as well as the identifier for the counter-trade that it should have matched, together with any other potential matches.

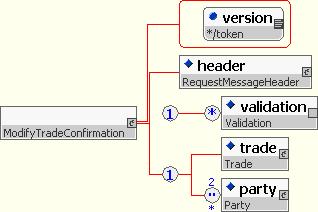

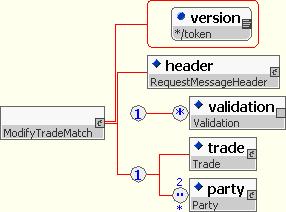

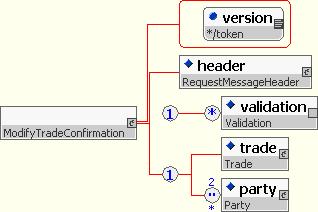

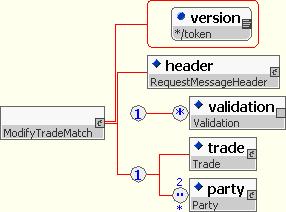

Whilst a trade is unconfirmed the requesting party may send new copies of the transaction data to replace the original trade details. The data content of the replacing transaction should match the same requirements as those for initiation. Transactions must be fully re-specified (rather than just the incremental differences). The content model for the 'ModifyTradeConfirmation' message which requests this is as follows:

There are a number of scenarios that can result in the processing of such messages:

-

The confirmation system may not be able to locate the original trade description to be modified.

The generated 'TradeNotFound' message contains the identifier for the trade the system was unable to find.

-

The modification may be accepted and propagated to the matching engine but the trade remains unmatched.

As with the initial matching request the 'ModifyTradeMatch' message contains a full copy of the trade.

-

The modification may be accepted and propagated to the matching engine resulting in a mismatched trade.

-

The modification may be accepted and propagated to the matching engine resulting in a matched trade.

Whilst a trade is unconfirmed the requesting party may ask the entire confirmation action to be cancelled. The cancellation message needs only to contain the information necessary to identify the transaction it affects and must match a currently unconfirmed transaction.

As in earlier cases there are a number of possible processing scenarios depending on the state of the trade within the confirmation system, namely:

-

If the cancellation applies to a trade that can not be located, then the sequence of messages is as follows:

-

If the cancellation applies to an existing unmatched trade then, it generates the following messages:

Once the confirmation system has identified the trade as unmatched it must request that the matching system remove the trade from its storage. This is done through a 'CancelTradeMatch' message.

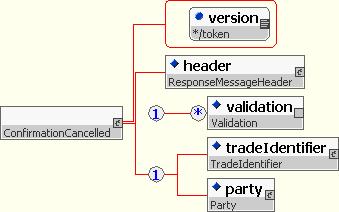

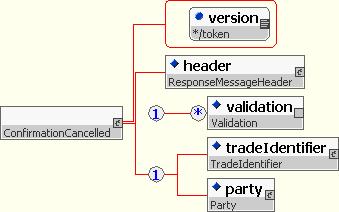

The response to the confirmation requester completes the process by acknowledging that the confirmation request is cancelled.

-

If the cancellation applies to a trade which has already been matched, then the message flow is as follows:

When the confirmation provider detects an unmatched trade that has been outstanding for a period of time, it sends a copy of the transaction to the indicated counterparty. The trade is not removed from the unmatched trade set so that a subsequent new trade confirmation or modification request may match against the trade.

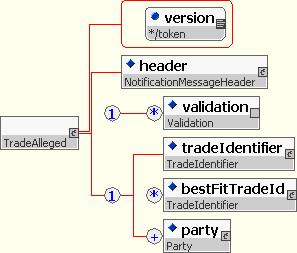

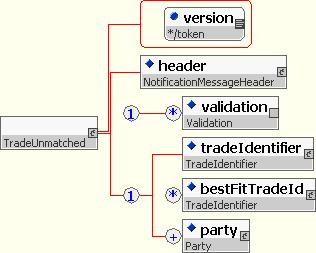

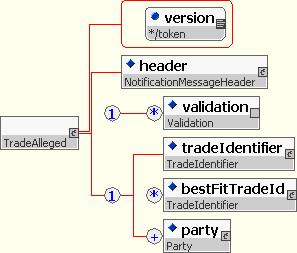

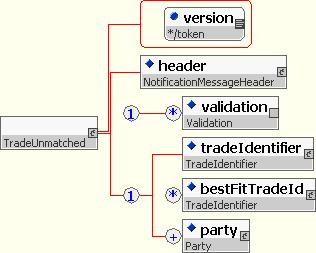

The 'TradeAlleged' message must provide the identification information for the transaction that is alleged against the counterparty. A confirmation service might provide additional information to suggest current unmatched trades that might be a counter transaction.

A request for trade confirmation that remains unmatched, even after alleged trade processing, for a length of time, should be returned to the requester within a message indicating a failure to match.

The 'TradeUnmatched' notification contains identification information for the unmatched trade and may contain suggestions for possible counter trades.

This section illustrates some processes in action with a third party performing the matching process. In general the sequence of requests and responses is the same as in the bilateral case and there are no additional trilateral specific message types.

As before the confirmation process is begun when the trading parties send a description of the trade to the confirmation system, now external to both parties.

The presence of the third party allows the match to be taken as legally binding and it is automatically considered confirmed without the need for any further messages.

If the request contains the details of a transaction that has already been processed by the conformation service then a number of possible errors can result from the request, namely:

-

If the trade has already been submitted and is currently unmatched or mismatched the service should reply with a 'TradeAlreadySubmitted' message.

-

If the trade has already been processed and has been matched, then the service should reply with a 'TradeAlreadyMatched' message.

The message pattern for the detection of a mismatch is the same as in the bilateral processing case.

As in the bilateral case either party can request that the details of an unmatched trade be replaced with a new definition. The series of scenarios are identical to the bilateral cases.

-

If no corresponding trade can be found in the confirmation system then a 'TradeNotFound' messags is generated.

-

The modification may be accepted and propagated to the matching engine but the trade remains unmatched.

-

The modification may be accepted and propagated to the matching engine resulting in a mismatched trade.

-

The modification may be accepted and propagated to the matching engine resulting in a matched trade.

As in the bilateral case either party can request that the confirmation processing for an unmatched trade be suspended and the trade definition removed from the set of unmatched trades.

-

If the cancellation applies to a trade that can not be located, then the sequence of messages is as follows:

-

If the cancellation applies to an existing unmatched trade, then it generates the following messages:

-

If the cancellation applies to a trade which has already been matched, then the message flow is as follows:

The process of notifying a counterparty of an alleged trade is exactly the same as in the bilateral case.

As in the bilateral case any trades that remain unmatched, even after alleged trade processing has been attempted, are eventually removed from the unmatched trade set.

At a number of points in the confirmation process it is possible that one or the other or both parties to a transaction received an unexpected error message from the other or the central service.

In order to determine the correct course of action to recover from such an error the participants need to determine the perceived state of their transaction within the other party's systems. This indicates that a simple status enquiry operation would be required to recover the necessary information.

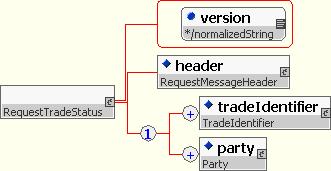

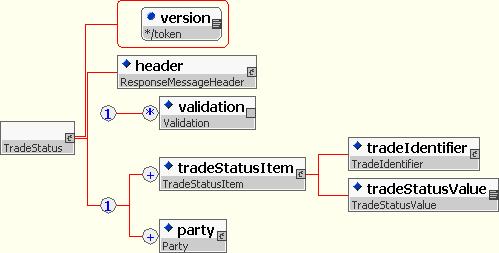

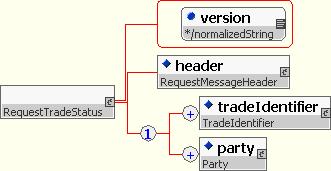

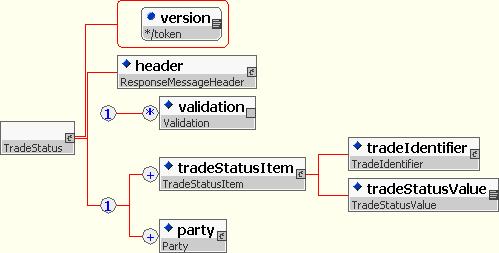

For efficiency the trade status enquiry message should allow more than one transaction to be checked at a time (e.g. all outstanding unmatched trades, etc.). Its content model is as follows: