Namespace: |

|

Content: |

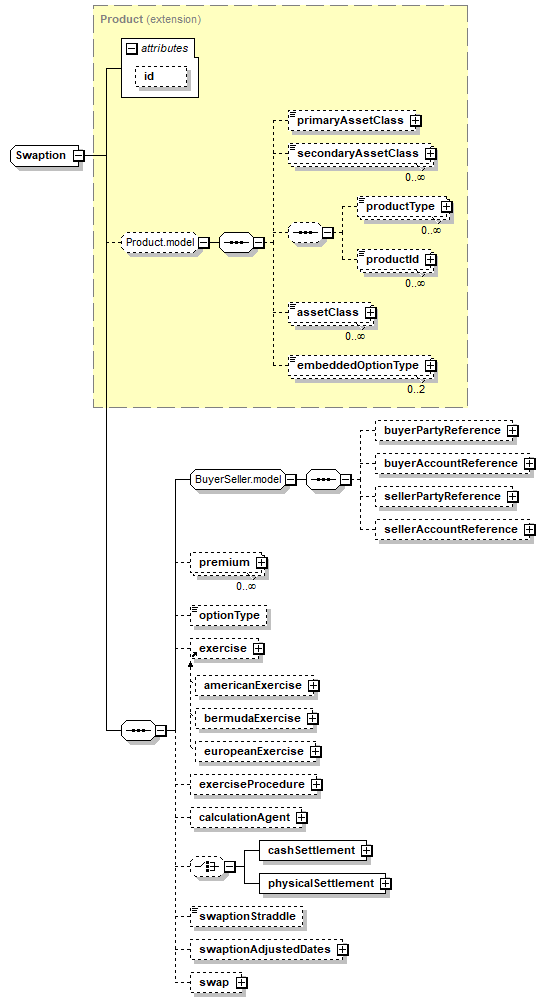

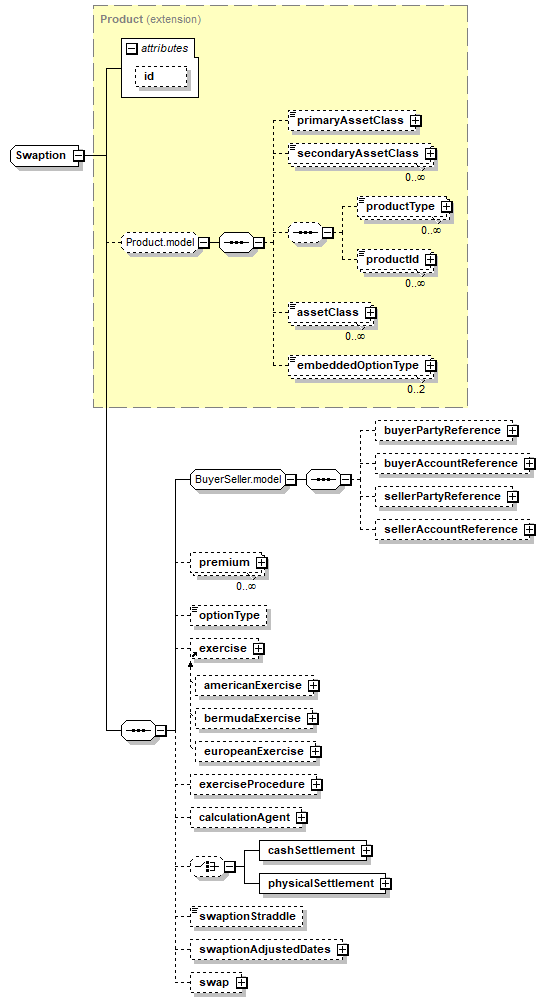

complex, 1 attribute, 20 elements |

Defined: |

globally in fpml-ird-5-10.xsd; see XML source |

Includes: |

definitions of 10 elements |

Used: |

at 1 location |

XML Representation Summary |

||||||

<... |

||||||

|

||||||

> |

||||||

|

||||||

</...> |

||||||

|

Type Derivation Tree

Product (extension)

|

|

<xsd:complexContent>

<xsd:extension base="Product">

</xsd:complexContent>

<xsd:sequence>

</xsd:extension>

<xsd:group ref="BuyerSeller.model"/>

</xsd:sequence>

<xsd:choice minOccurs="0">

</xsd:choice>

</xsd:complexType>

|

Type: |

CalculationAgent, complex content |

Type: |

CashSettlement, complex content |

Type: |

Exercise, empty content

|

Abstract: |

(may not be used directly in instance XML documents) |

Subst.Gr: |

may be substituted with 3 elements |

Type: |

ExerciseProcedure, complex content |

Type: |

SwaptionTypeEnum, simple content |

|

enumeration of xsd:token

|

Enumeration: |

|

Type: |

SwaptionPhysicalSettlement, complex content |

Type: |

Payment, complex content |

Type: |

Swap, complex content |

Type: |

SwaptionAdjustedDates, complex content |

Type: |

xsd:boolean, predefined, simple content |

|

XML schema documentation generated with DocFlex/XML 1.10b5 using DocFlex/XML XSDDoc 2.8.1 template set. All content model diagrams generated by Altova XMLSpy via DocFlex/XML XMLSpy Integration.

|