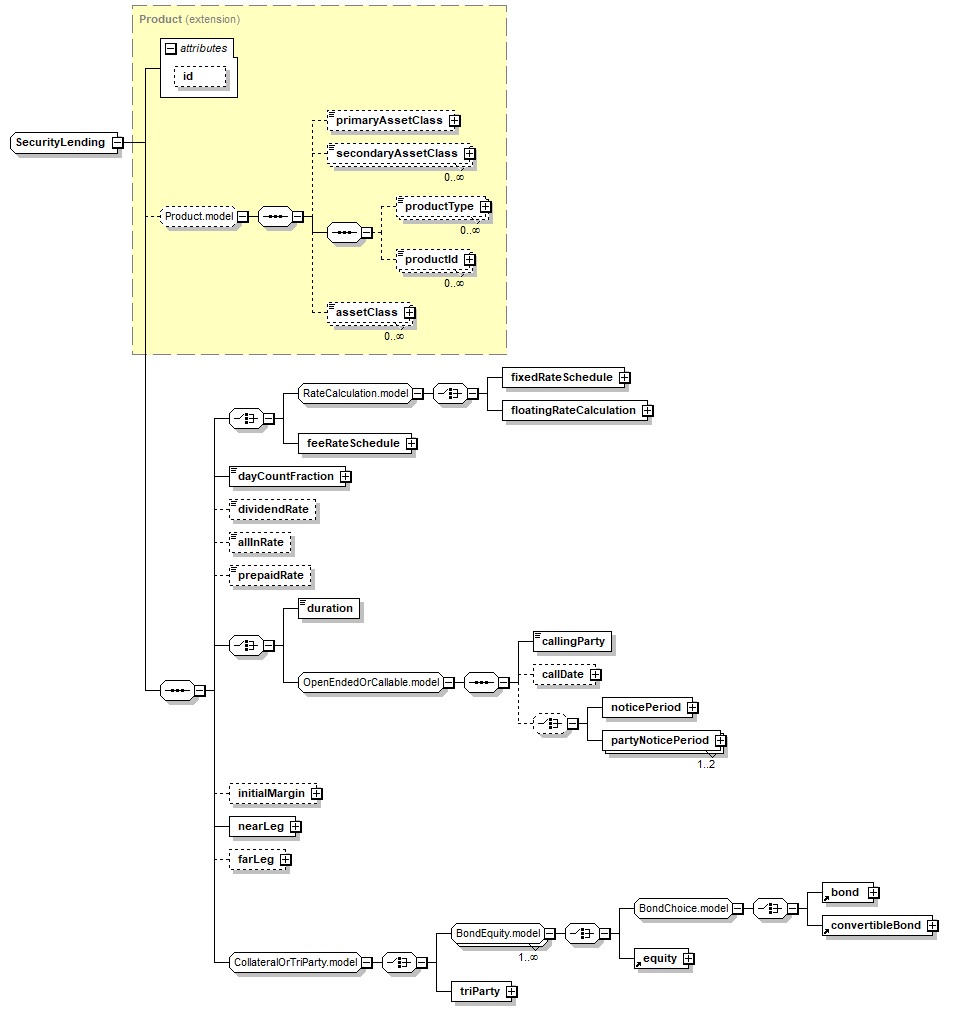

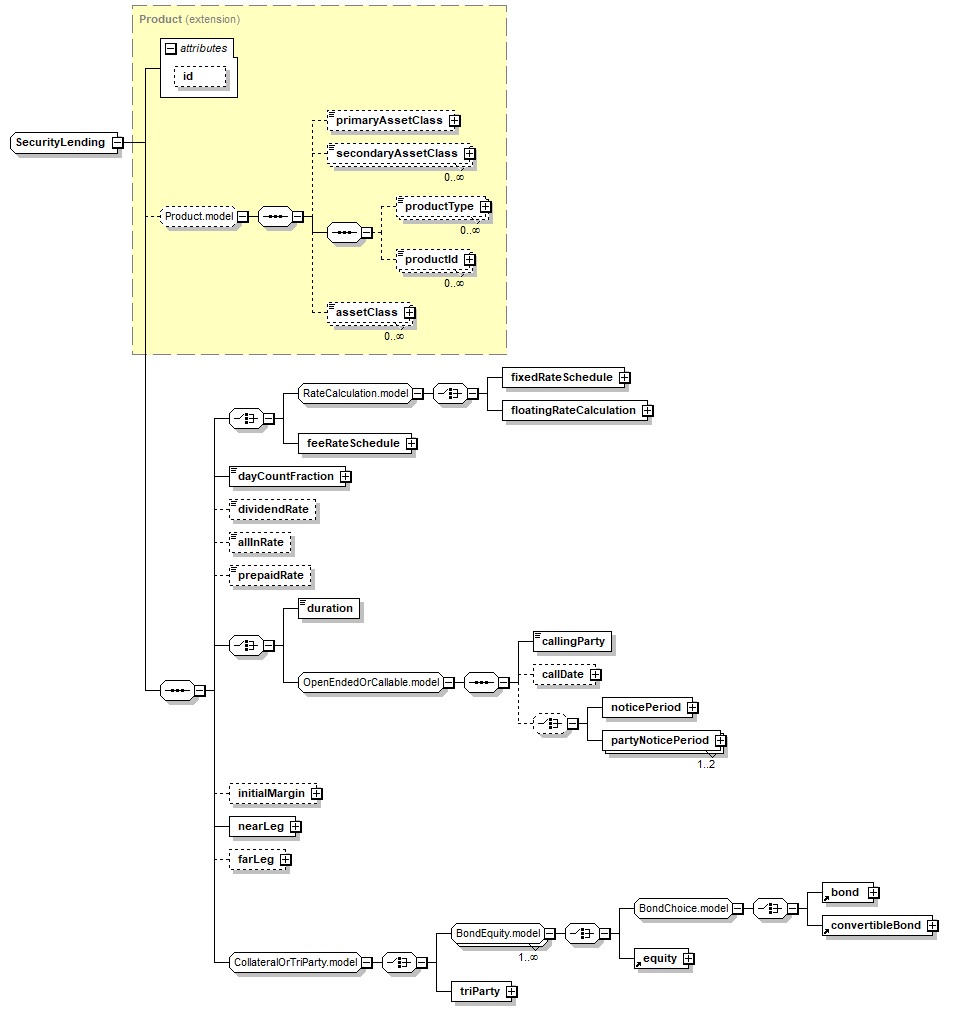

complexType "SecurityLending"

Namespace: |

|

Content: |

|

Defined: |

|

Includes: |

|

Used: |

|

XML Representation Summary |

<... |

|

|

|

> |

|

Content: |

( primaryAssetClass?, secondaryAssetClass*, productType*, productId*, assetClass*)?, ( fixedRateSchedule | floatingRateCalculation | feeRateSchedule), dayCountFraction, dividendRate?, allInRate?, prepaidRate?, ( duration | ( callingParty, callDate?, ( noticePeriod | partyNoticePeriod[1..2])?)), initialMargin?, nearLeg, farLeg?, (( bond | convertibleBond | equity)+ | triParty) |

|

</...> |

Content Model Elements (24):

-

All Direct / Indirect Based Elements (1):

-

Annotation

A Security Lending, modeled as an FpML:Product. The owner of the securities lends the securities for collateral, which may be cash or non-cash collateral at: an agreed date, specific time frame and price. The stock borrower supplies the collateral: The stock borrower pays a fee on the stock being lent. If cash collateral, the cash borrower pays a rate of interest known as a rebate. Note: this Security Lending model is a candidate model for further industry input.

|

Type Derivation Tree

SecurityLending SecurityLending

|

XML Source (w/o annotations (14); see within schema source)

<xsd:complexContent>

<xsd:extension base="Product">

<xsd:sequence>

<xsd:choice>

</xsd:choice>

<xsd:element minOccurs="0" name="dividendRate" type="xsd:decimal"/>

<xsd:element minOccurs="0" name="allInRate" type="xsd:decimal"/>

<xsd:element minOccurs="0" name="prepaidRate" type="xsd:decimal"/>

<xsd:choice>

</xsd:choice>

</xsd:sequence>

</xsd:extension>

</xsd:complexContent>

</xsd:complexType>

|

Content Element Detail (all declarations; defined within this component only; 9/24)

-

Type: |

xsd:decimal, predefined, simple content |

Specifies the rate used to express the cost of borrowing as a percentage of dividend value and is useful when borrowing over dividend season.

XML Source (w/o annotations (1); see within schema source)

<xsd:element minOccurs="0" name="allInRate" type="xsd:decimal"/>

|

-

The day count fraction for calculating a fee or a rebate on a SBL transaction.

Simple Content

maxLength: |

255

|

minLength: |

0

|

XML Source (w/o annotations (1); see within schema source)

-

Type: |

xsd:decimal, predefined, simple content |

Specifies the proportion of the value of the dividend on the borrowed shares that the borrower is legally obligated to return to the lender.

XML Source (w/o annotations (1); see within schema source)

<xsd:element minOccurs="0" name="dividendRate" type="xsd:decimal"/>

|

-

A duration code for the security lending transaction. This defines a type of a security lending transaction with fixed duration. The fixed duration can only by Term for a security lending transaction.

Simple Content

Enumeration: |

"Term" |

- |

Indicates that a contract is a regular term contract, with a start date and an end date. Business rule: When the repo is 'Term', both spot and forward legs must be specified.

|

|

XML Source (w/o annotations (1); see within schema source)

-

The far leg of the Security Lending and Borrowing (SBL) agreement. The Deliverer/Reciver model in the far leg must be the exact opposite of the one found in the near leg.

XML Source (w/o annotations (1); see within schema source)

-

The stock borrower pays a fee on the stock being lent.

XML Source (w/o annotations (1); see within schema source)

-

Defines initial margin applied to a SBL transaction.

XML Source (w/o annotations (1); see within schema source)

-

A Security Lending and Borrowing (SBL) agreement is modeled as two Deliverer/Receiver transactions which are called legs. This is the spot leg, i.e. the transaction that will be executed on the near settlement date of the contract.

XML Source (w/o annotations (1); see within schema source)

-

Type: |

xsd:decimal, predefined, simple content |

Specifies the rate which is applied to cash collateral when cash collateral settled ahead of borrowed security.

XML Source (w/o annotations (1); see within schema source)

<xsd:element minOccurs="0" name="prepaidRate" type="xsd:decimal"/>

|