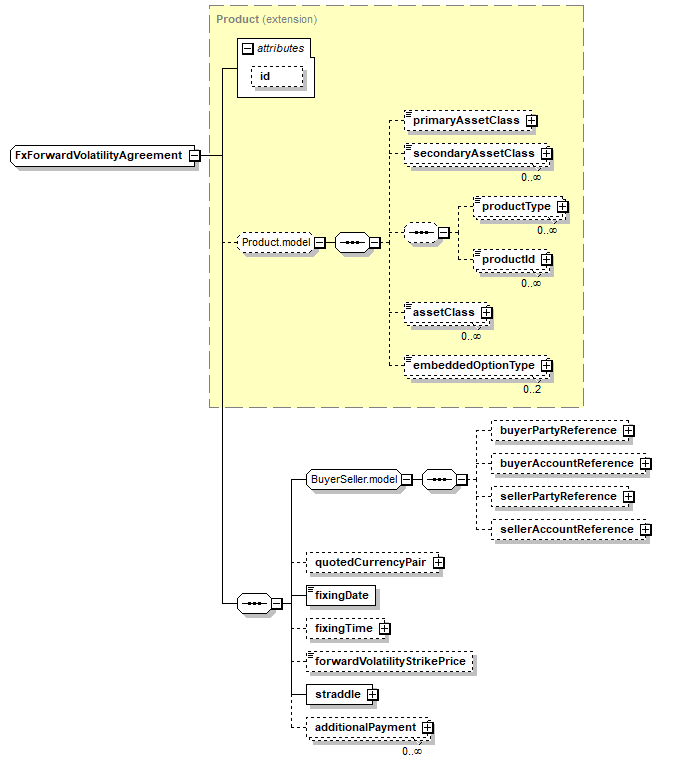

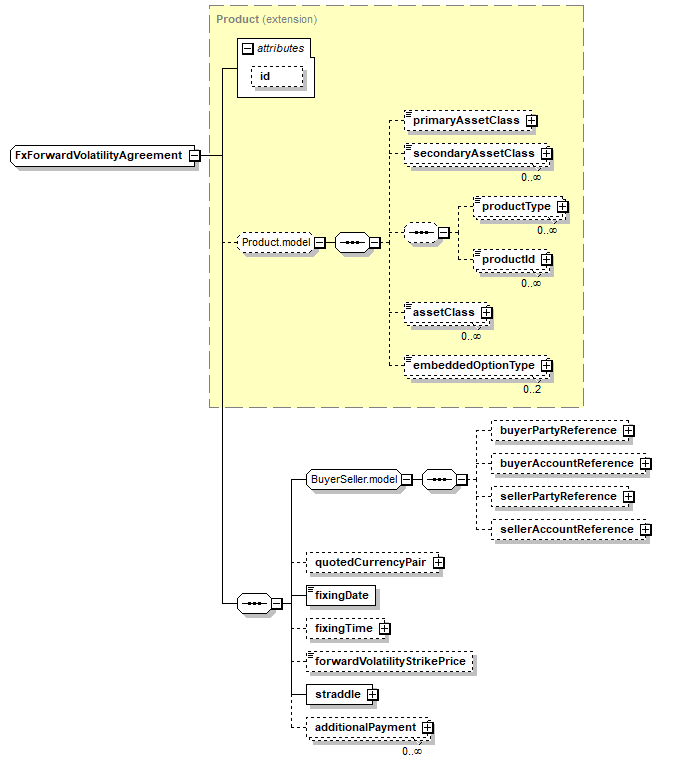

complexType "FxForwardVolatilityAgreement"

Namespace: |

|

Content: |

|

Defined: |

|

Includes: |

|

Used: |

|

XML Representation Summary |

<... |

|

|

|

> |

|

Content: |

( primaryAssetClass?, secondaryAssetClass*, ( productType*, productId*)?, assetClass*, embeddedOptionType[0..2])?, buyerPartyReference?, buyerAccountReference?, sellerPartyReference?, sellerAccountReference?, quotedCurrencyPair?, fixingDate, fixingTime?, forwardVolatilityStrikePrice?, straddle, additionalPayment* |

|

</...> |

Content Model Elements (16):

-

All Direct / Indirect Based Elements (1):

-

Annotation

Describes a contract on future levels of implied volatility. The main characteristic of this product is that the underlying is a straddle (underlying options) with a specific tenor starting from the fixing (effective or pricing) date, and are priced on that fixing date using a level of volatility that is agreed at the time of execution of the volatility agreement.

|

Type Derivation Tree

FxForwardVolatilityAgreement FxForwardVolatilityAgreement

|

XML Source (w/o annotations (8); see within schema source)

<xsd:complexContent>

<xsd:extension base="Product">

<xsd:sequence>

</xsd:sequence>

</xsd:extension>

</xsd:complexContent>

</xsd:complexType>

|

Content Element Detail (all declarations; defined within this component only; 6/16)

-

The currency, amount and payment details for the Forward Volatility Agreement, as agreed at the time of execution.

XML Source (w/o annotations (1); see within schema source)

-

Type: |

xsd:date, predefined, simple content |

The date when the underlying options are priced using the agreed forwardVolatilityStrikePrice and other market factors as agreed by the parties. Also known as "Effective Date" or "Reference Date".

XML Source (w/o annotations (1); see within schema source)

-

The time of the fixing date when the underlying options are priced using the agreed forwardVolatilityStrikePrice and other market factors as agreed by the parties.

XML Source (w/o annotations (1); see within schema source)

-

the Volatility level as agreed on the Trade Date.

Simple Content

XML Source (w/o annotations (1); see within schema source)

-

A currency Pair the straddle is based on.

XML Source (w/o annotations (1); see within schema source)

-

details of the straddle (underlying options).

XML Source (w/o annotations (1); see within schema source)