|

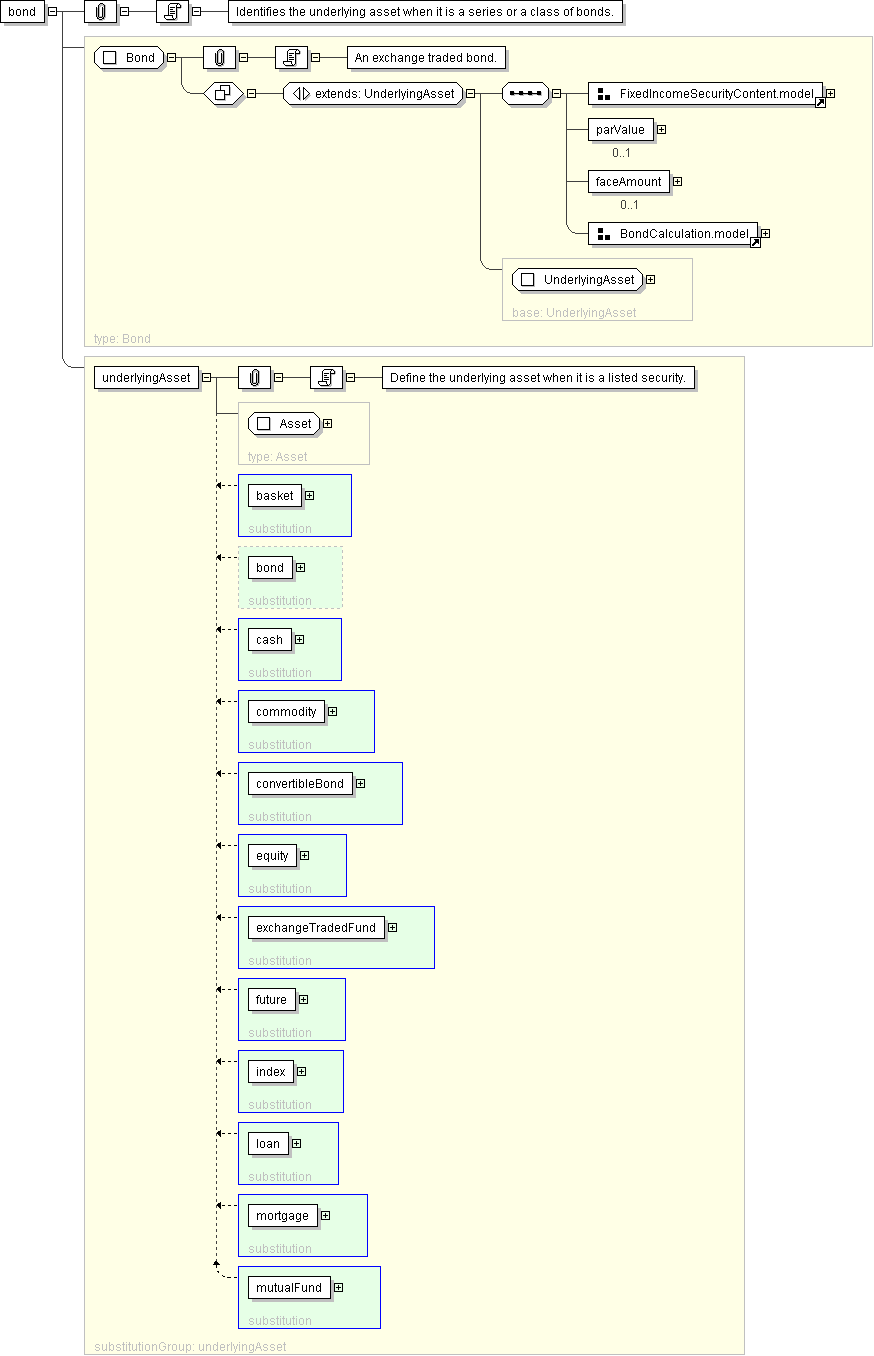

| Name | bond |

|---|---|

| Used by (from the same schema document) | Model Group BondChoice.model |

| Type | Bond |

| Nillable | no |

| Abstract | no |

| Documentation | Identifies the underlying asset when it is a series or a class of bonds. |

'Identification of the underlying asset, using public and/or private identifiers.'

'Trading currency of the underlyer when transacted as a cash instrument.'

'Identification of the exchange on which this asset is transacted for the purposes of calculating a contractural payoff. The term \"Exchange\" is assumed to have the meaning as defined in the ISDA 2002 Equity Derivatives Definitions.'

'Identification of the clearance system associated with the transaction exchange.'

'An optional reference to a full FpML product that defines the simple product in greater detail. In case of inconsistency between the terms of the simple product and those of the detailed definition, the values in the simple product override those in the detailed definition.'

'Specifies the issuer name of a fixed income security or convertible bond. This name can either be explicitly stated, or specified as an href into another element of the document, such as the obligor.'

'Specifies if the bond has a variable coupon, step-up/down coupon or a zero-coupon.'

'Specifies the coupon rate (expressed in percentage) of a fixed income security or convertible bond.'

'The date when the principal amount of a security becomes due and payable.'

'Specifies the nominal amount of a fixed income security or convertible bond.'

'Specifies the total amount of the issue. Corresponds to the par value multiplied by the number of issued security.'

'Specifies the frequency at which the bond pays, e.g. 6M.'