|

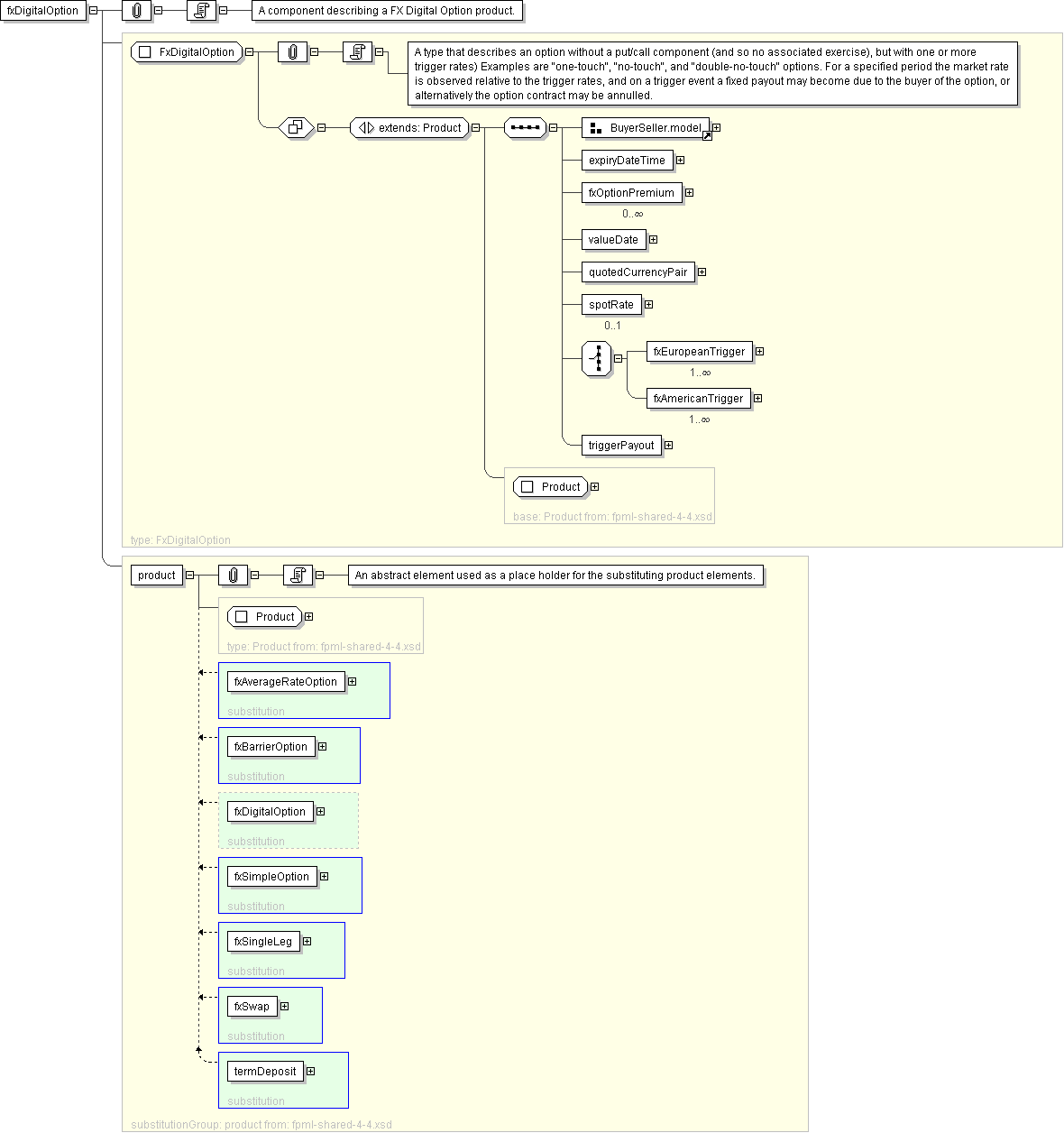

| Name | fxDigitalOption |

|---|---|

| Type | FxDigitalOption |

| Nillable | no |

| Abstract | no |

| Documentation | A component describing a FX Digital Option product. |

'A classification of the type of product. FpML defines a simple product categorization using a coding scheme.'

'A product reference identifier allocated by a party. FpML does not define the domain values associated with this element. Note that the domain values for this element are not strictly an enumerated list.'

'A reference to the party that buys this instrument, ie. pays for this instrument and receives the rights defined by it. See 2000 ISDA definitions Article 11.1 (b). In the case of FRAs this the fixed rate payer.'

'A reference to the party that sells (\"writes\") this instrument, i.e. that grants the rights defined by this instrument and in return receives a payment for it. See 2000 ISDA definitions Article 11.1 (a). In the case of FRAs this is the floating rate payer.'

'The date and time in a location of the option expiry. In the case of american options this is the latest possible expiry date and time.'

'Premium amount or premium installment amount for an option.'

'Defines the two currencies for an FX trade and the quotation relationship between the two currencies.'

'An optional element used for FX forwards and certain types of FX OTC options. For deals consumated in the FX Forwards Market, this represents the current market rate for a particular currency pair. For barrier and digital/binary options, it can be useful to include the spot rate at the time the option was executed to make it easier to know whether the option needs to move \"up\" or \"down\" to be triggered.'

'A European trigger occurs if the trigger criteria are met, but these are valid (and an observation is made) only at the maturity of the option.'

'An American trigger occurs if the trigger criteria are met at any time from the initiation to the maturity of the option.'

'The amount of currency which becomes payable if and when a trigger event occurs.'