Namespace: |

|

Content: |

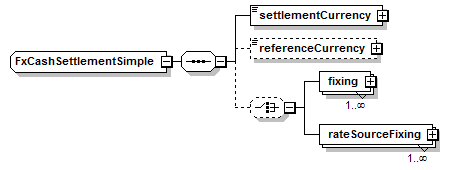

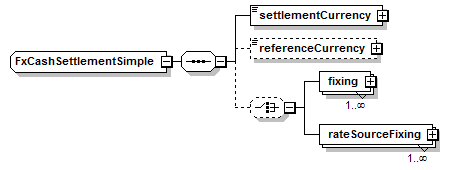

complex, 4 elements |

Defined: |

globally in fpml-shared-5-8.xsd; see XML source |

Includes: |

definitions of 4 elements |

Used: |

at 4 locations |

XML Representation Summary |

|||||

<...> |

|||||

|

|||||

</...> |

|||||

|

<xsd:sequence>

<xsd:element name="settlementCurrency" type="Currency"/>

<xsd:choice minOccurs="0">

</xsd:choice>

</xsd:sequence>

</xsd:complexType>

|

Type: |

FxFixing, complex content |

Type: |

FxRateSourceFixing, complex content |

Type: |

Currency, simple content |

|

xsd:normalizedString

|

maxLength: |

255

|

minLength: |

0

|

Type: |

Currency, simple content |

|

xsd:normalizedString

|

maxLength: |

255

|

minLength: |

0

|

|

XML schema documentation generated with DocFlex/XML 1.9.0 using DocFlex/XML XSDDoc 2.8.0 template set. All content model diagrams generated by Altova XMLSpy via DocFlex/XML XMLSpy Integration.

|