1.1 STATUS OF THIS DOCUMENT

This is the FpML 4.4 Recommendation for review by the public and by FpML members and working groups.

The FpML Working Groups encourage reviewing organizations to provide feedback as early as possible. Comments on this document should be sent by filling in the form at the following link: http://www.fpml.org/issues. An archive of the comments is available at http://www.fpml.org/issues/

There are also asset class-specific mailing lists; you can join them at the following link:

A list of current FpML Recommendations and other technical documents can be found at

This document has been produced as part of the FpML 4.4 activity and is part of the Standards Approval Process.

The FpML documentation is organized into a number of subsections.

This section provides an overview of the specification.

1.2.1 Schema Reference

These are automatically generated reference documents detailing the contents of the various sections in the FpML schema.

- Core Definitions:

- Products:

- EQD

- Bond Options

- Options

- Loan

- Pricing and Risking:

- Messaging Framework:

- Allocation Components

- Confirmation Components

- Contract Notification Components

- Credit Event Notification Components

- Matching Status Components

- Messaging Components

- Pre-trade Components

- Trade Notification Components

- Trade Execution Components

- Post-trade Confirmation Components

- Post-trade Execution Components

- Post-trade Negotiation Components

- Post-trade Components

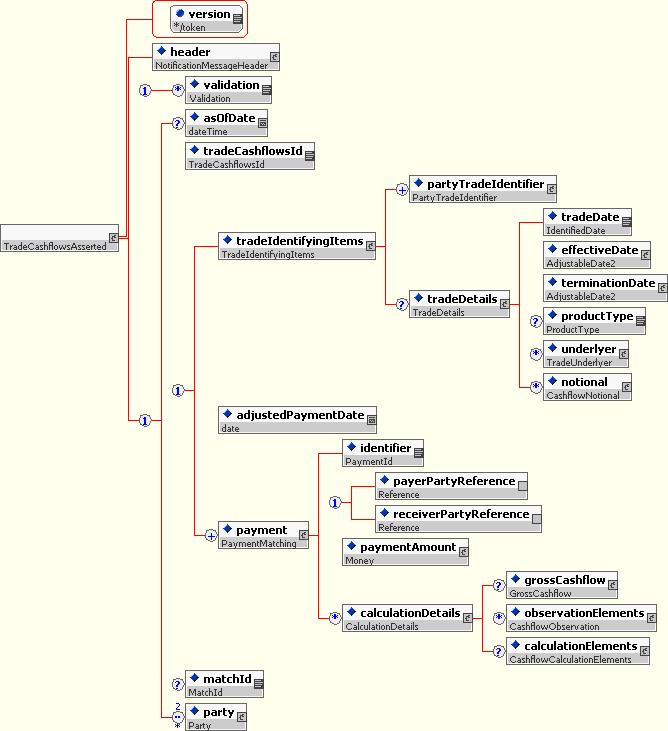

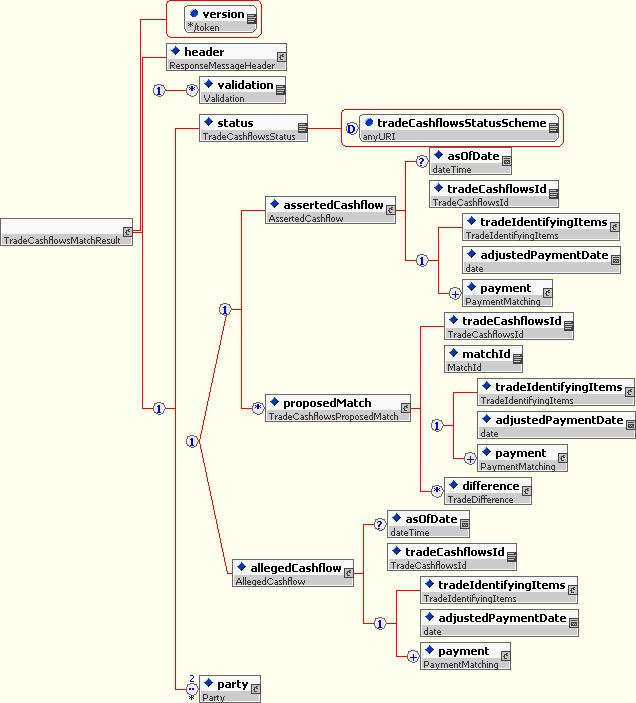

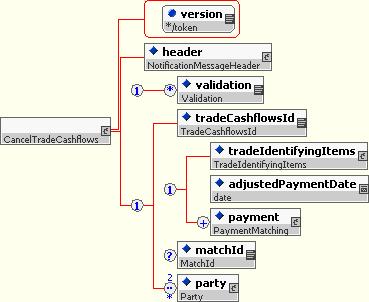

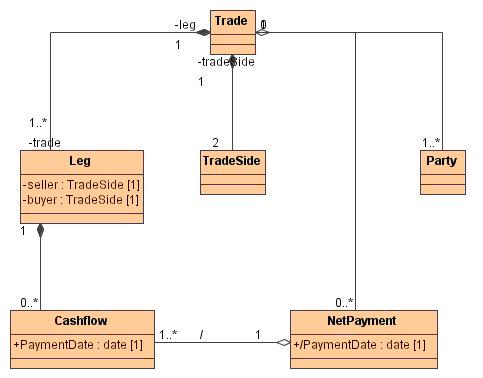

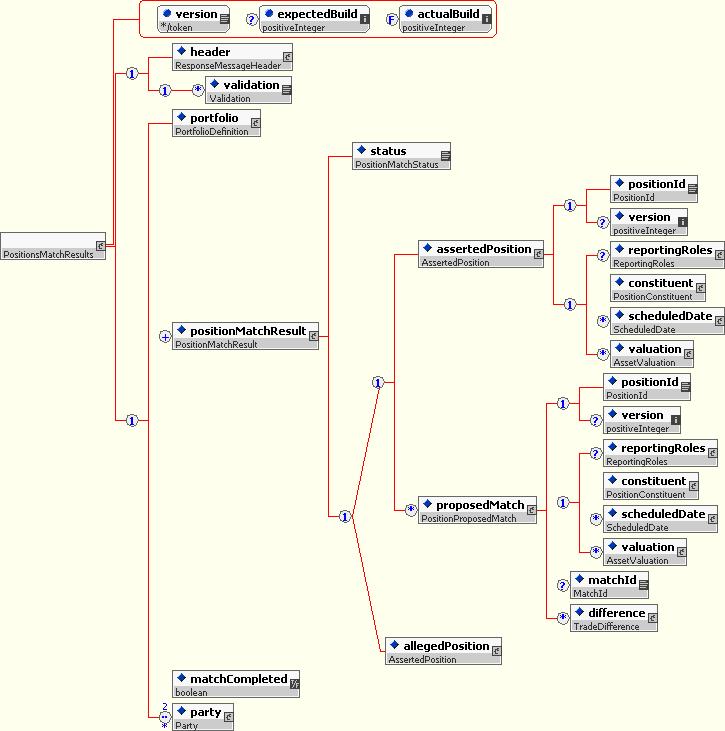

- Cash Flow Matching and Portfolio Reconciliation Components

- Reference:

- Index and cross-reference of definitions

- Schema and Example files - Provides zip file with FpML schemas and examples.

1.2.2 Other Documents in the Specification

- Examples - Provides sample FpML for each section.

- Scheme Definitions - Describes standard FpML schemes, and the values that they can take.

- FpML Products Object Model (PDF) - Gives an overview of the financial products covered in FpML and their interrelationships.

- FpML Messaging Object Model (PDF) - Gives an overview of the FpML Messaging Framework.

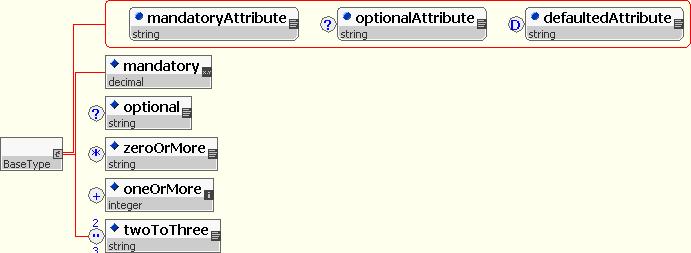

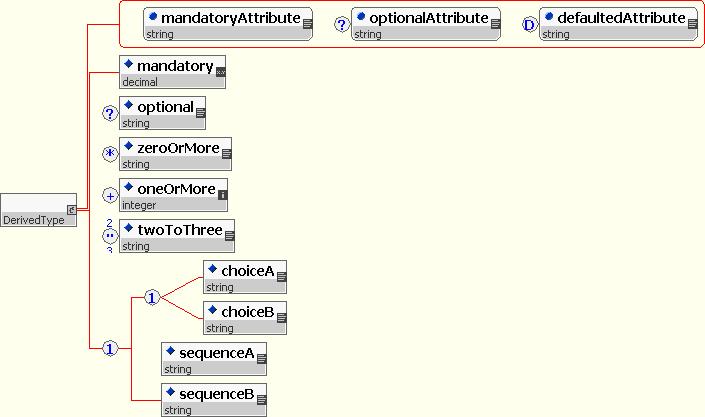

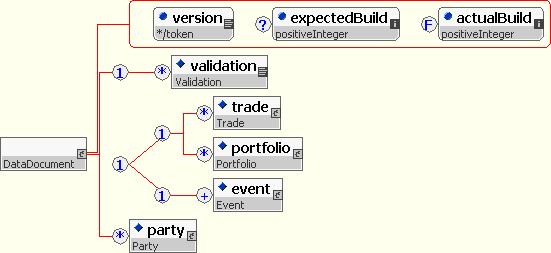

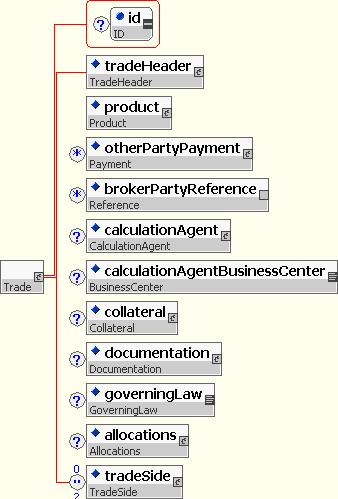

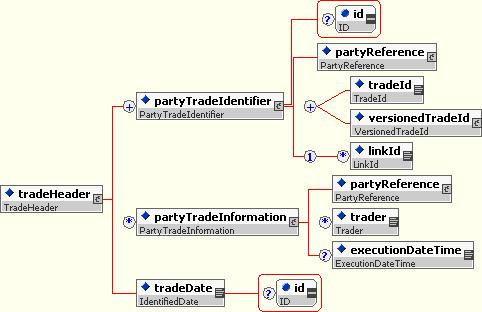

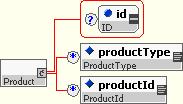

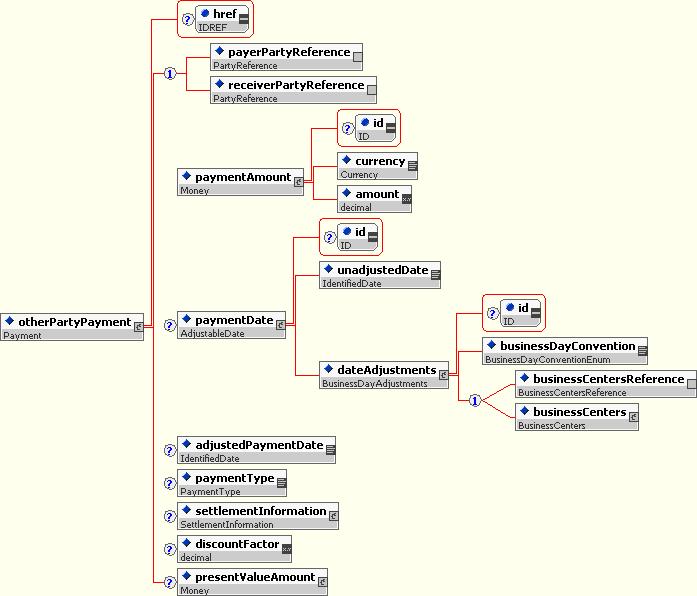

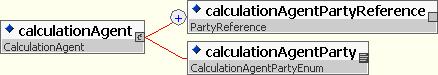

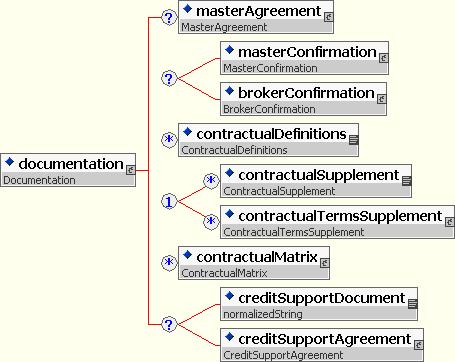

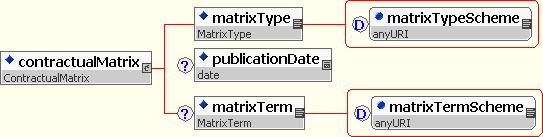

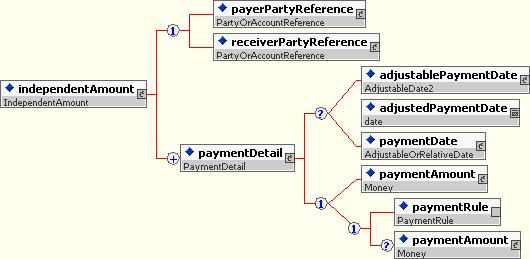

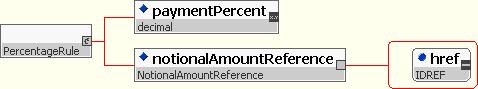

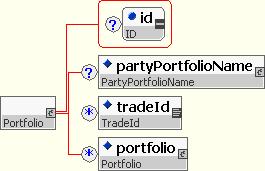

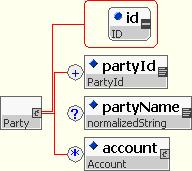

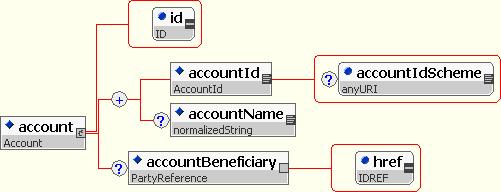

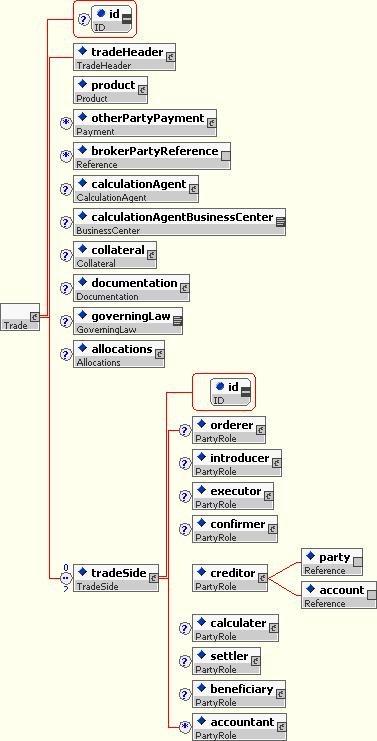

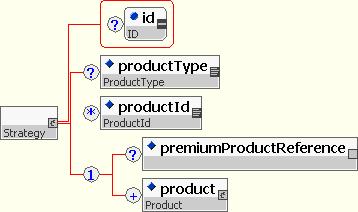

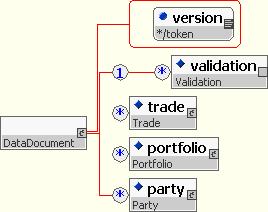

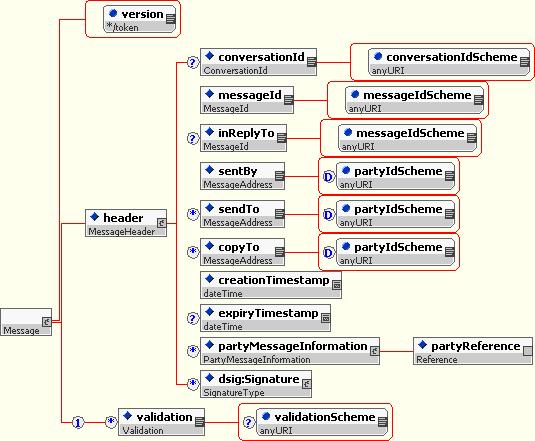

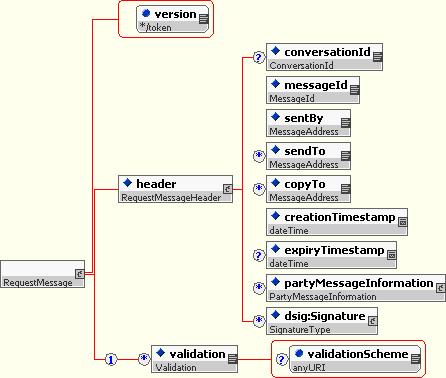

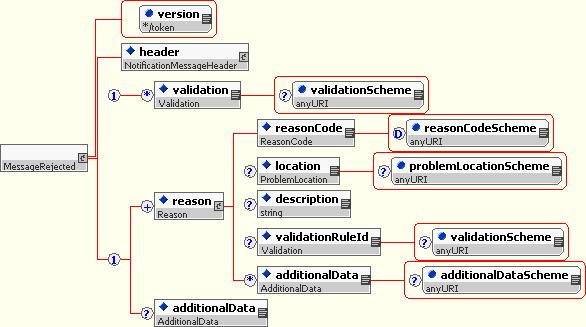

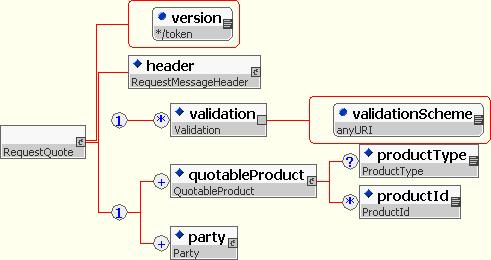

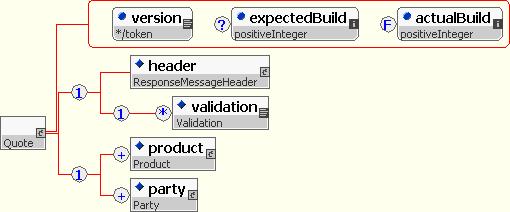

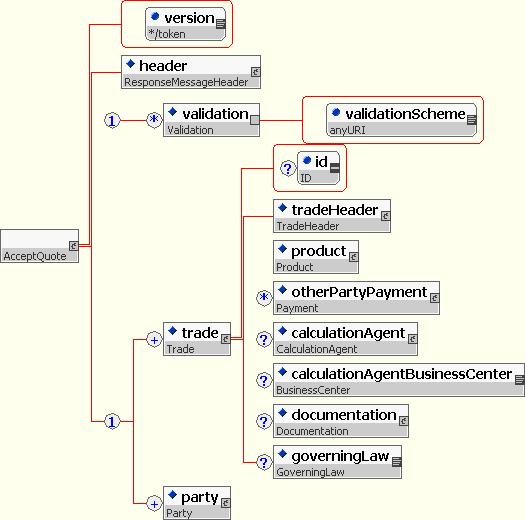

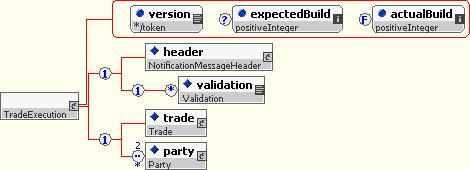

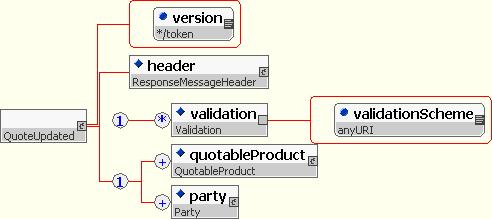

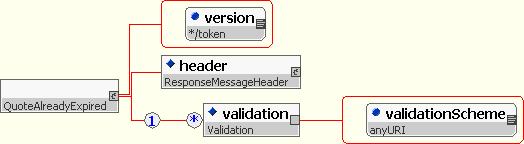

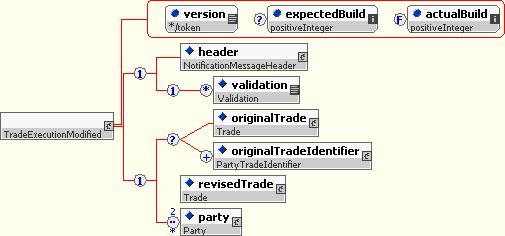

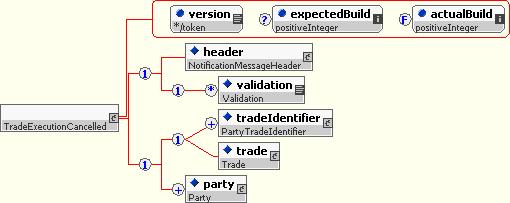

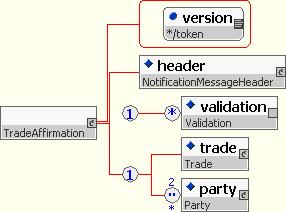

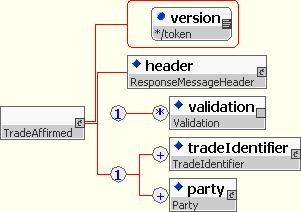

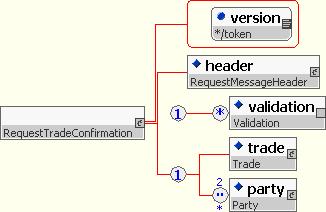

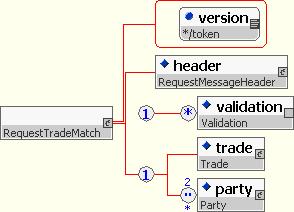

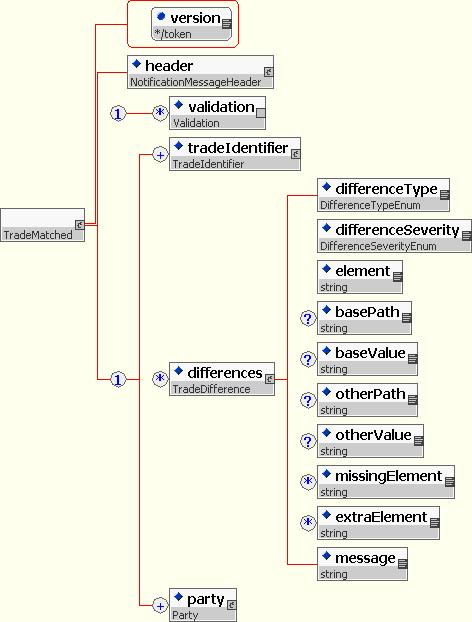

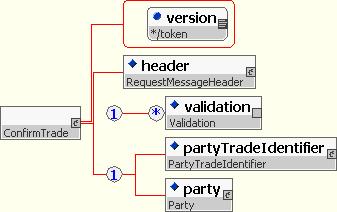

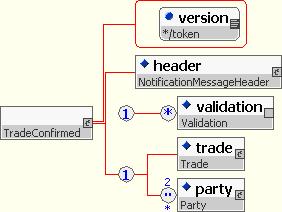

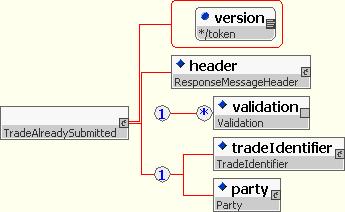

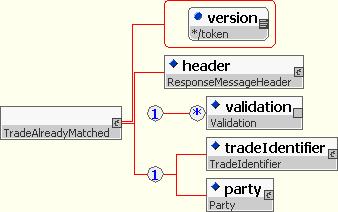

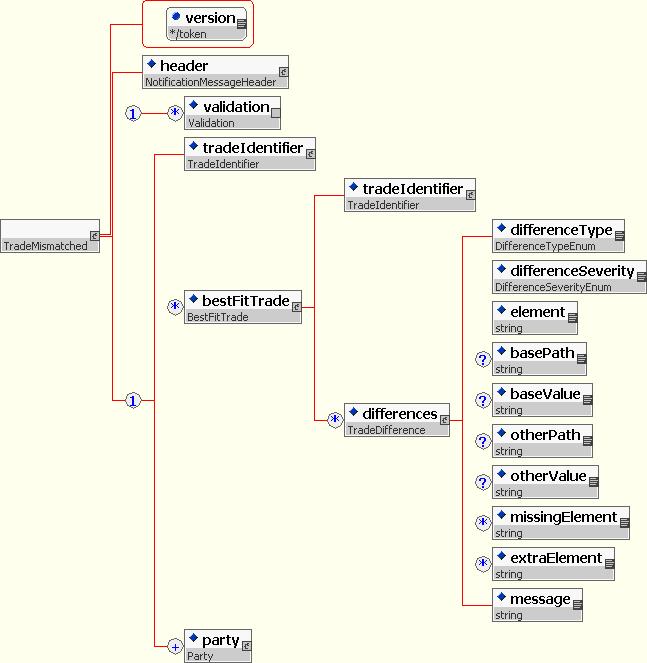

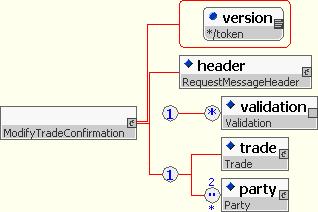

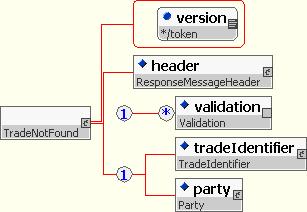

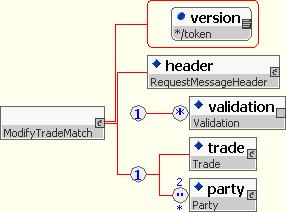

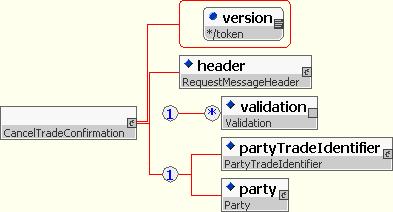

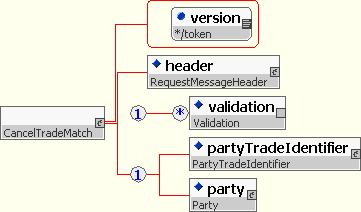

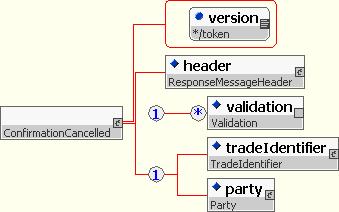

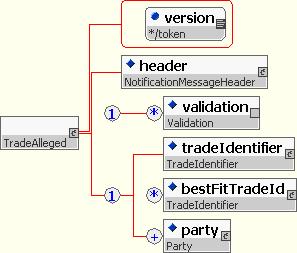

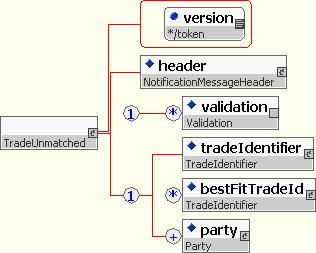

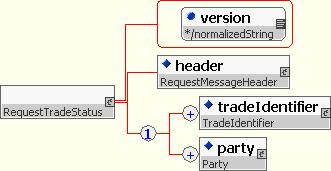

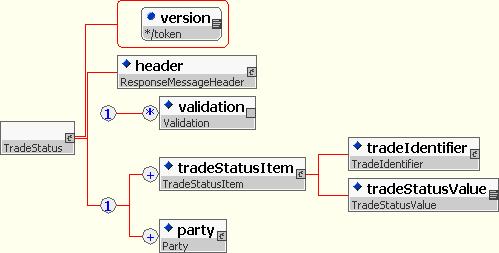

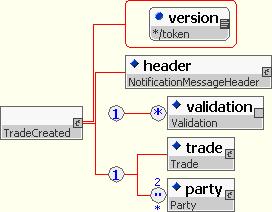

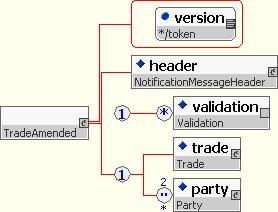

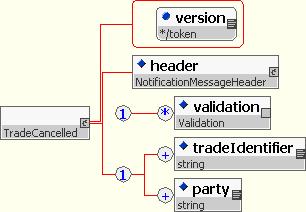

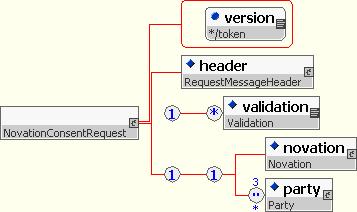

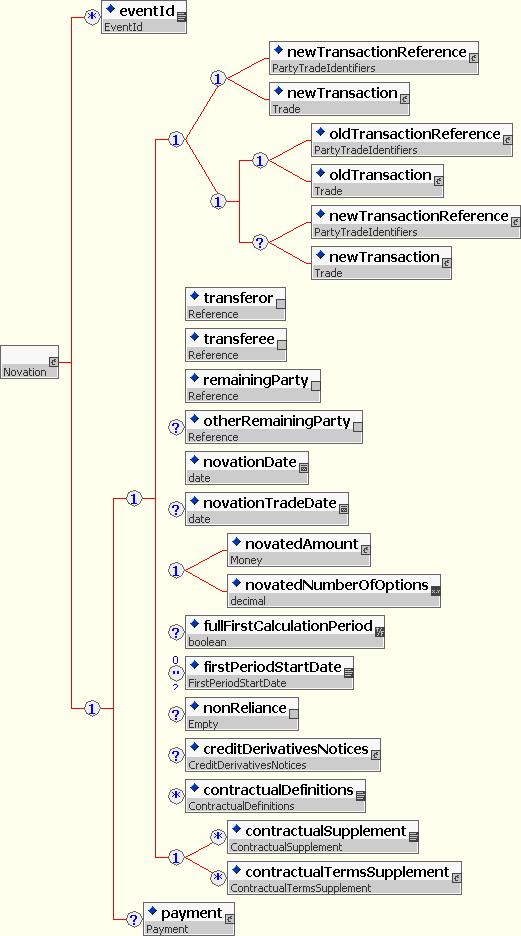

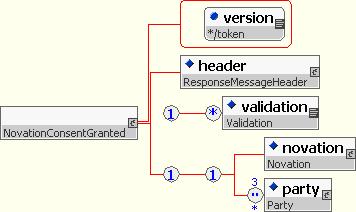

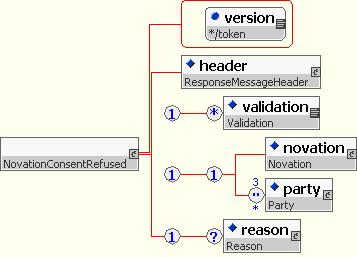

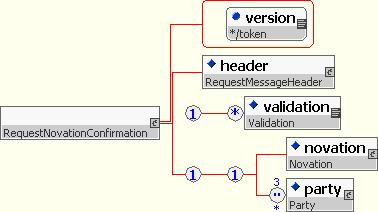

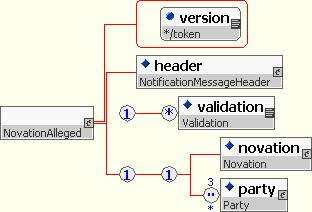

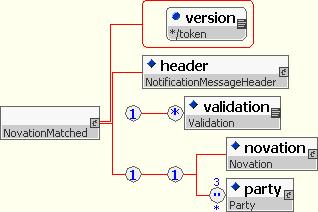

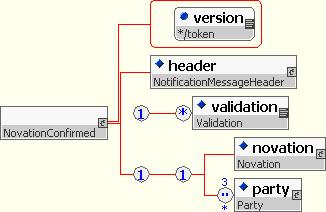

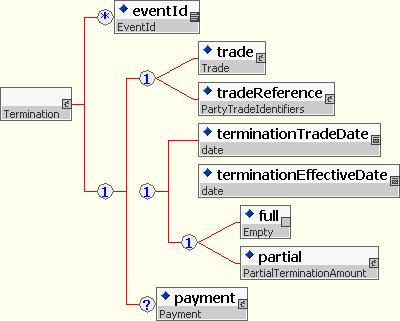

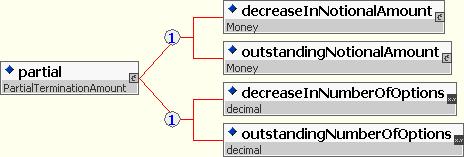

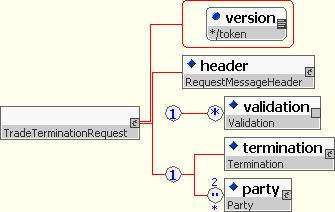

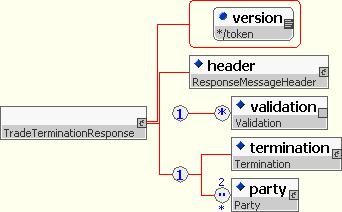

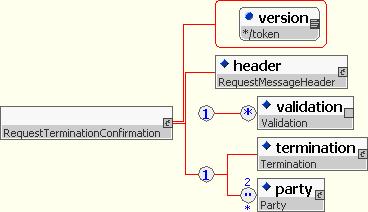

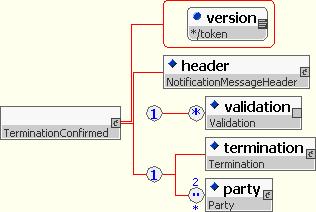

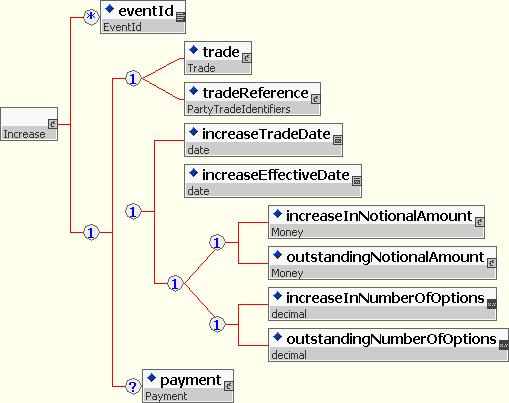

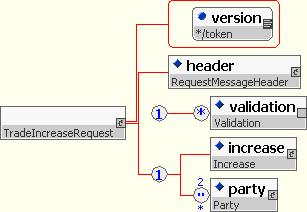

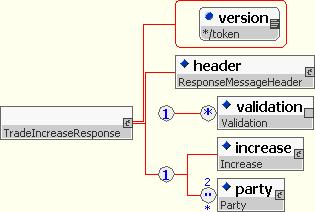

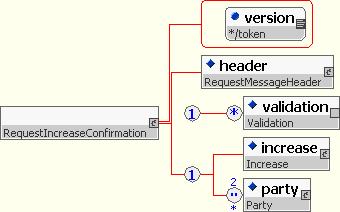

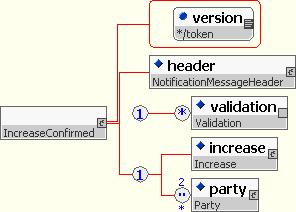

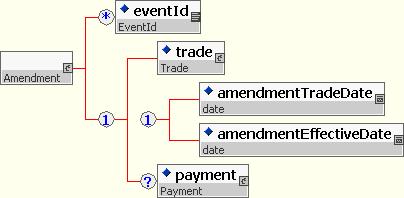

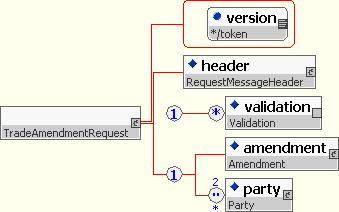

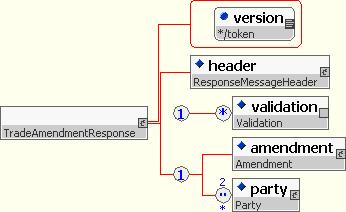

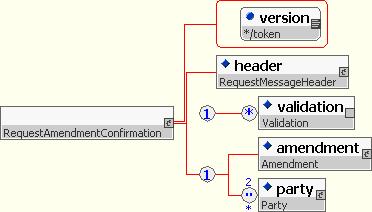

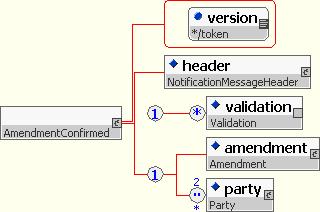

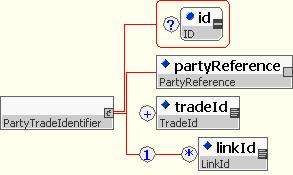

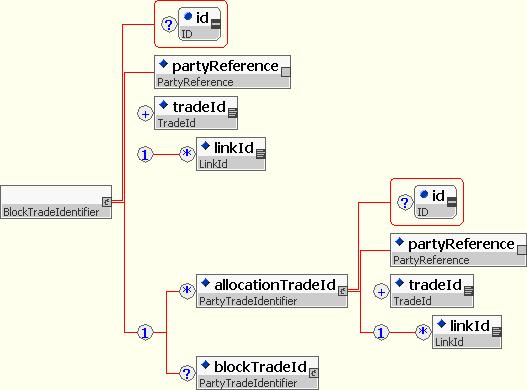

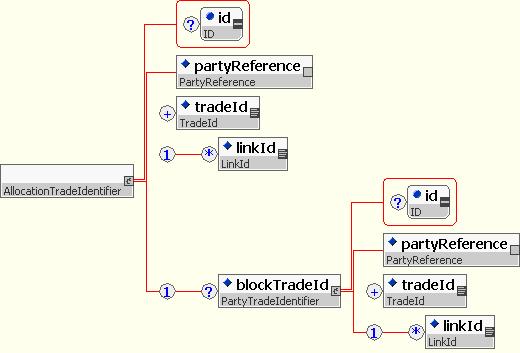

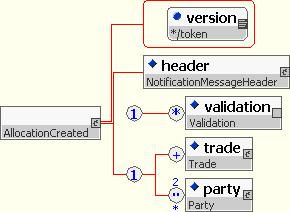

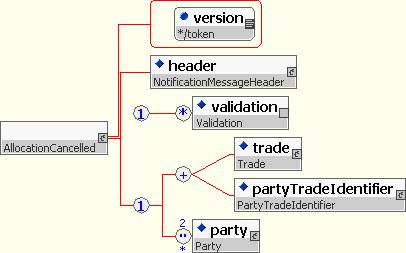

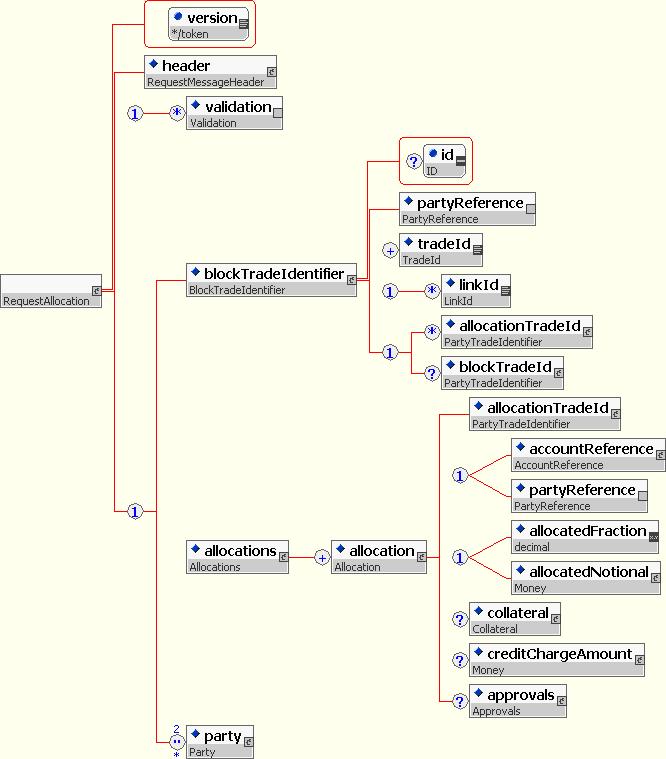

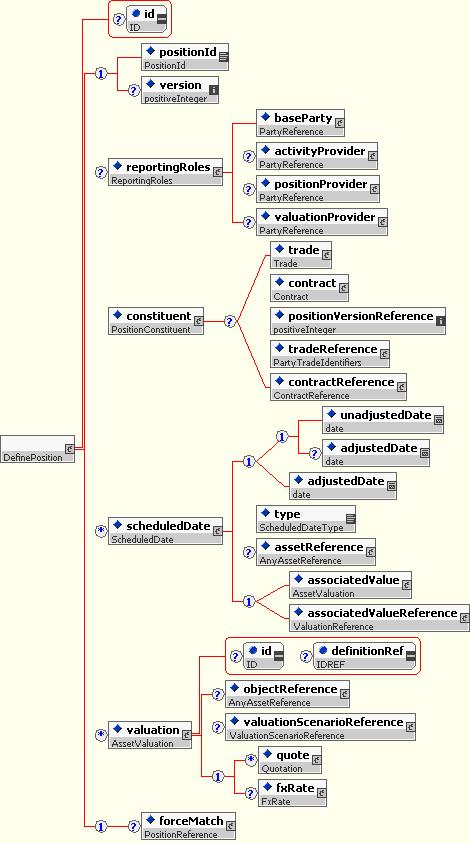

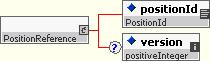

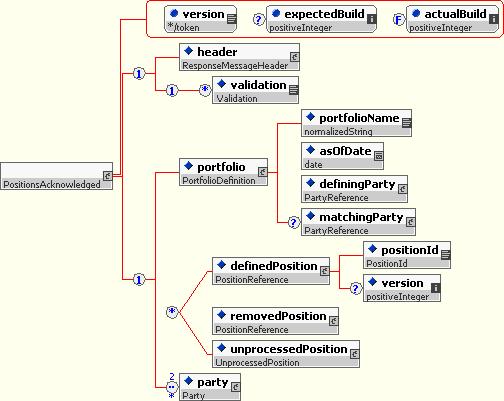

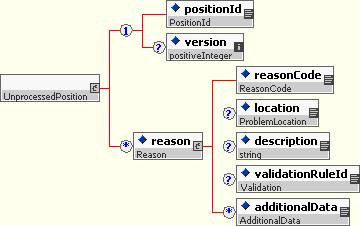

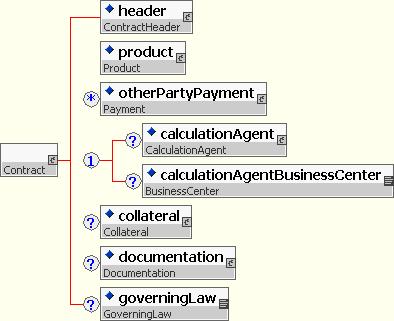

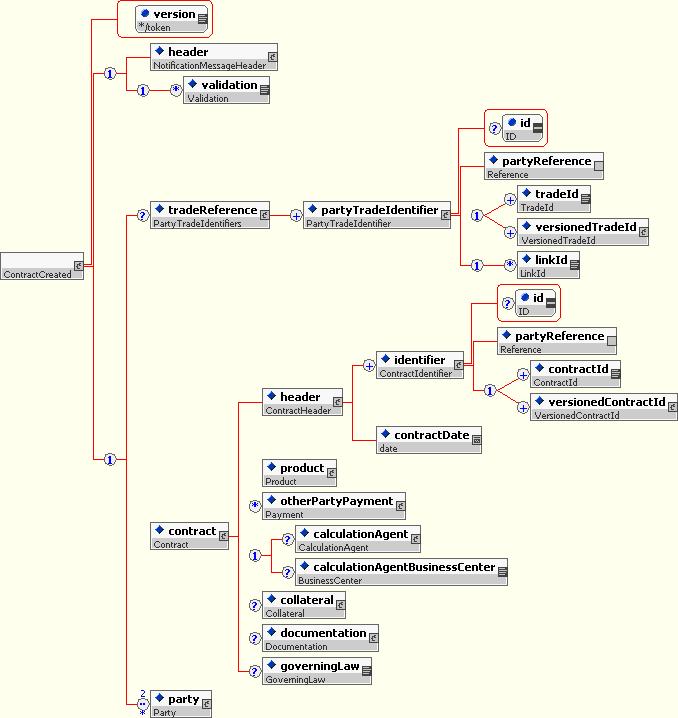

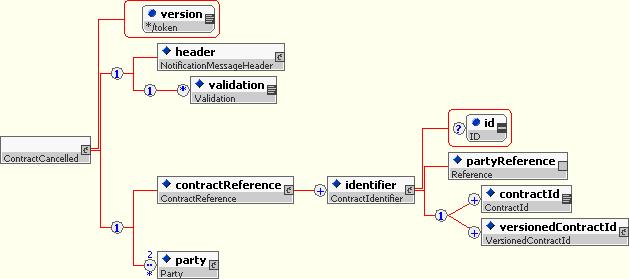

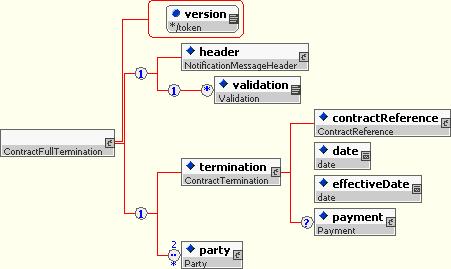

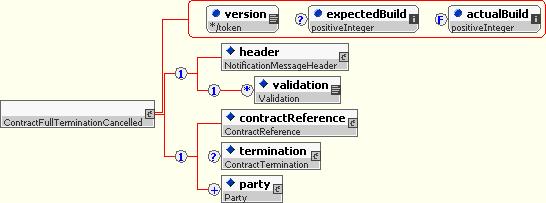

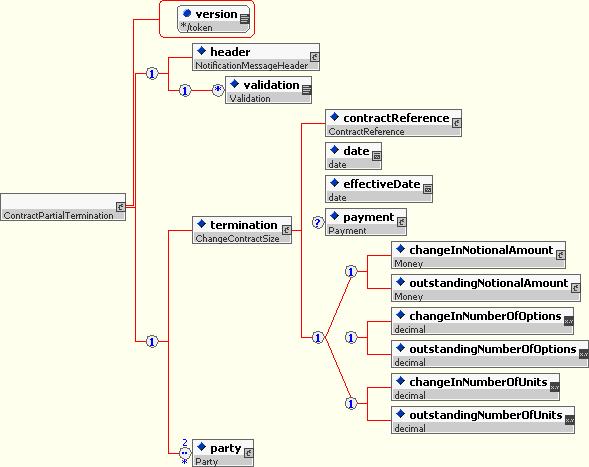

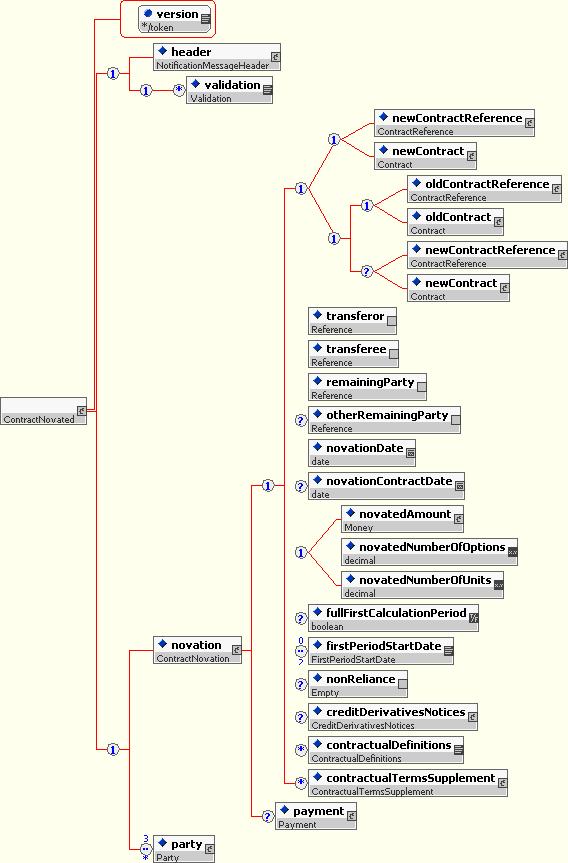

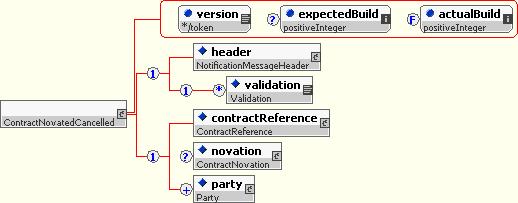

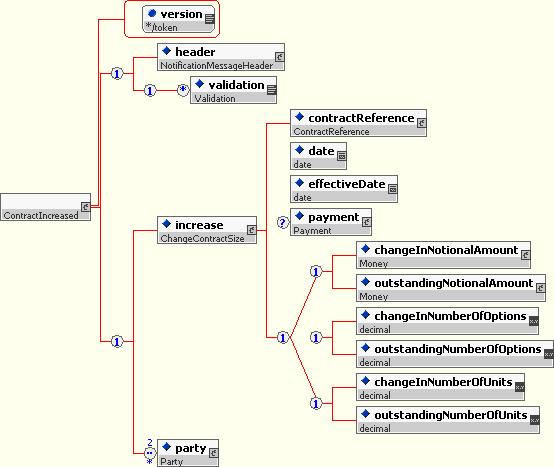

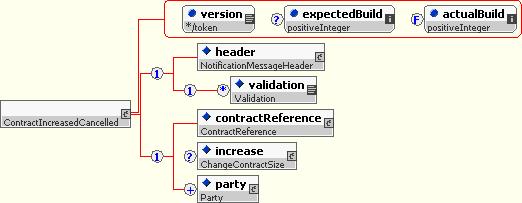

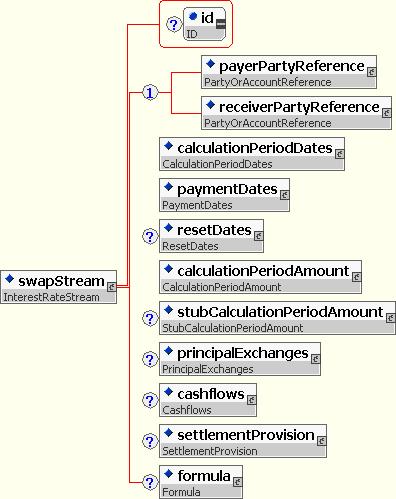

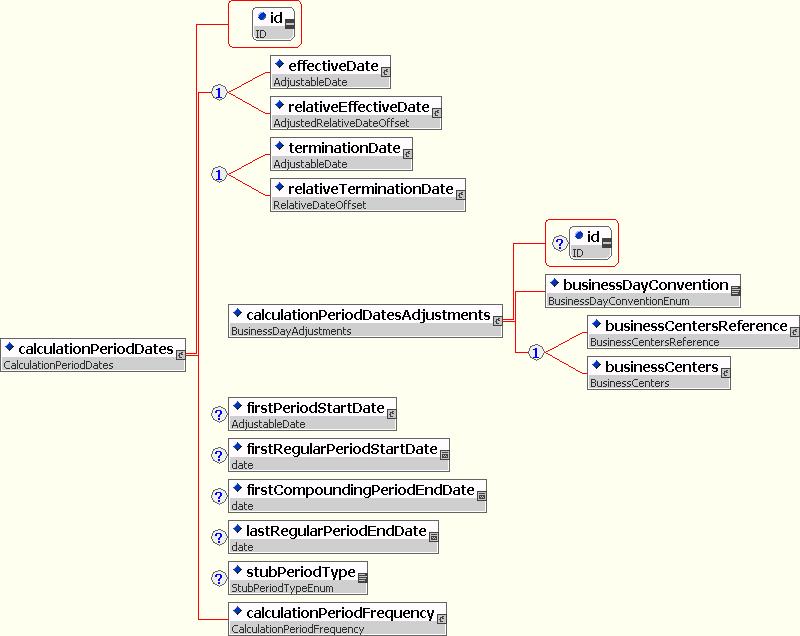

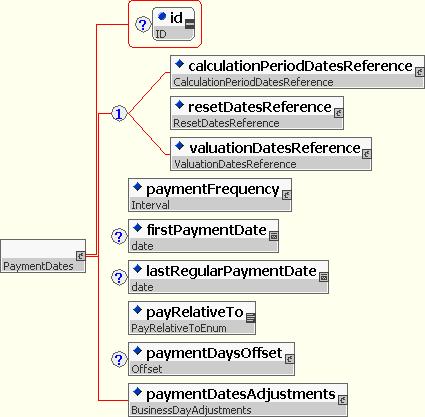

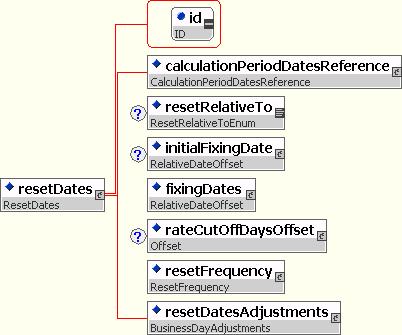

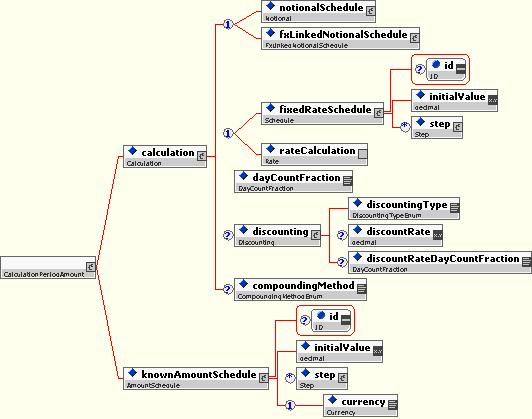

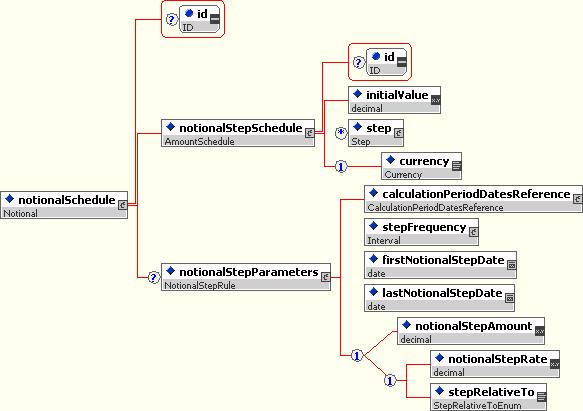

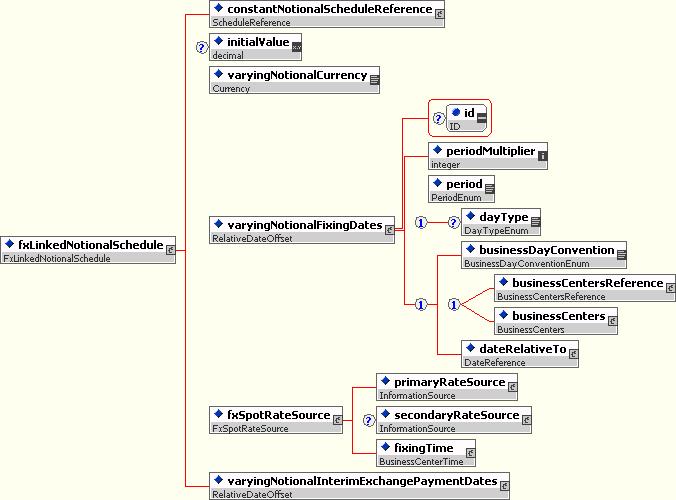

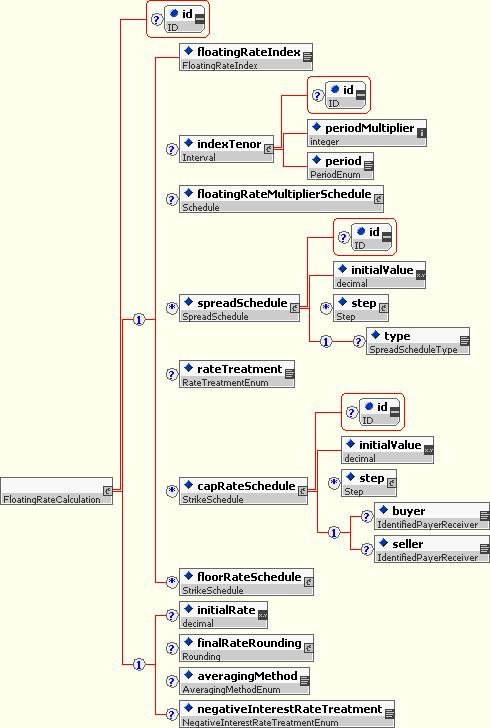

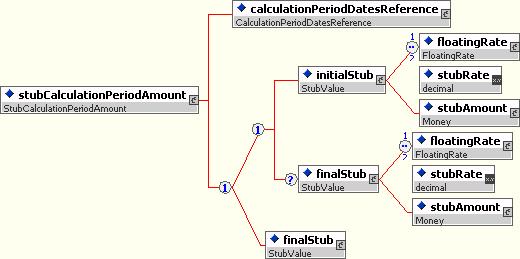

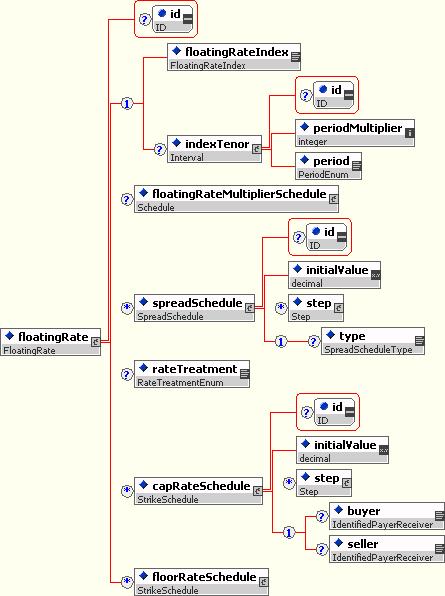

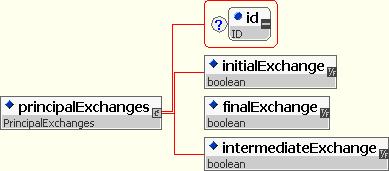

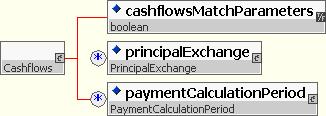

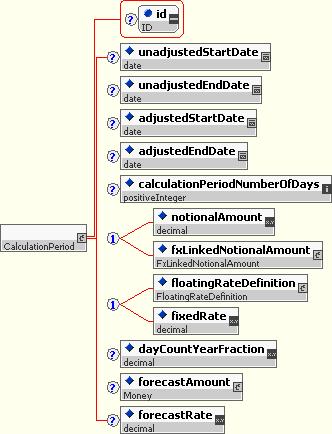

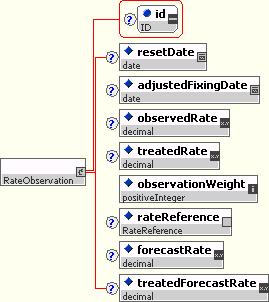

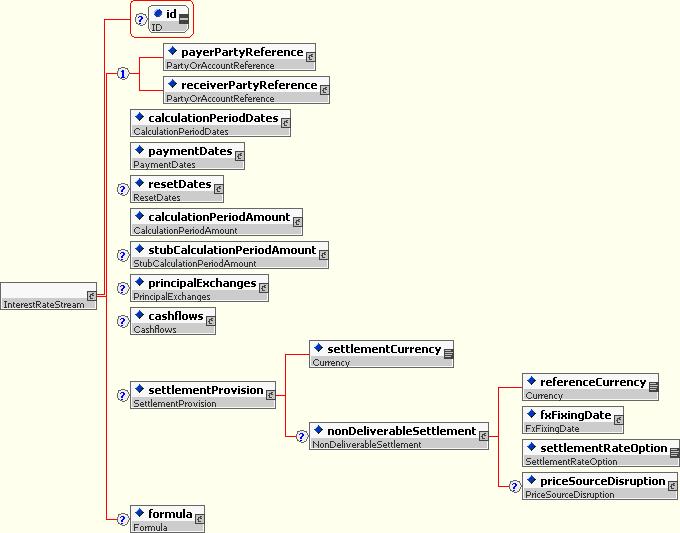

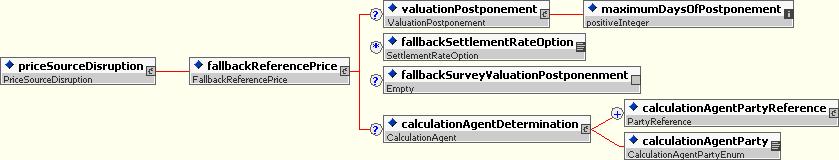

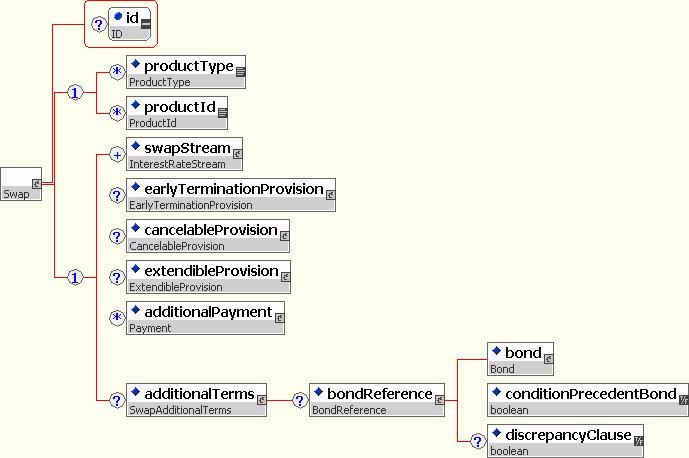

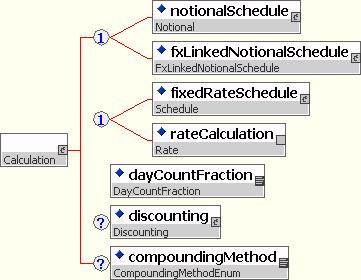

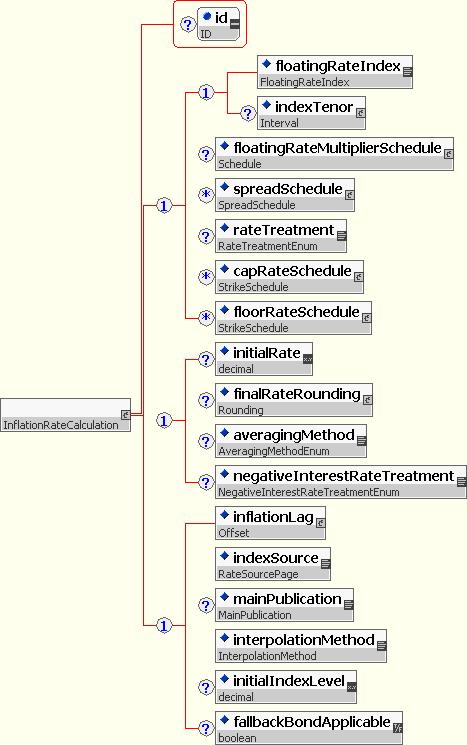

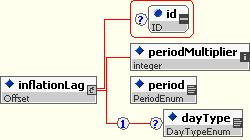

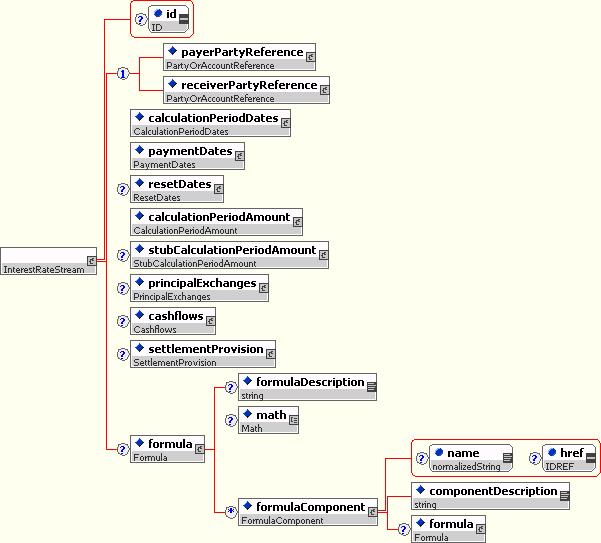

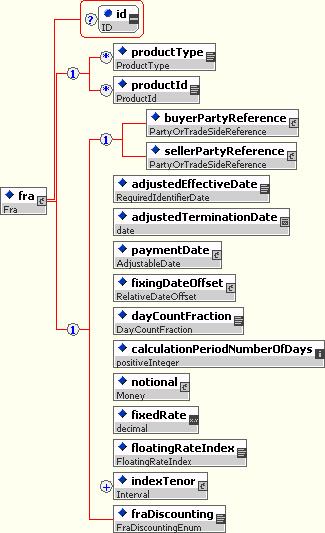

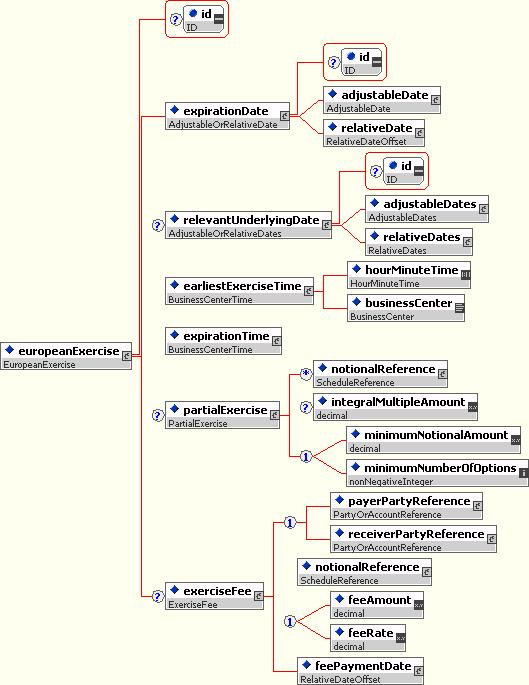

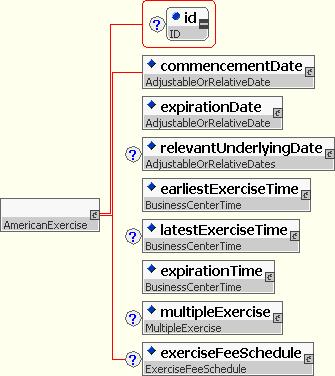

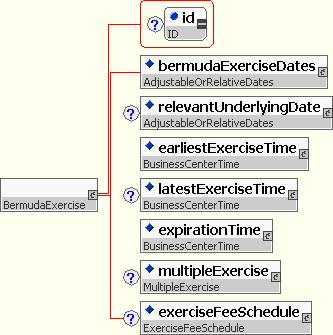

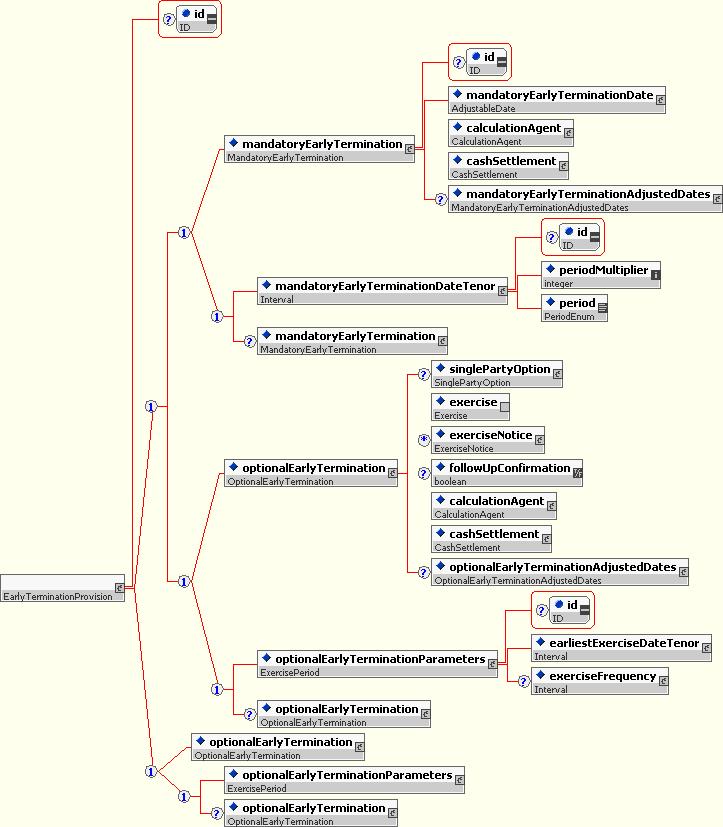

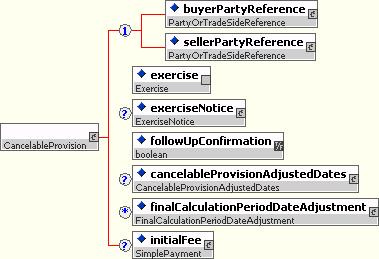

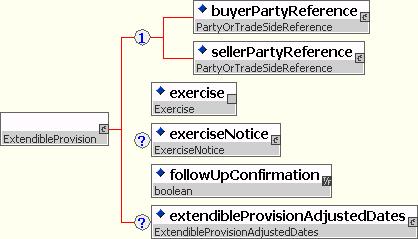

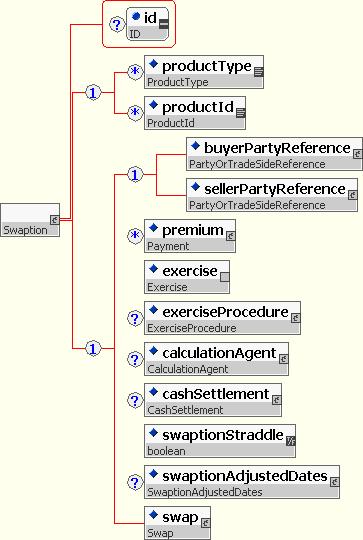

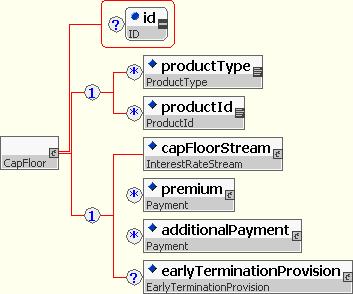

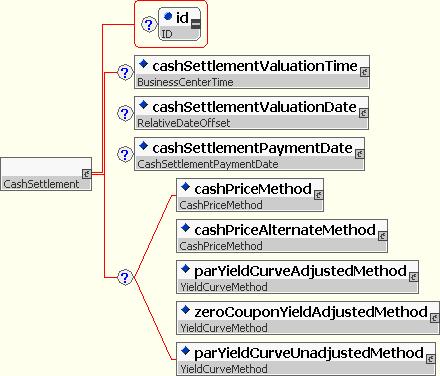

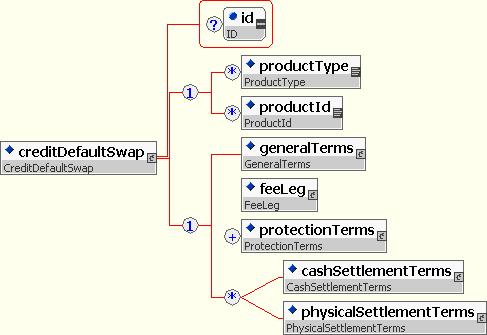

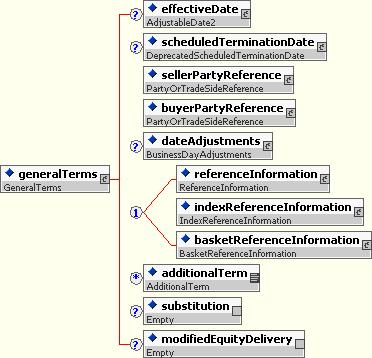

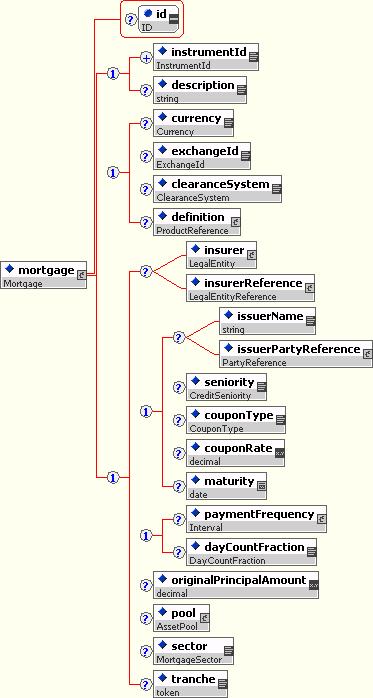

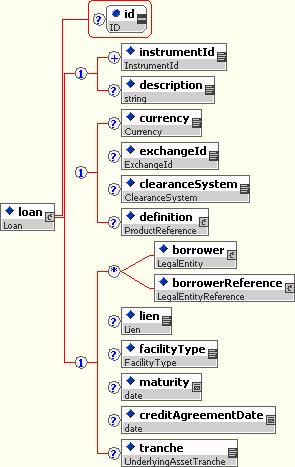

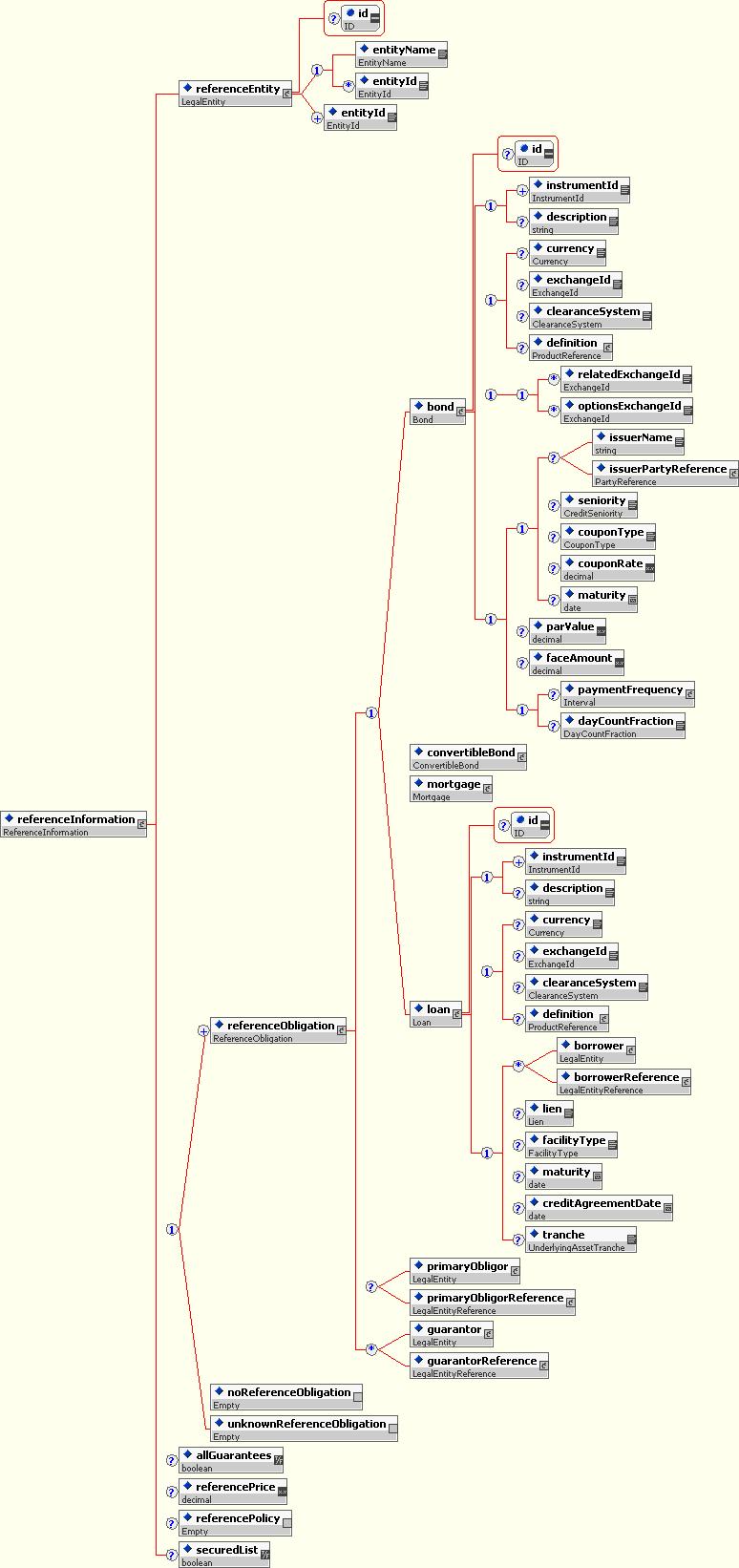

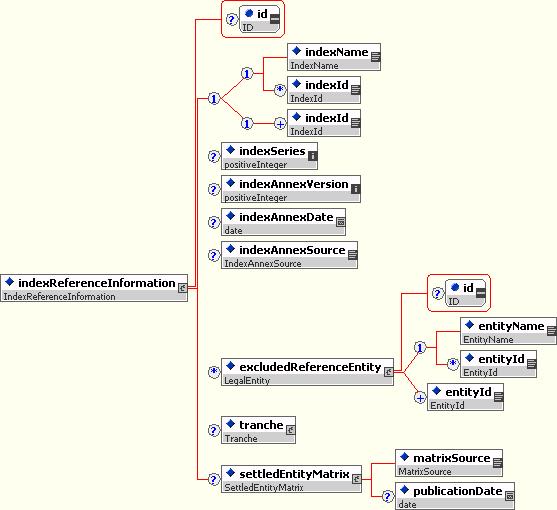

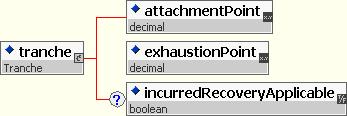

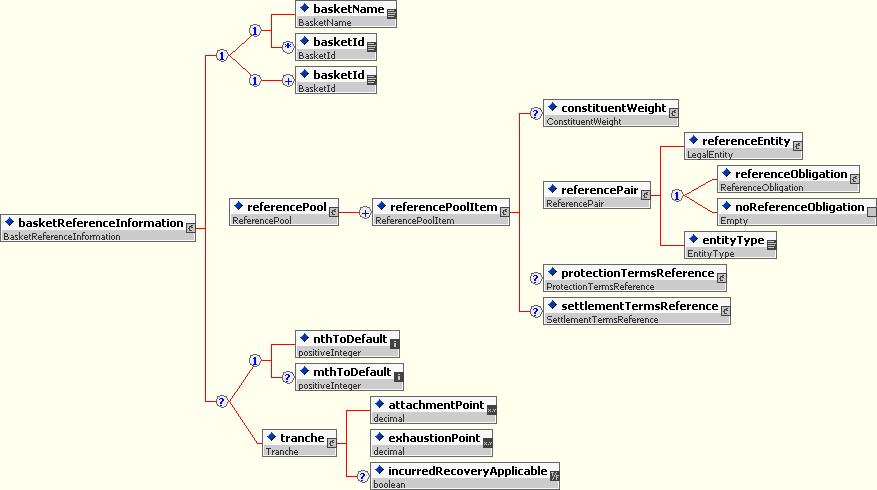

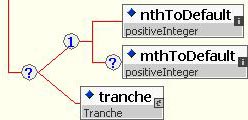

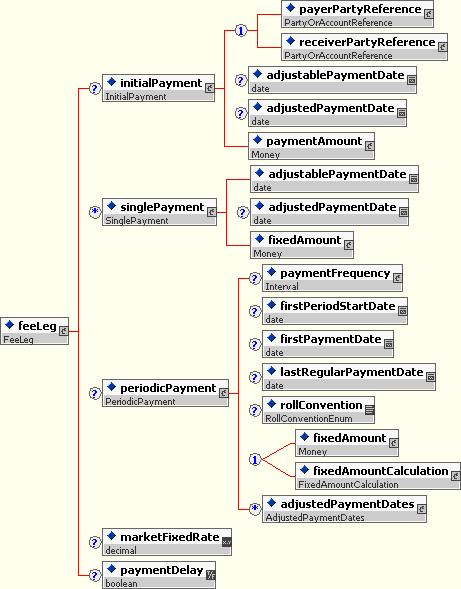

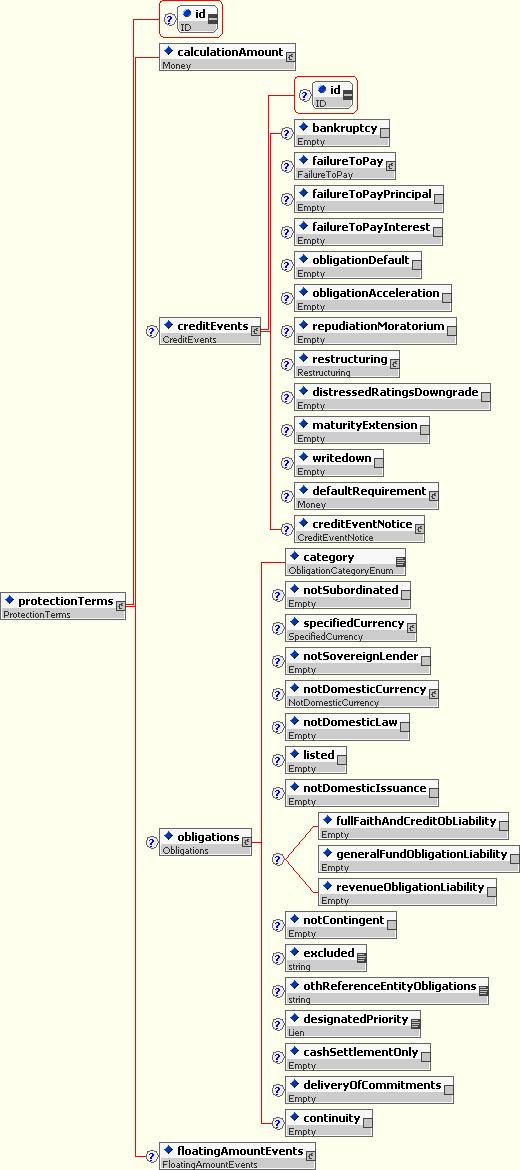

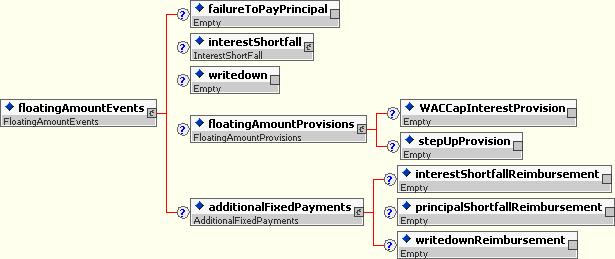

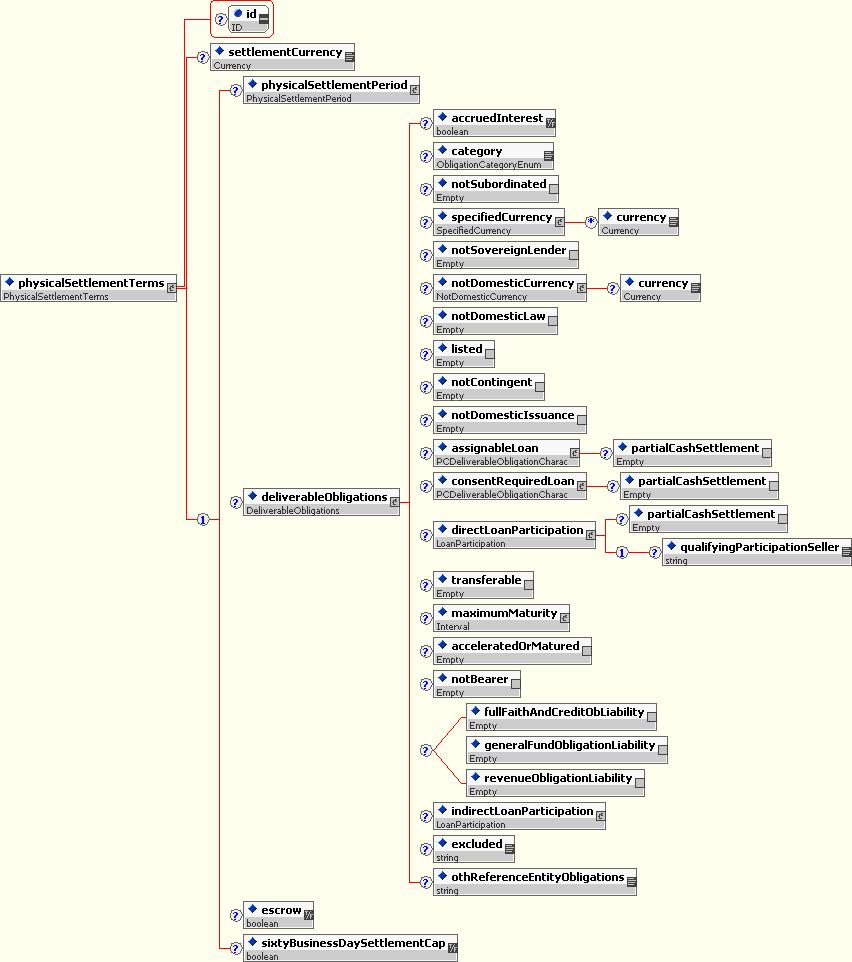

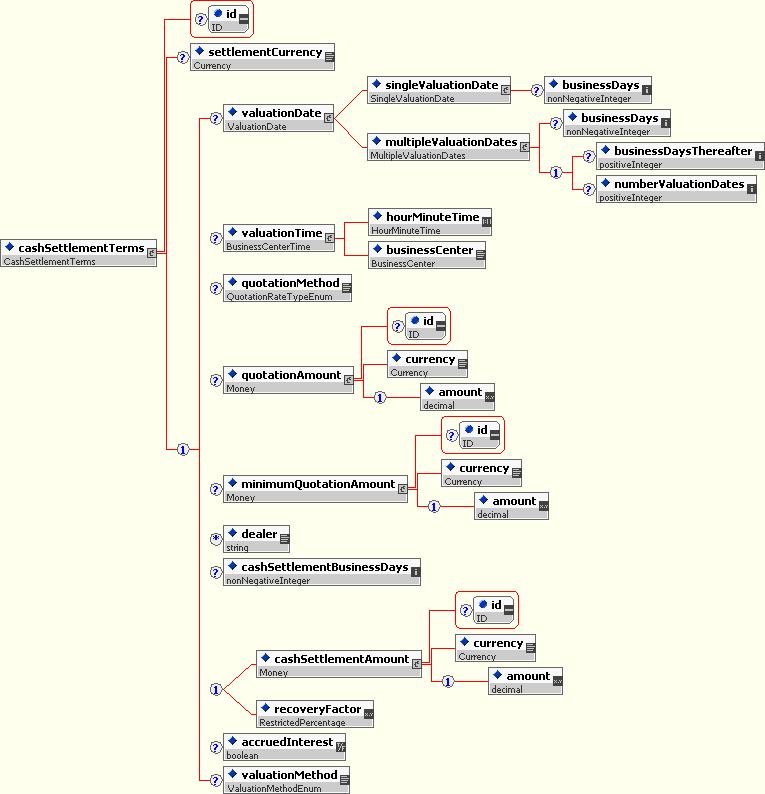

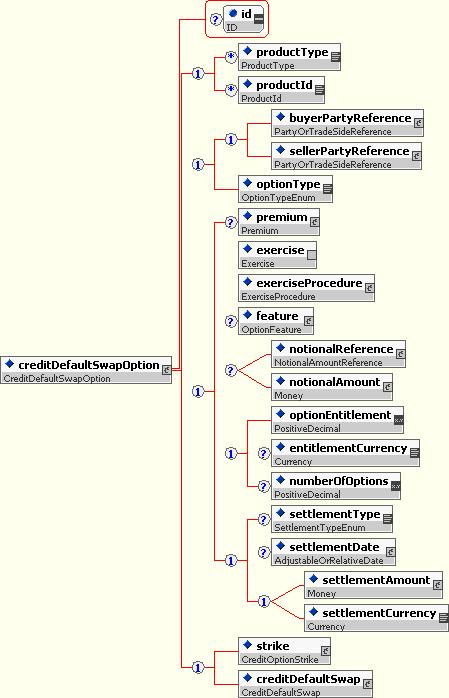

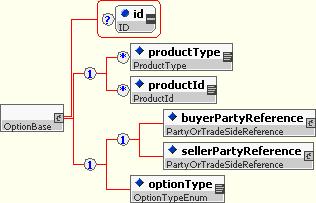

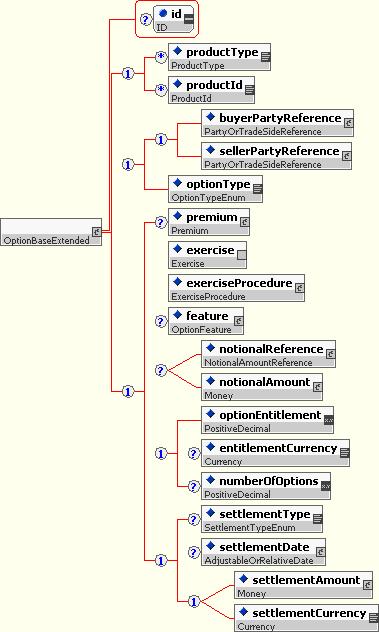

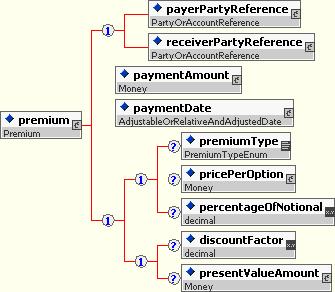

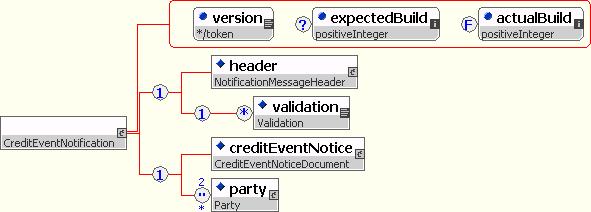

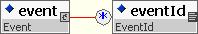

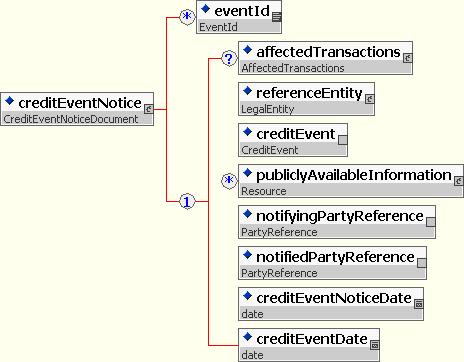

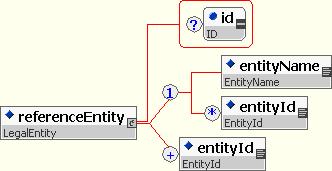

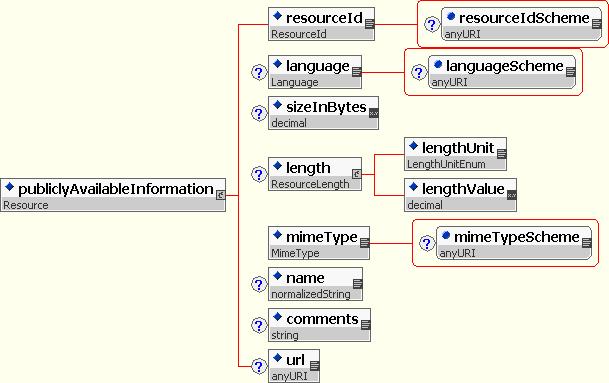

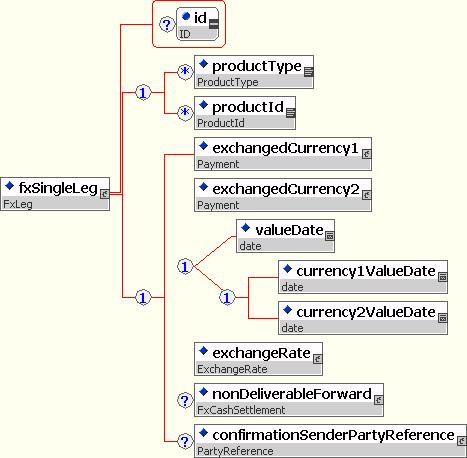

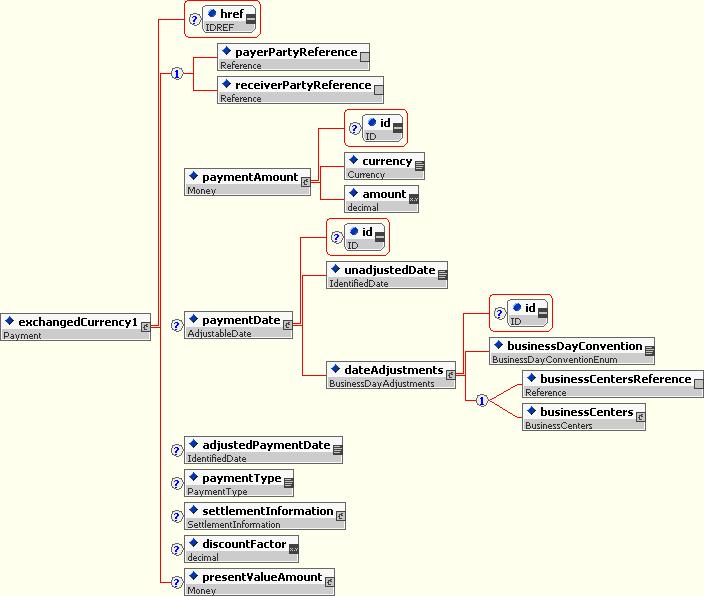

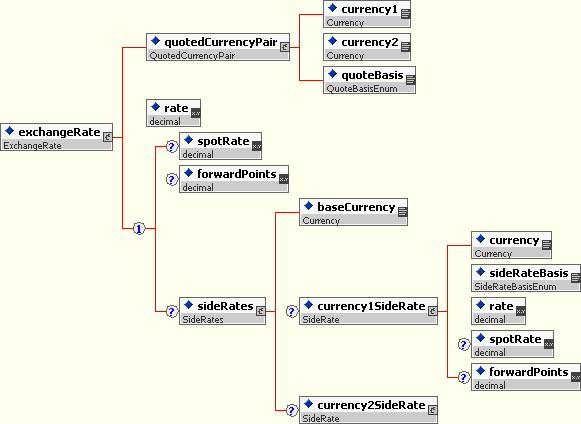

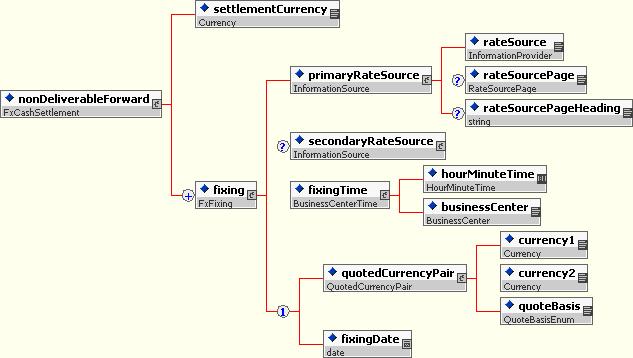

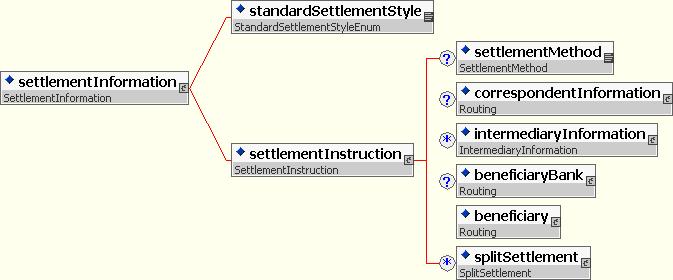

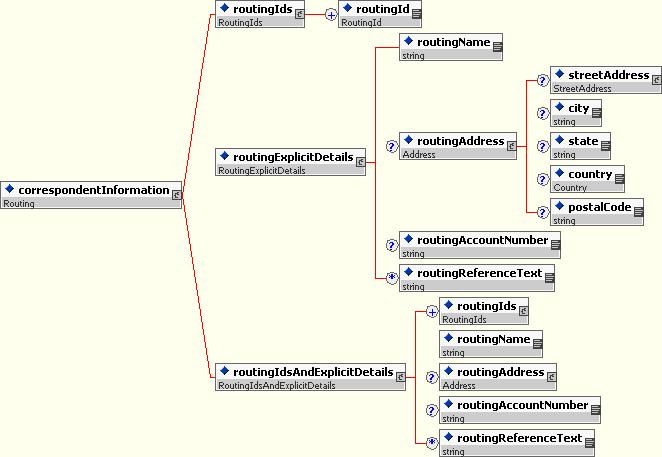

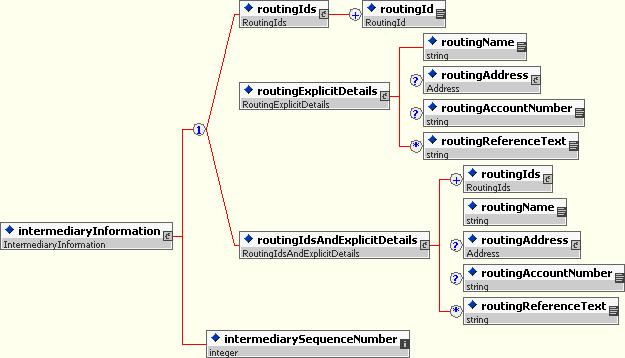

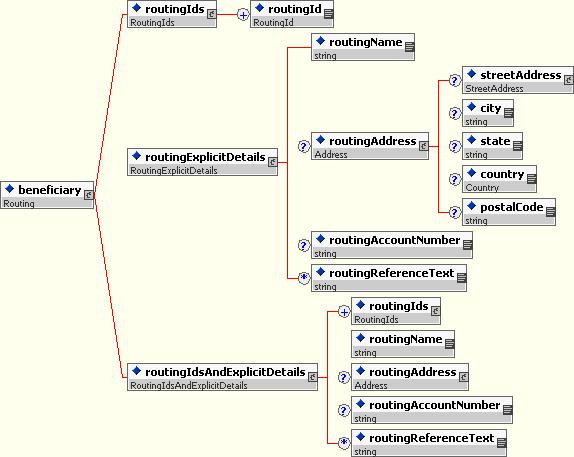

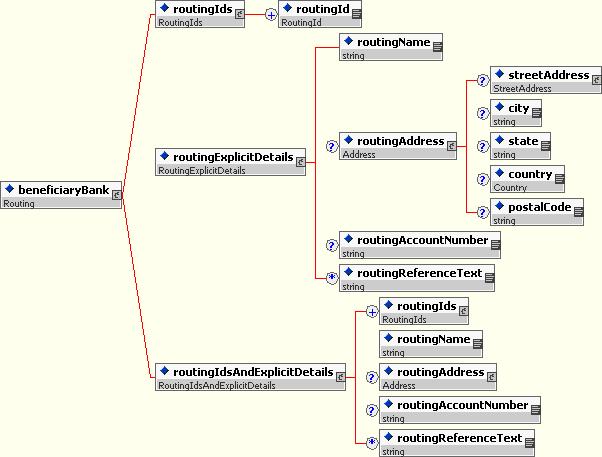

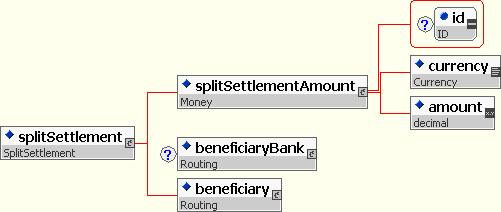

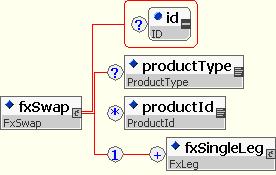

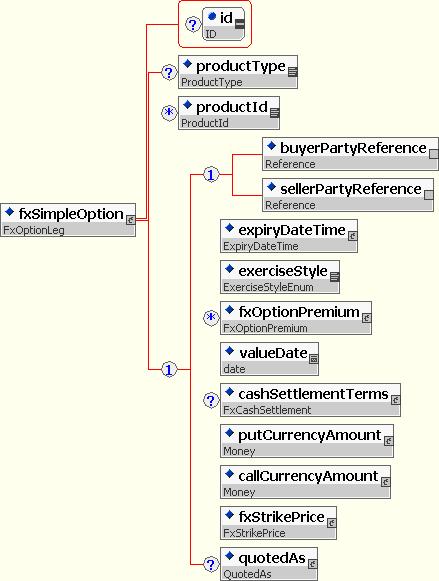

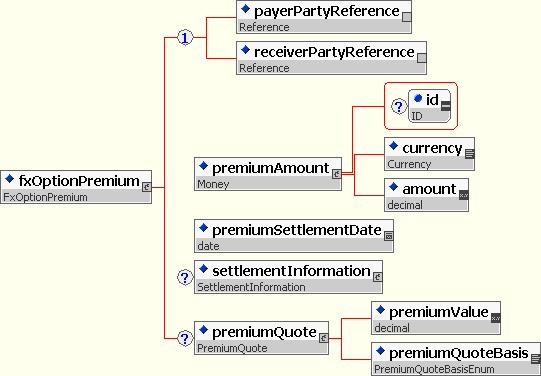

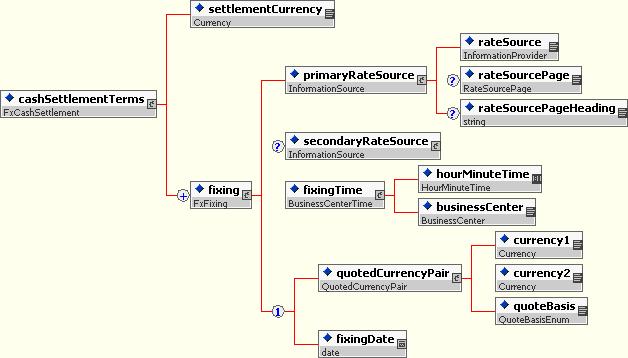

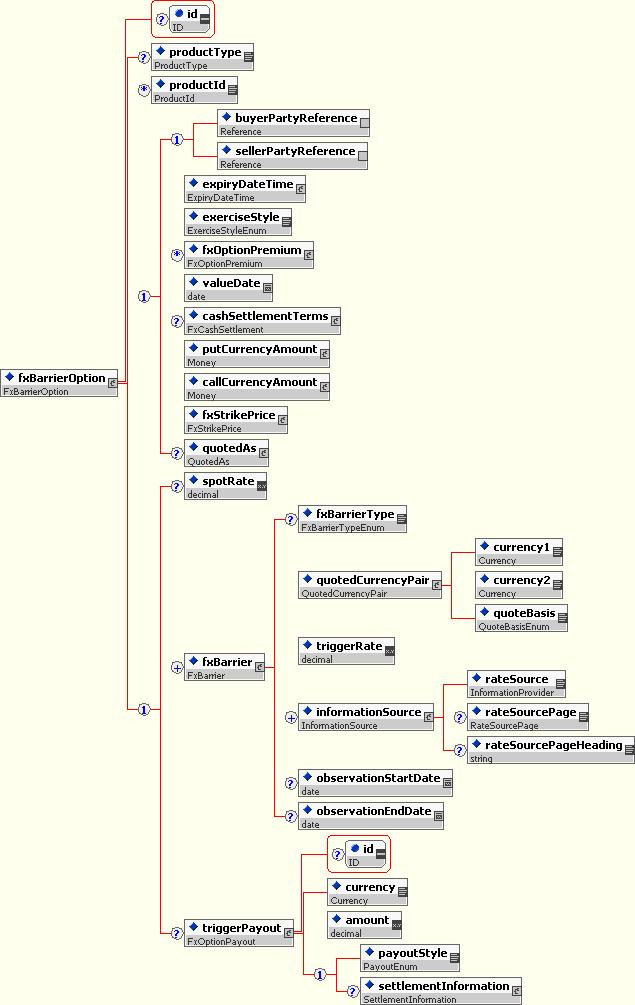

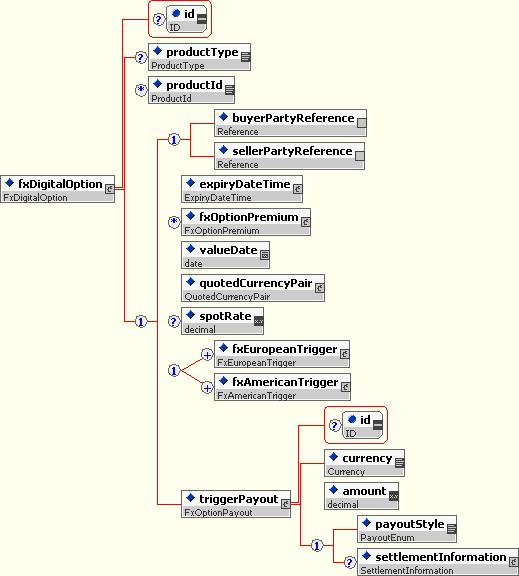

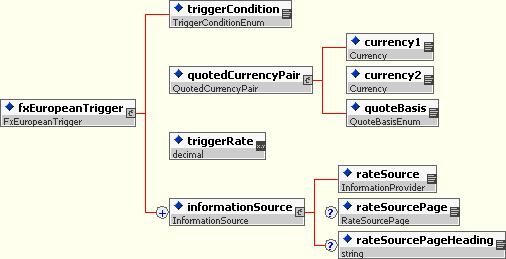

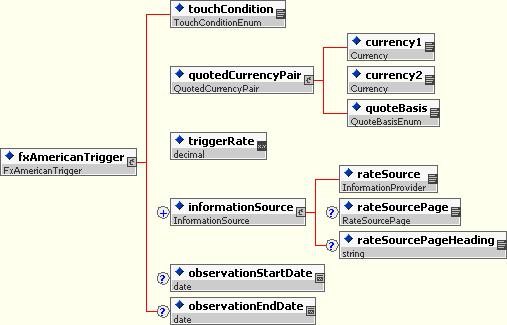

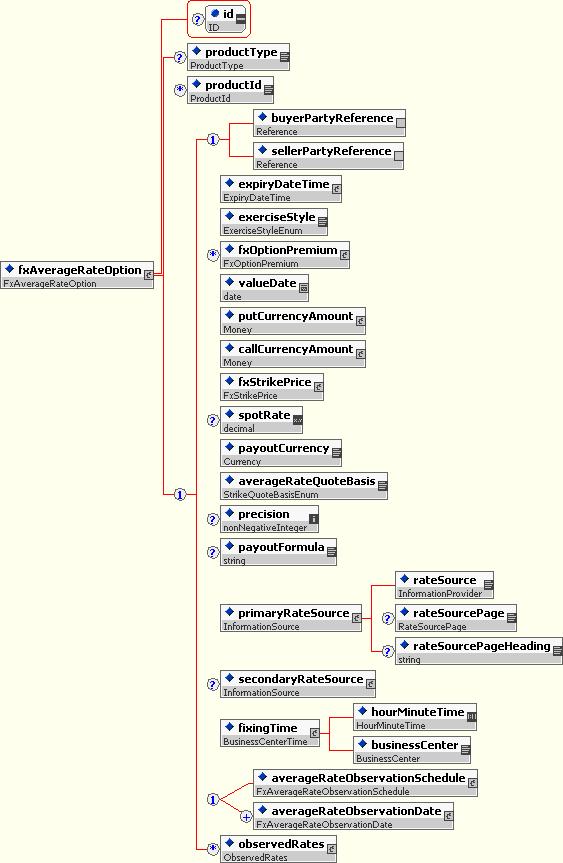

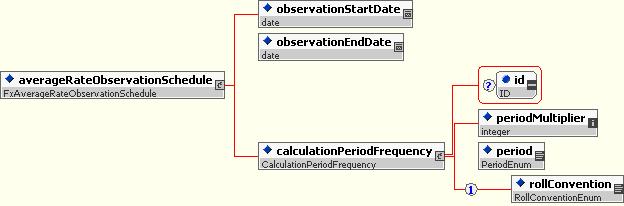

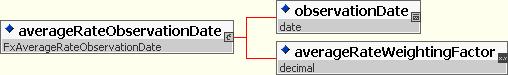

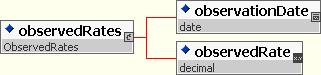

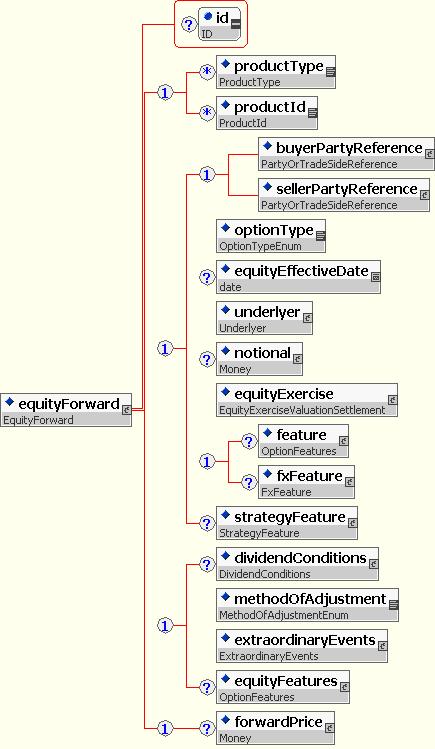

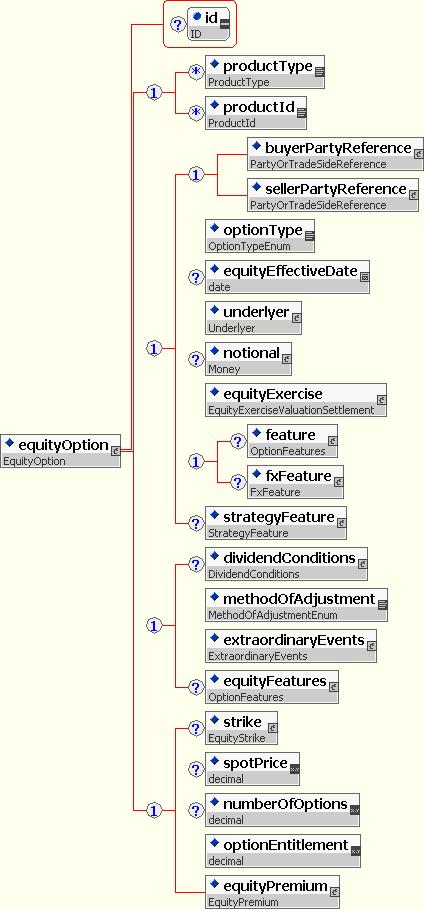

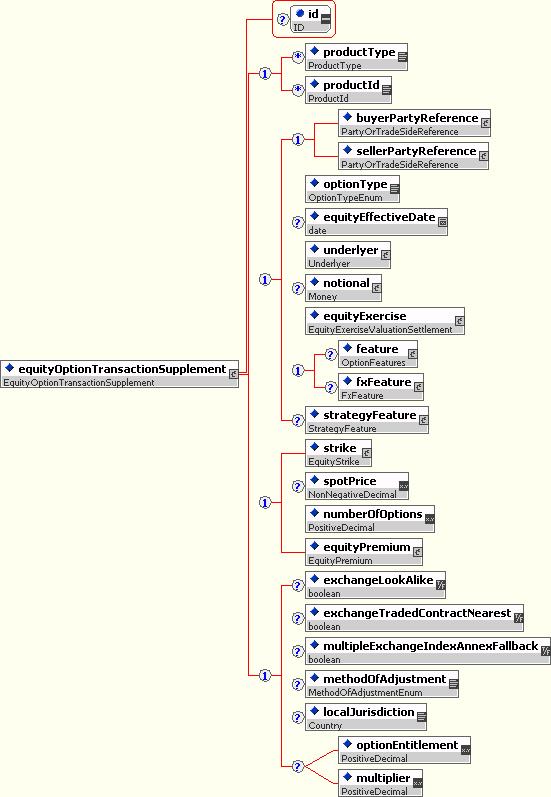

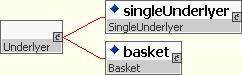

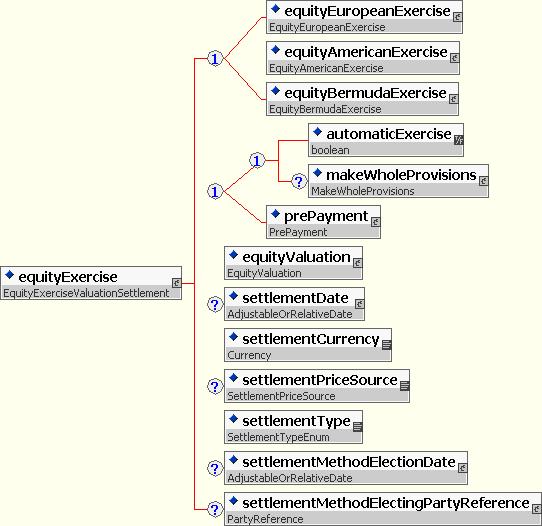

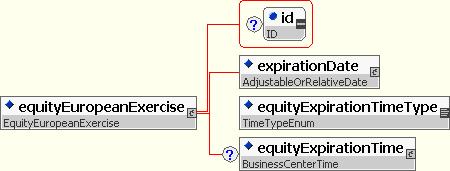

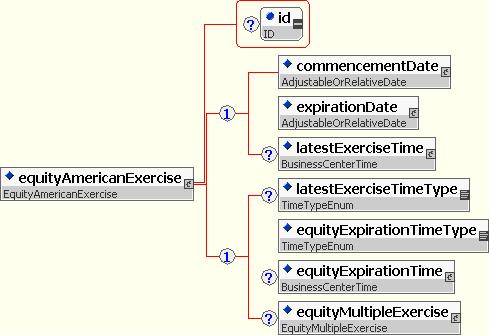

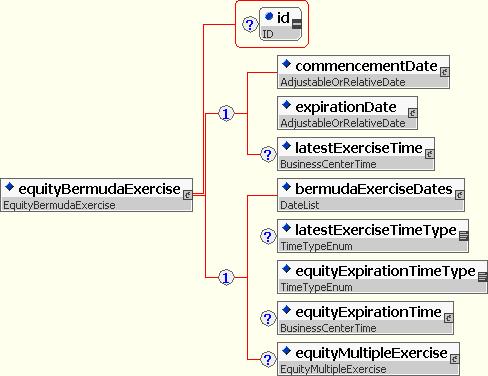

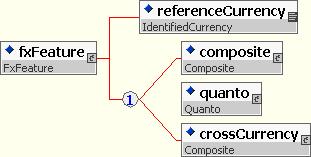

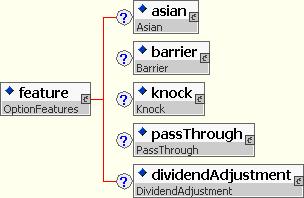

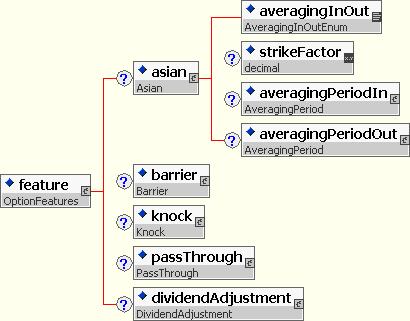

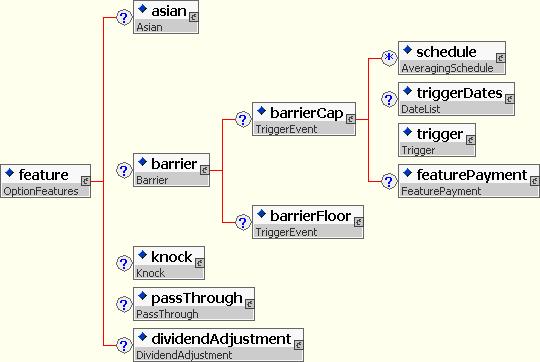

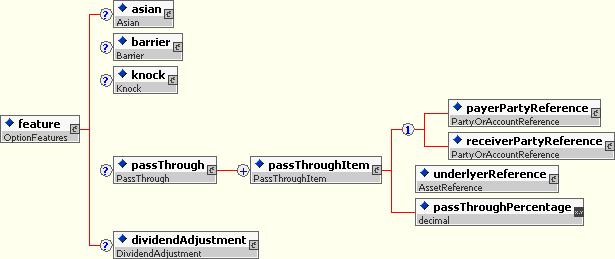

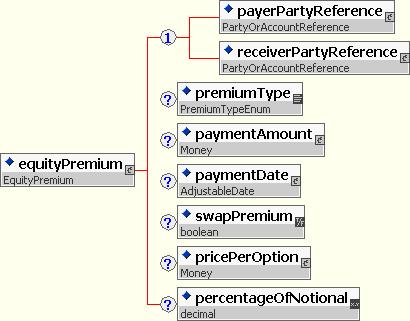

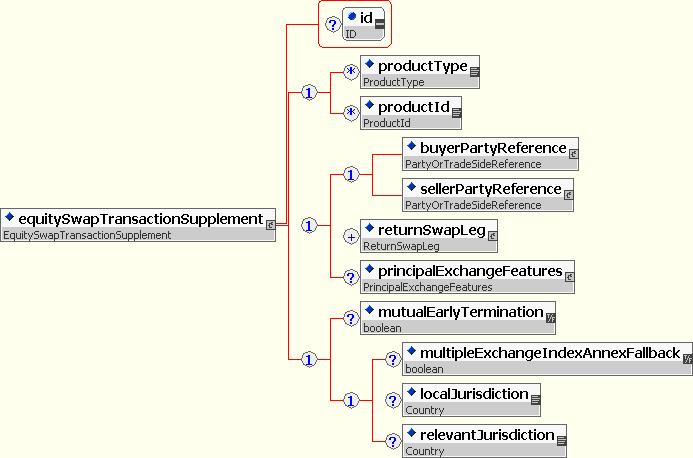

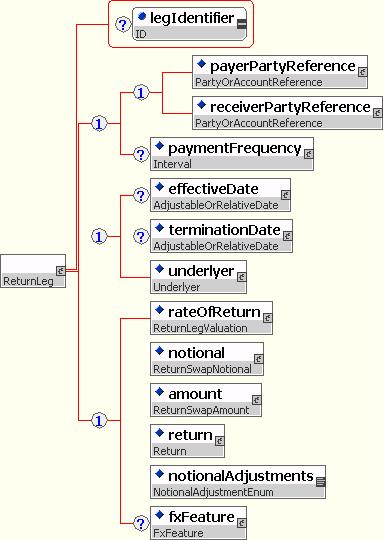

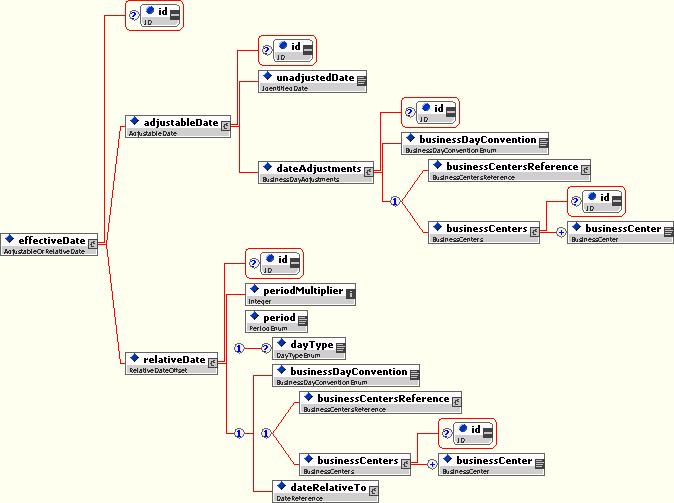

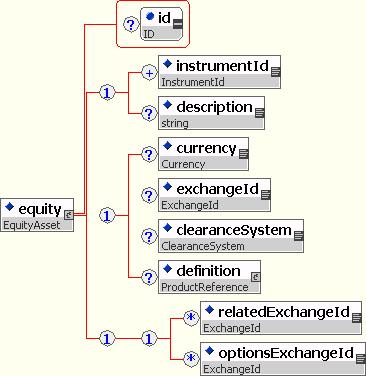

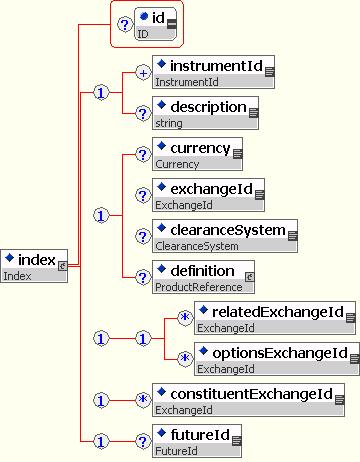

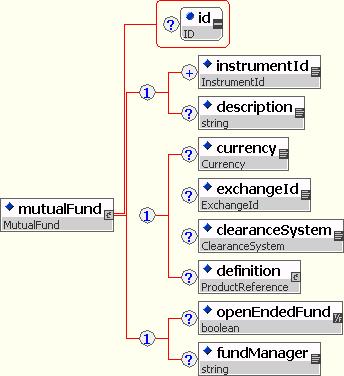

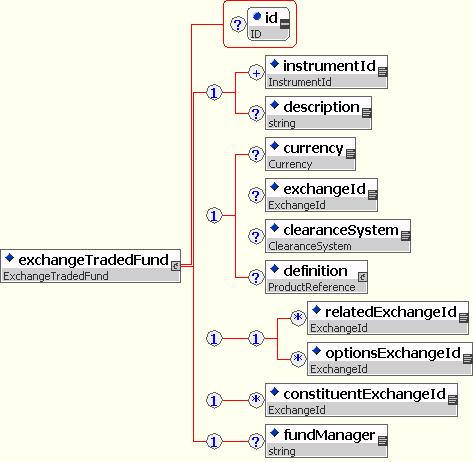

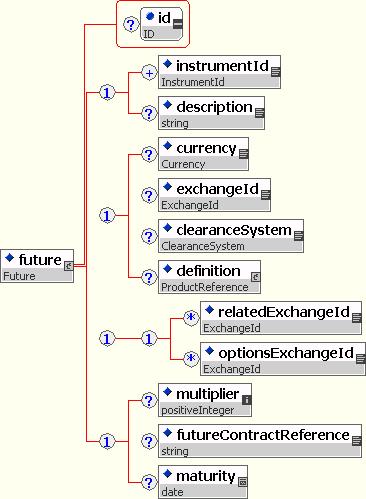

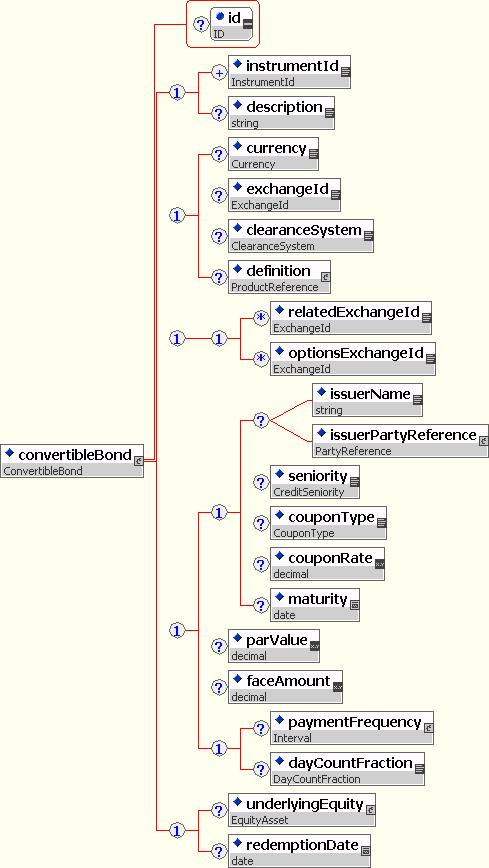

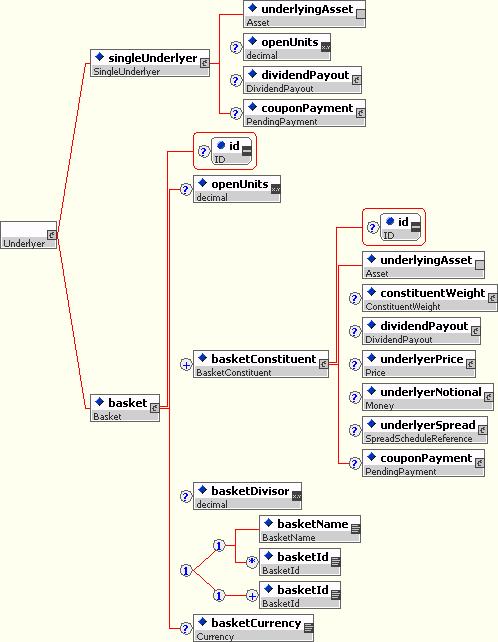

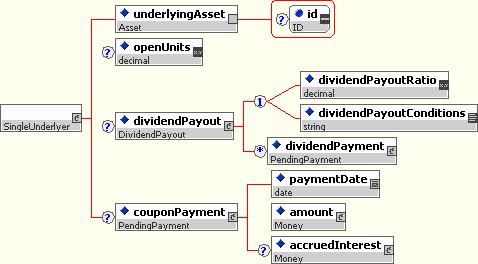

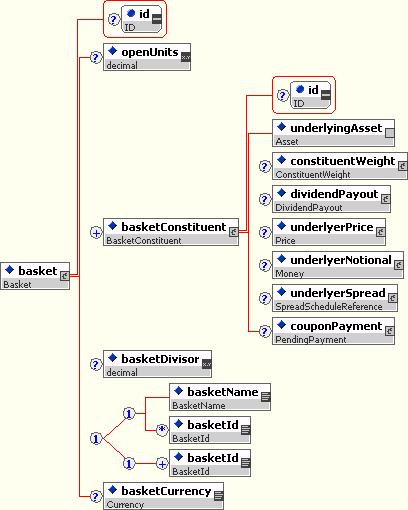

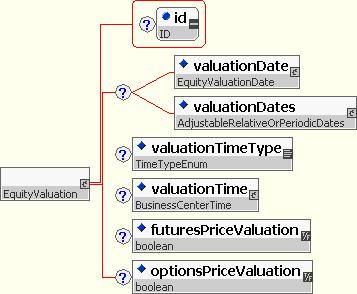

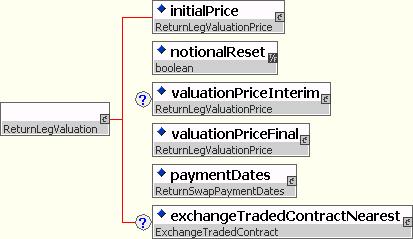

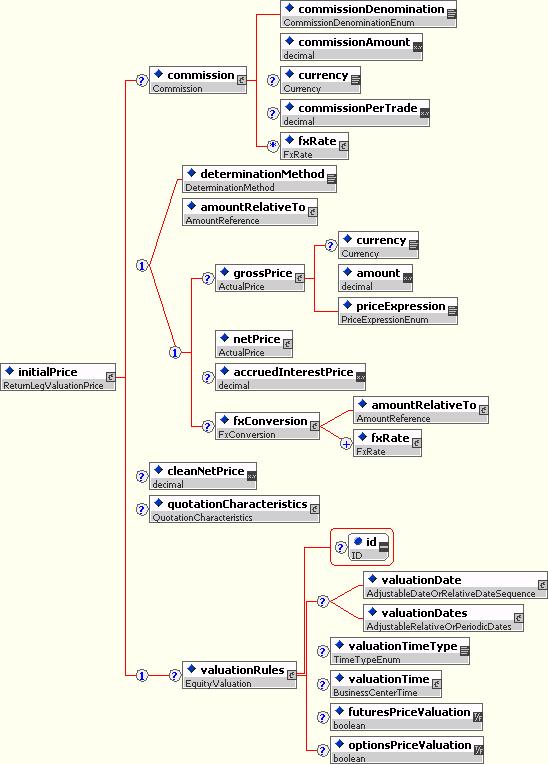

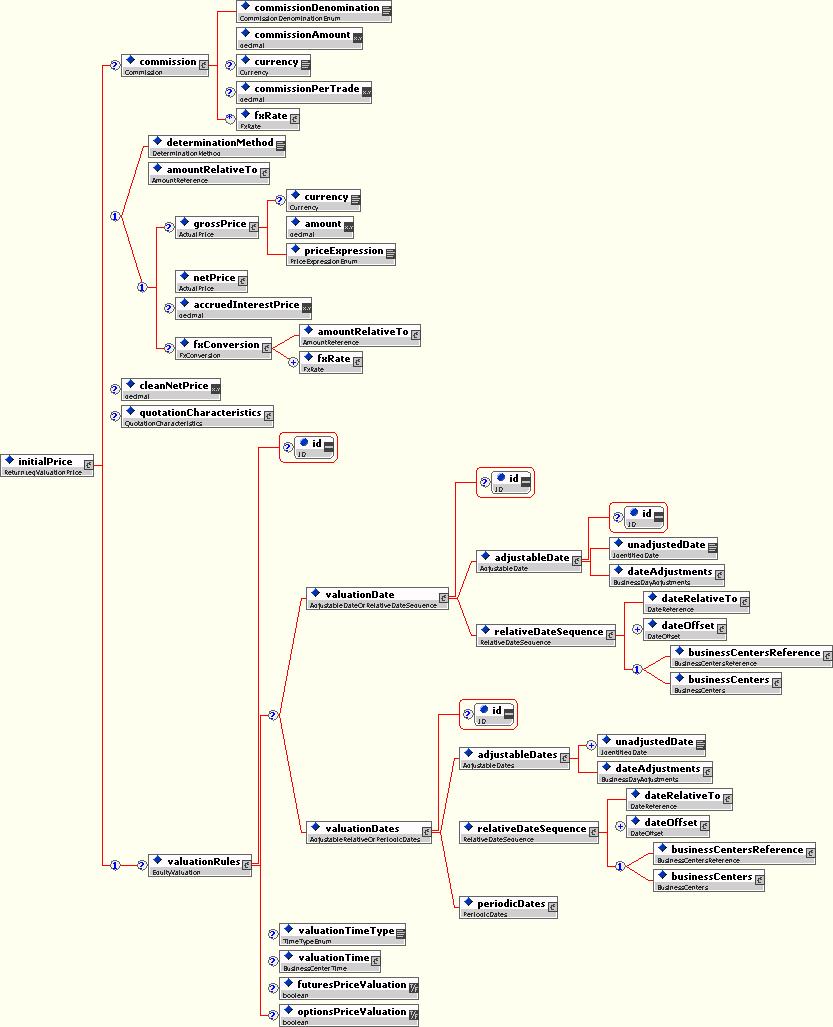

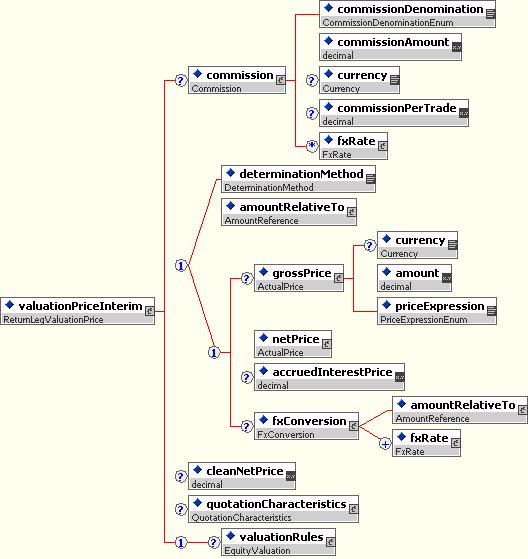

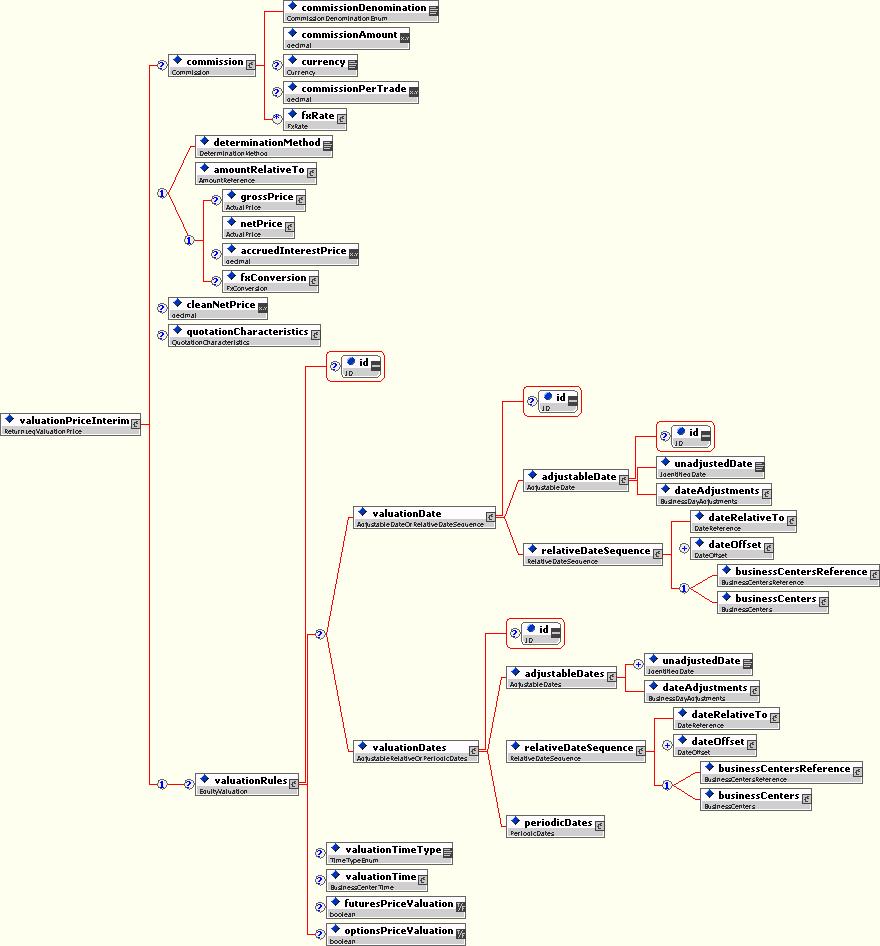

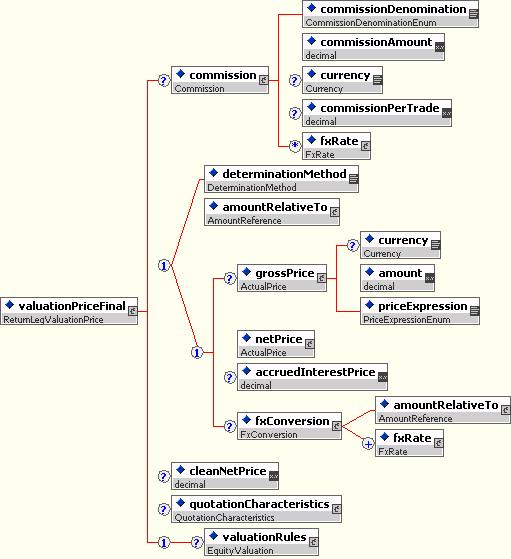

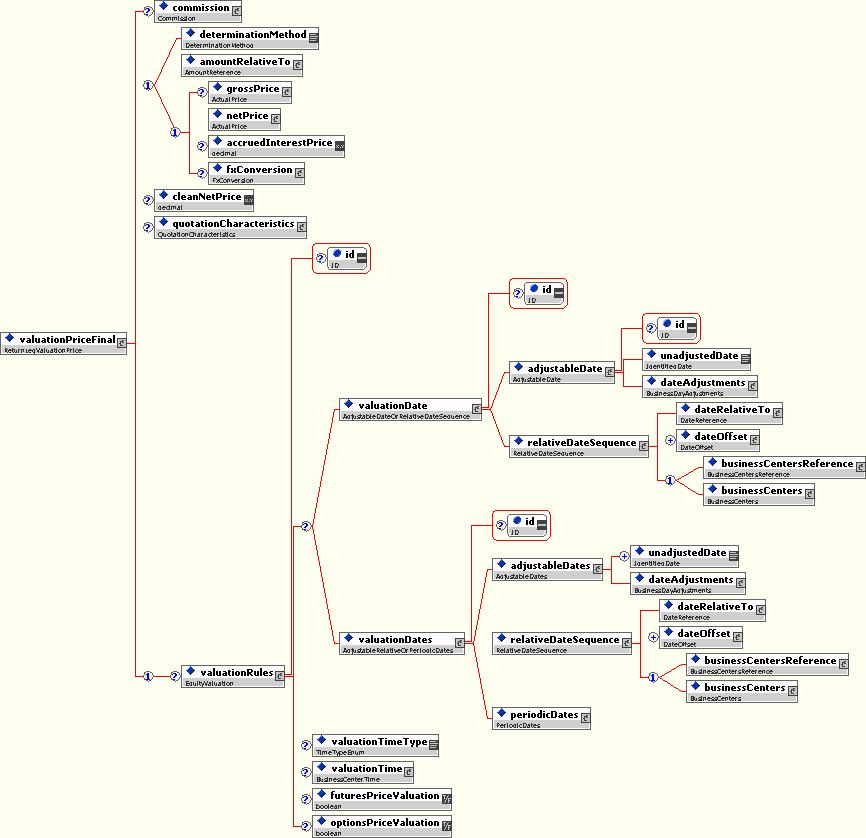

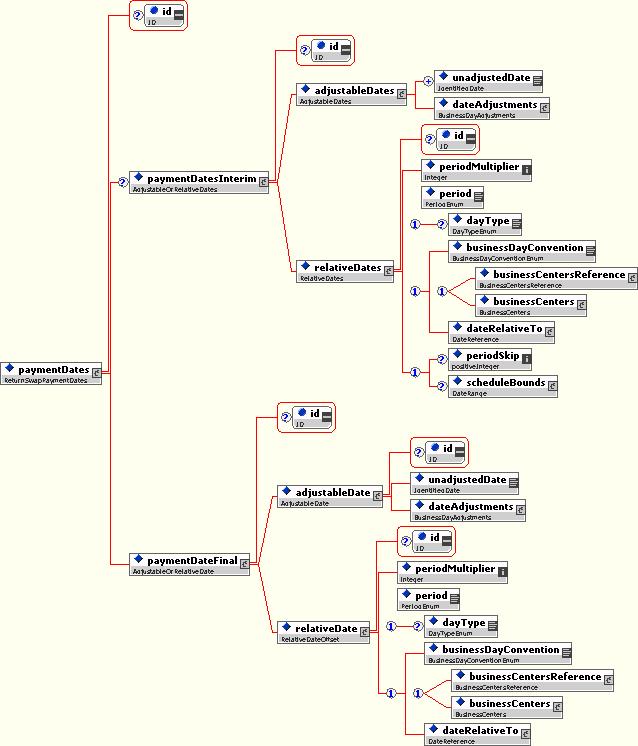

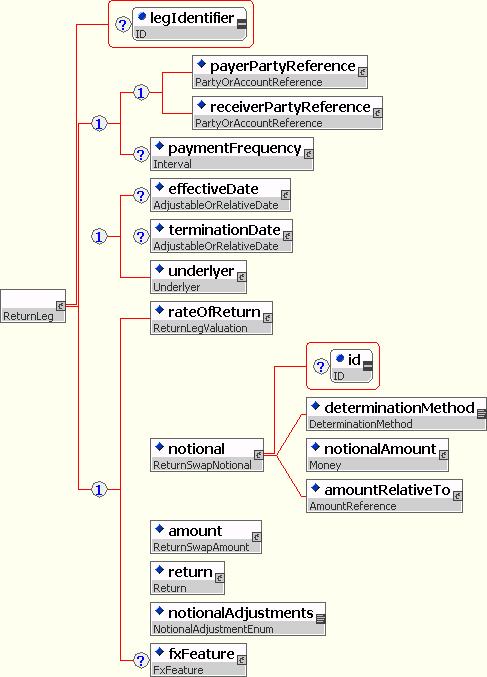

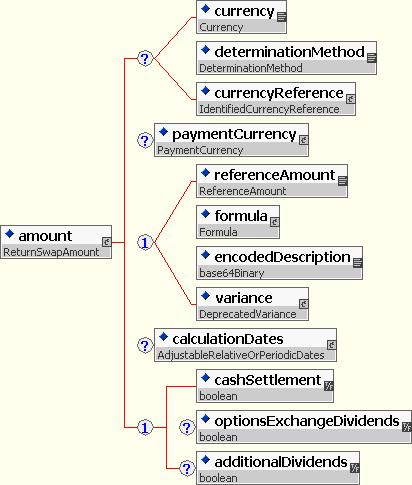

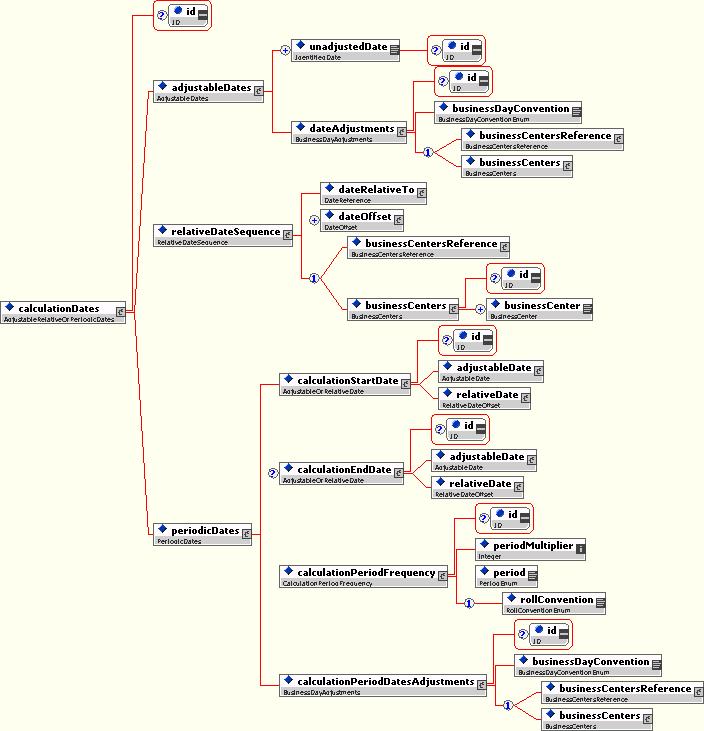

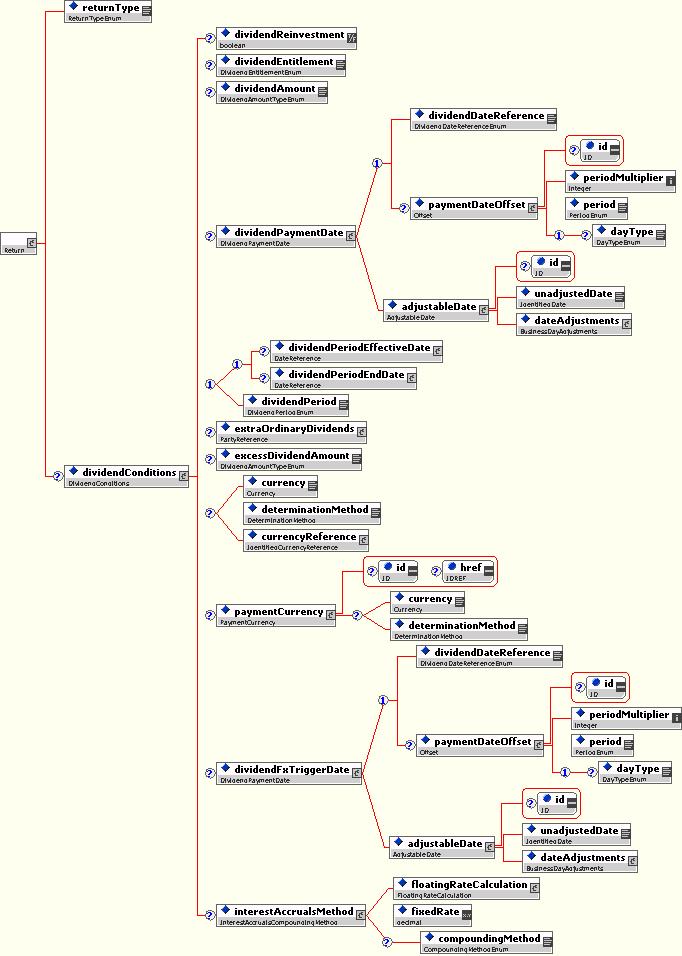

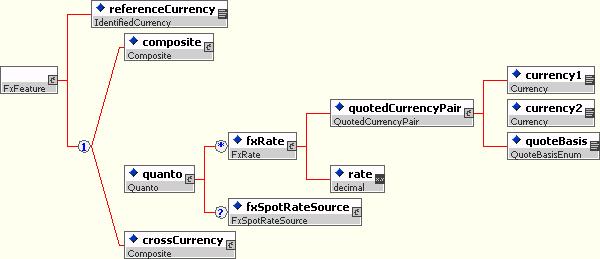

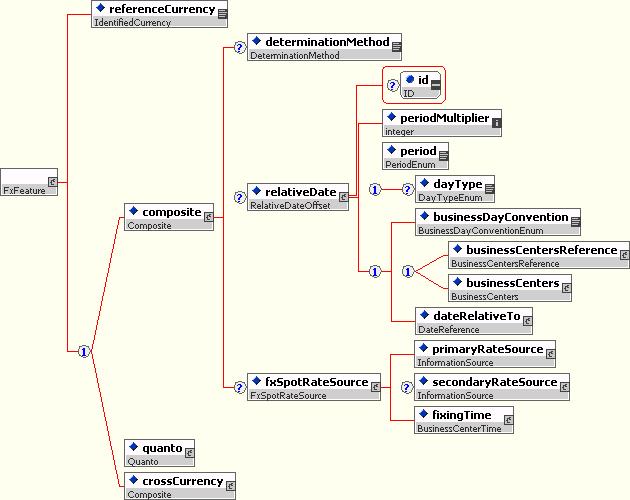

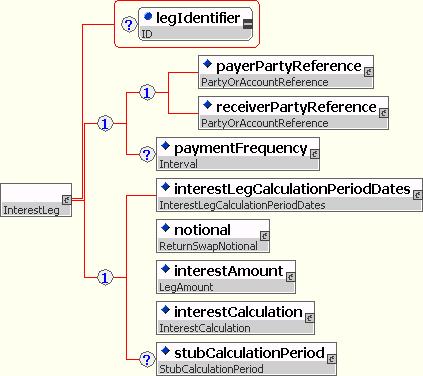

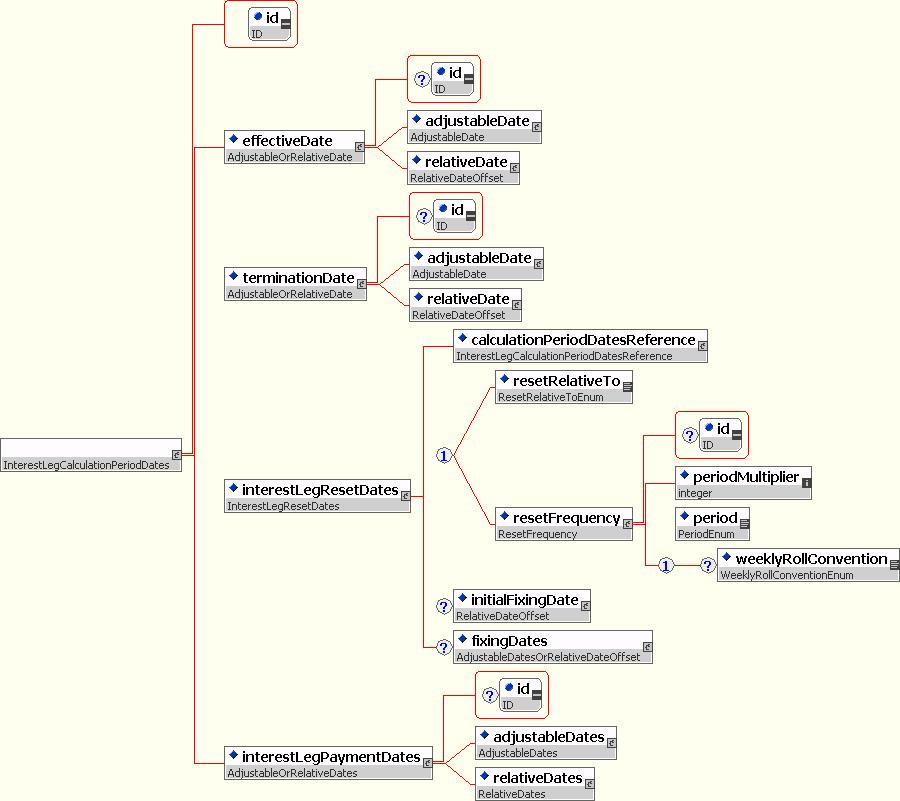

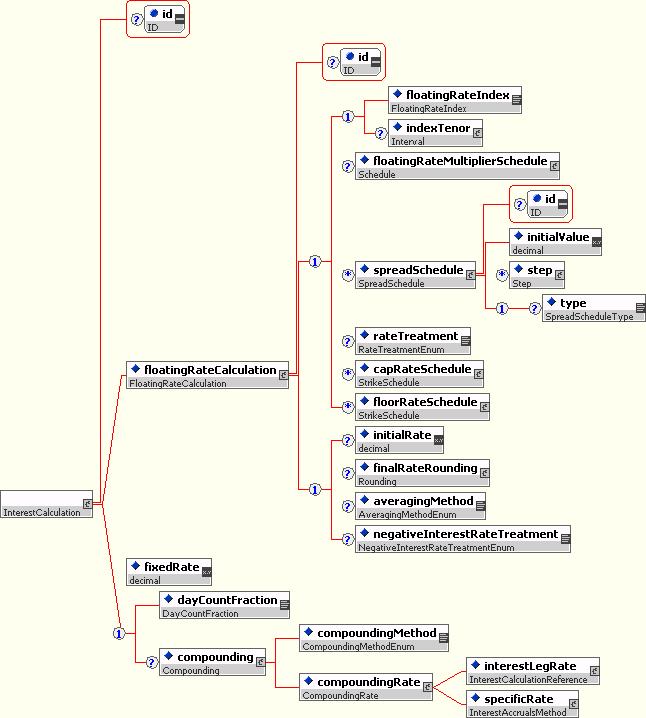

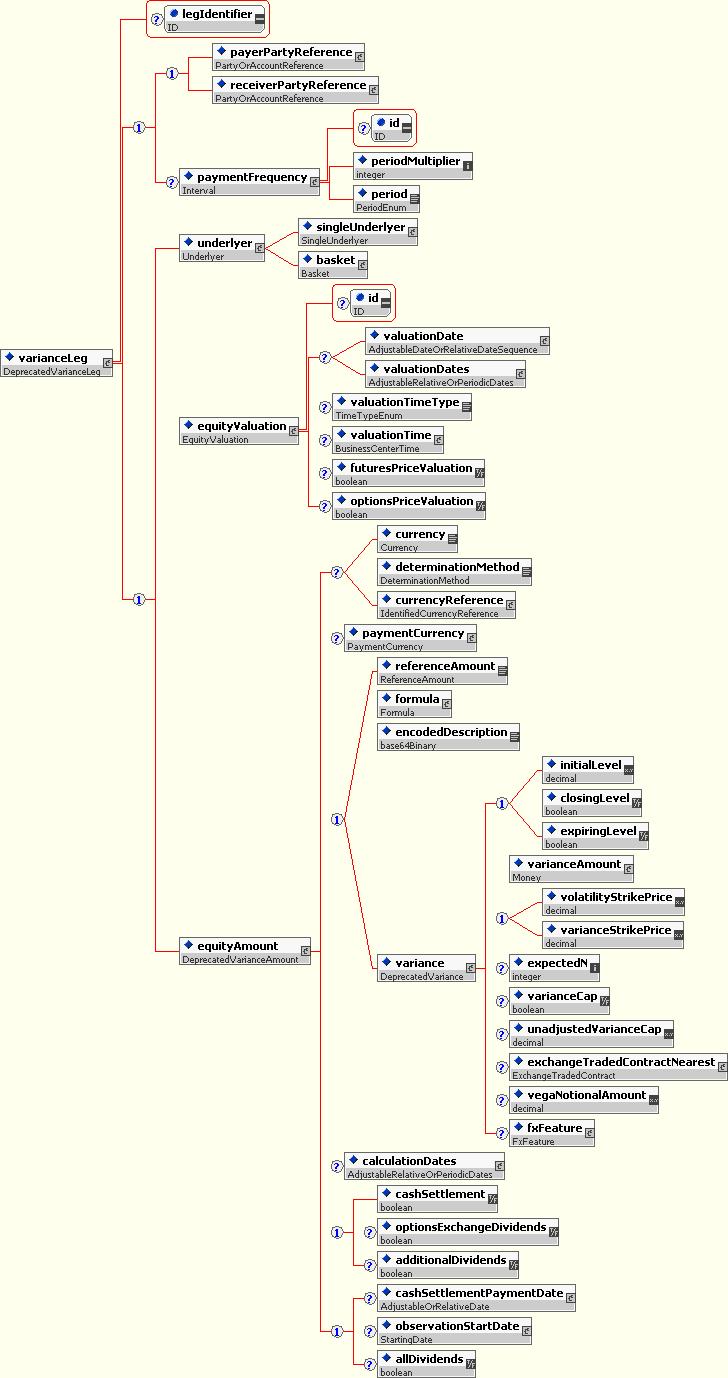

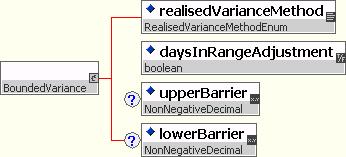

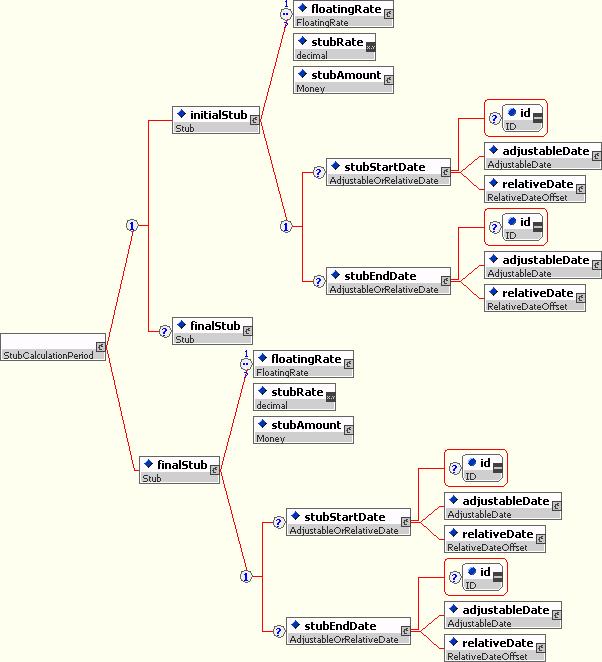

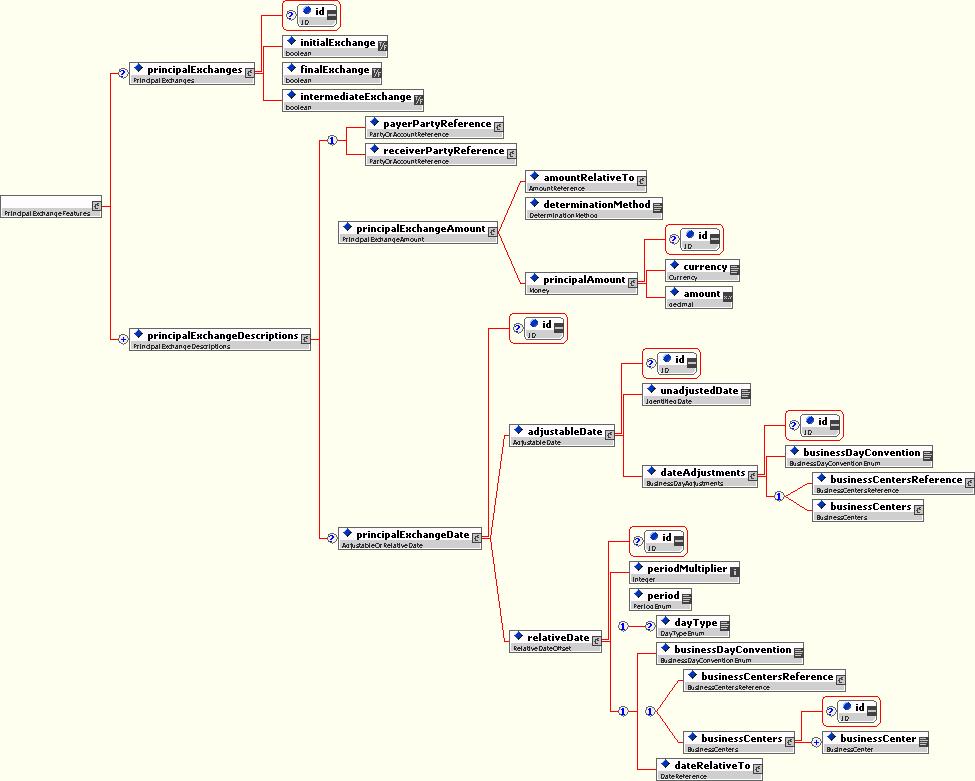

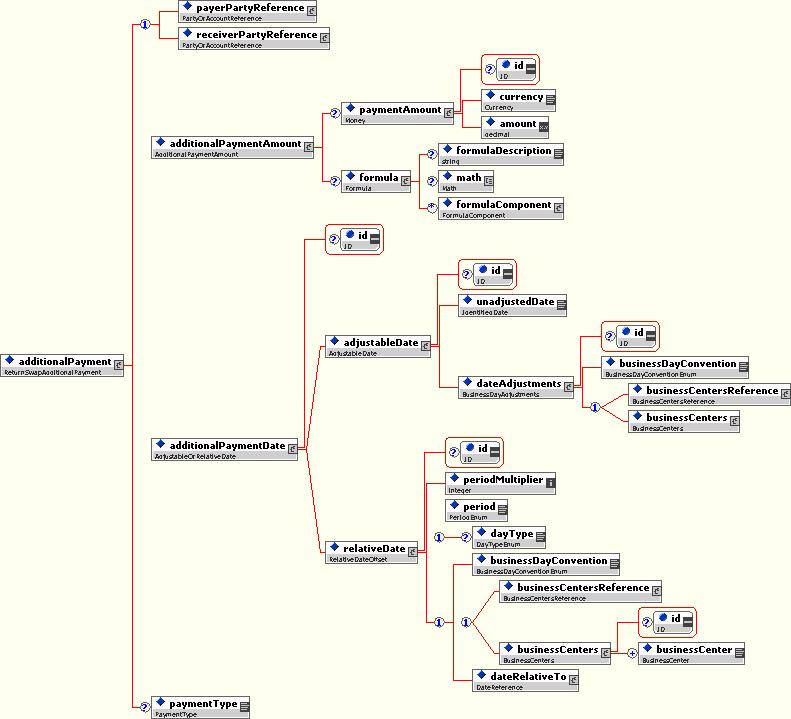

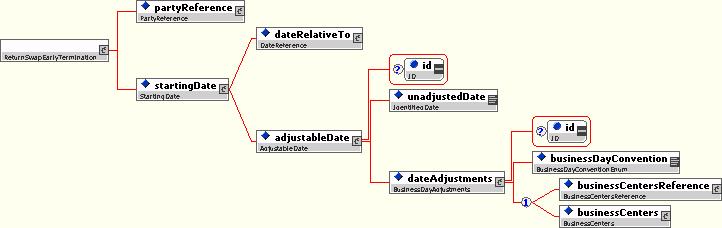

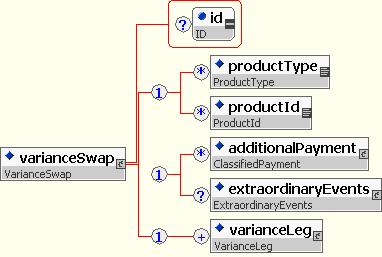

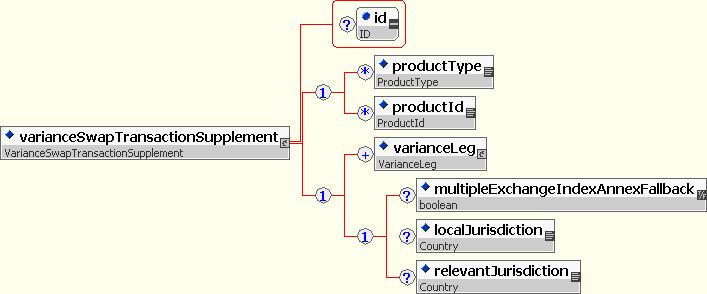

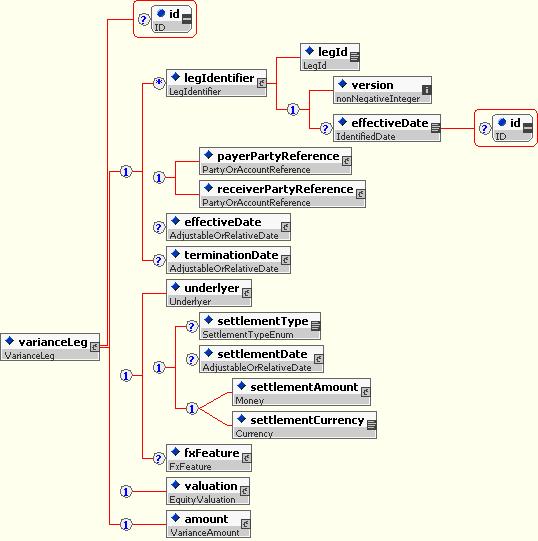

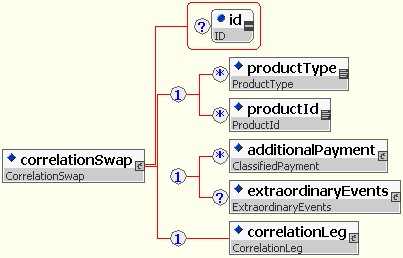

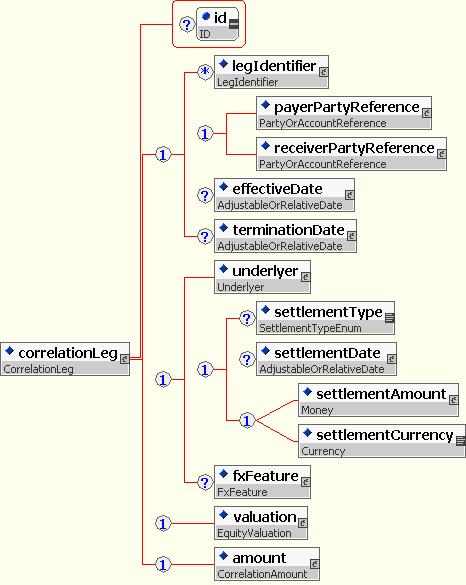

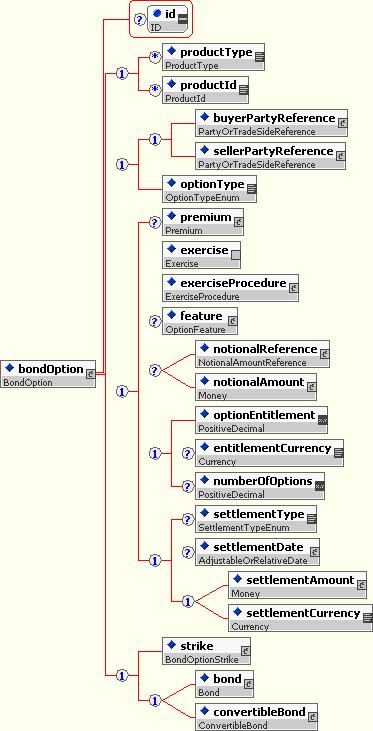

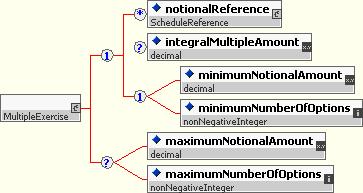

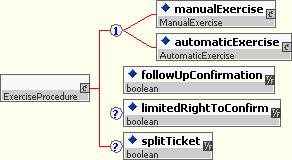

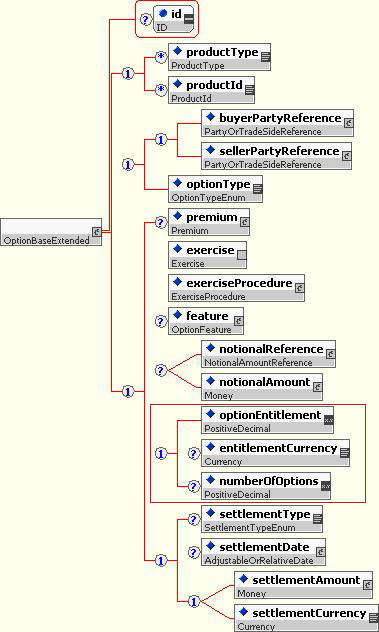

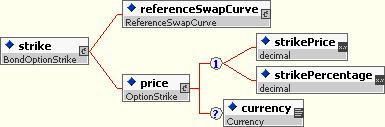

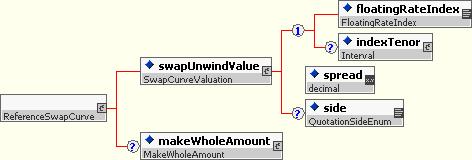

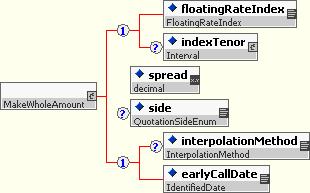

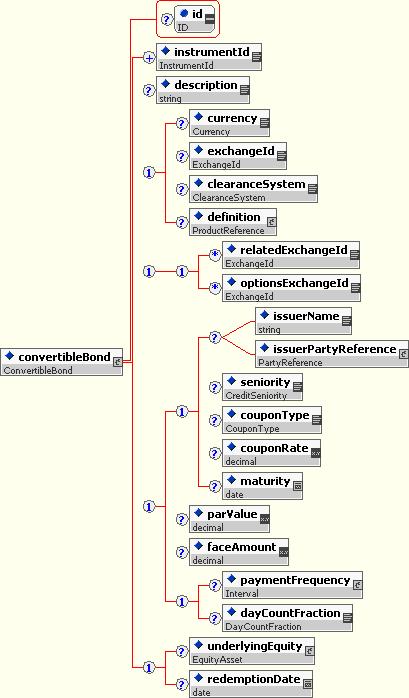

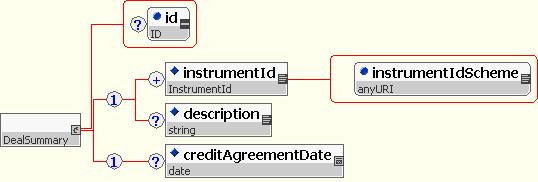

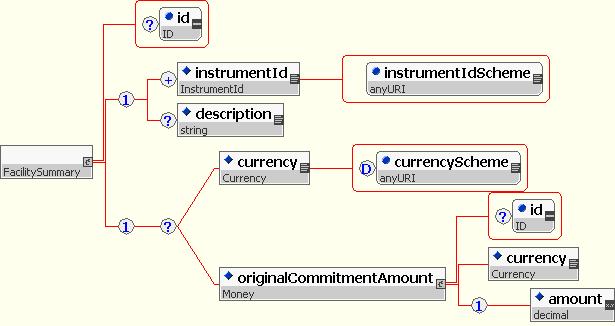

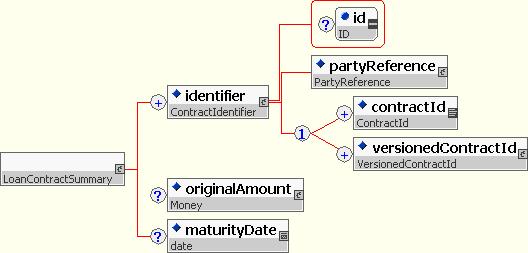

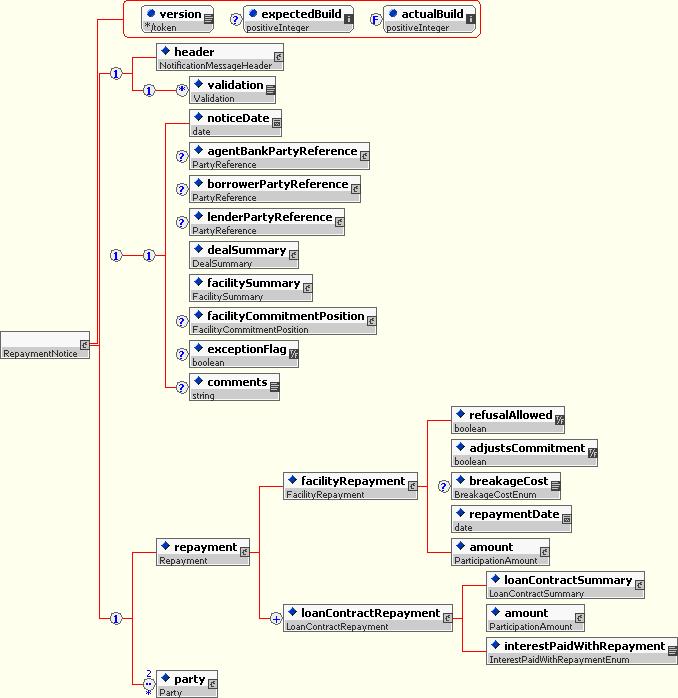

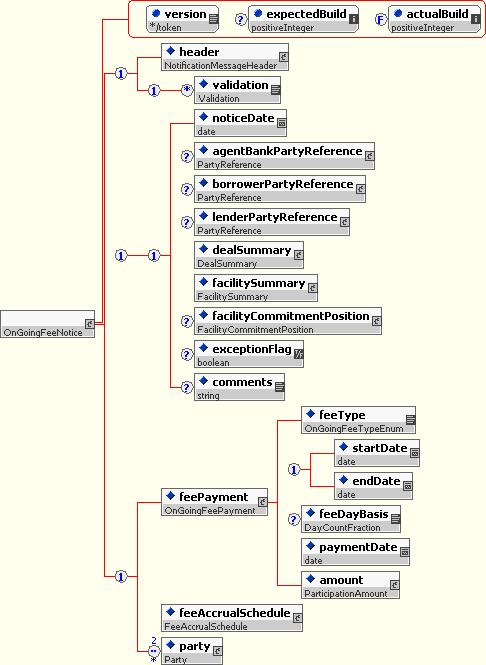

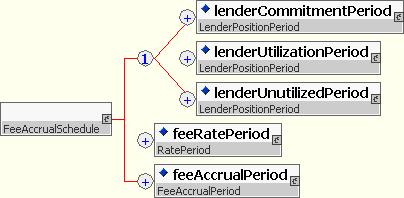

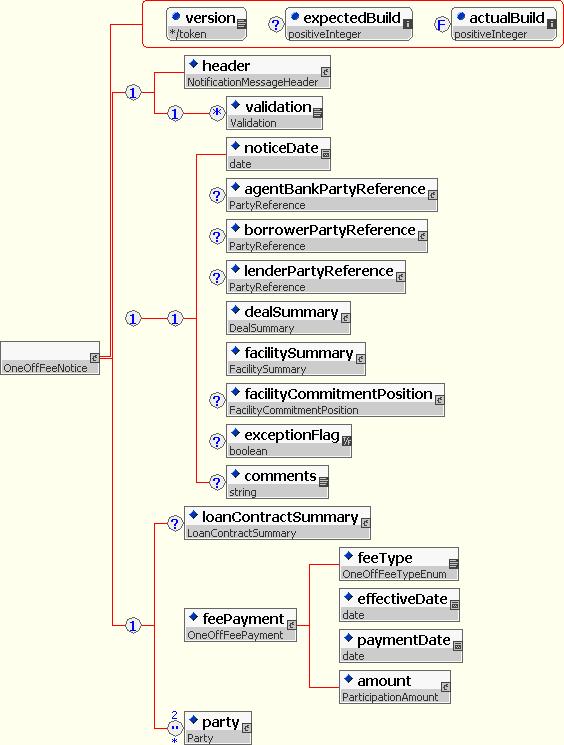

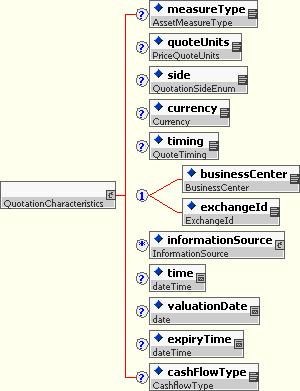

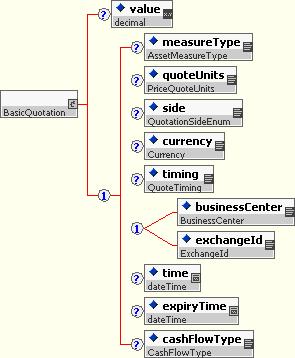

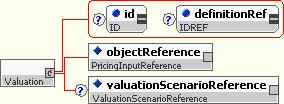

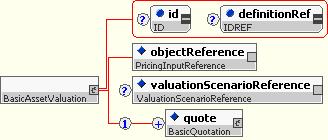

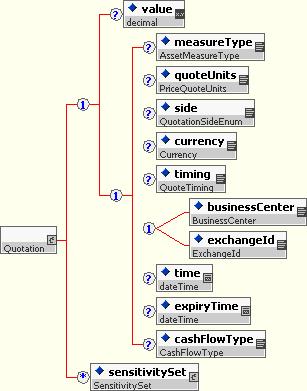

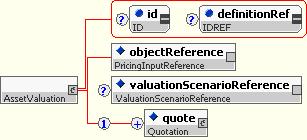

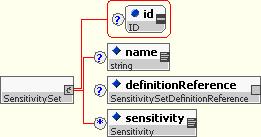

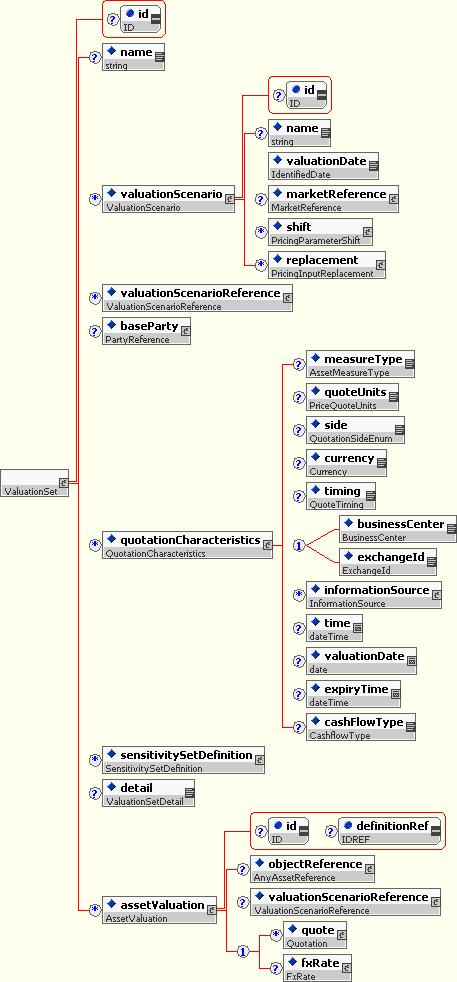

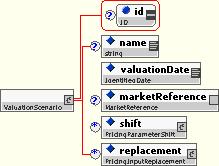

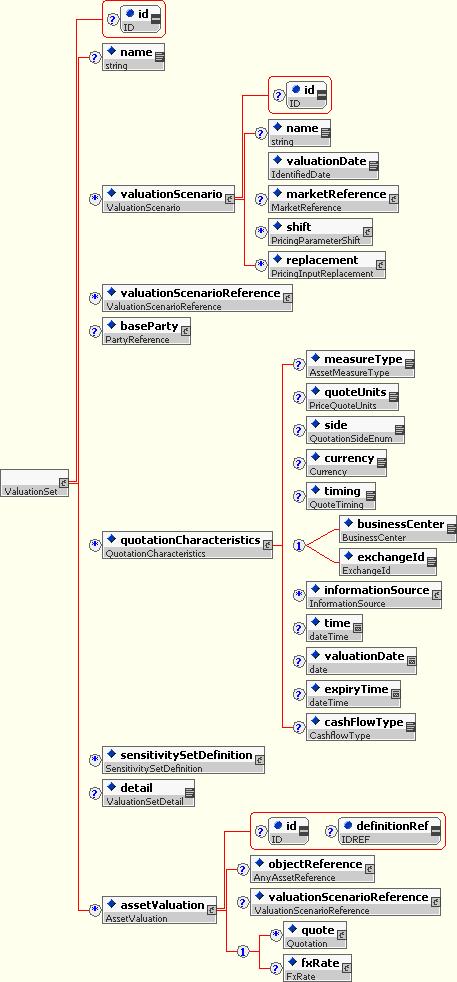

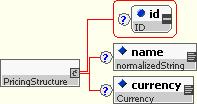

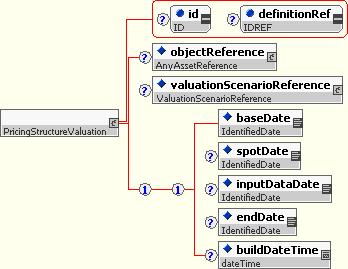

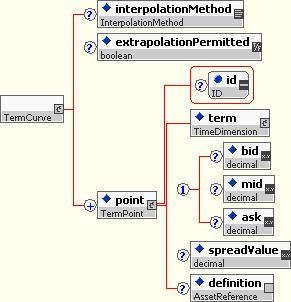

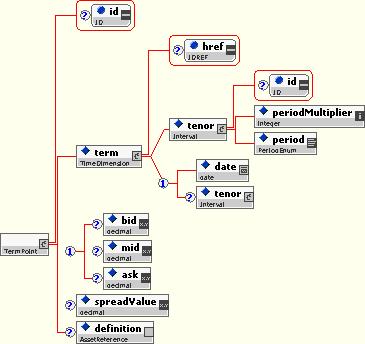

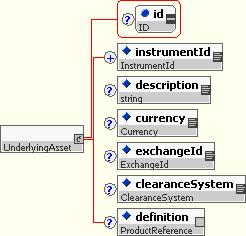

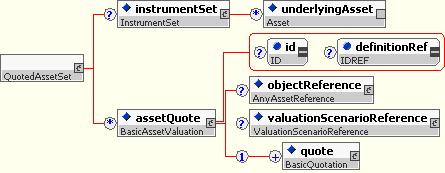

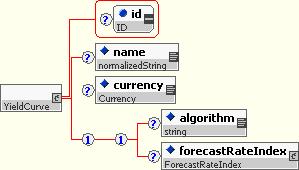

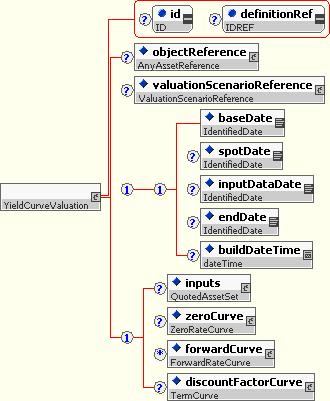

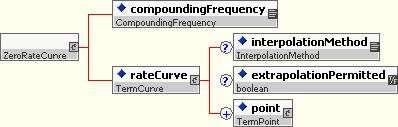

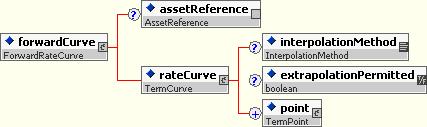

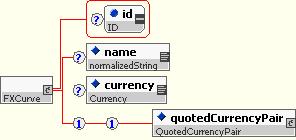

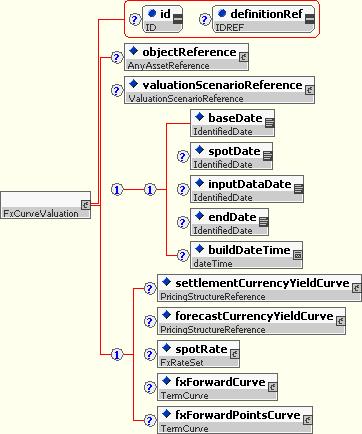

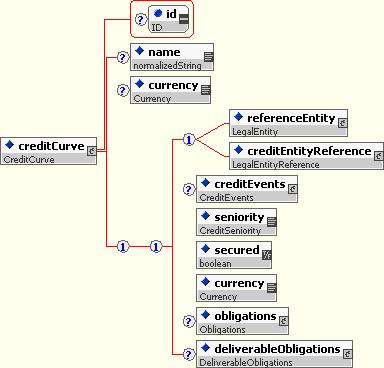

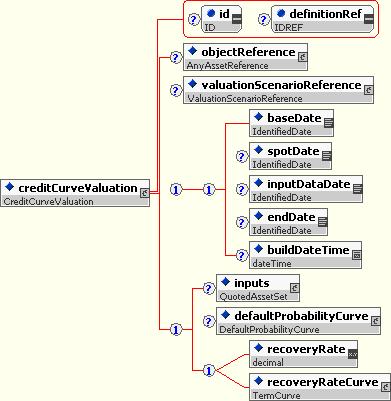

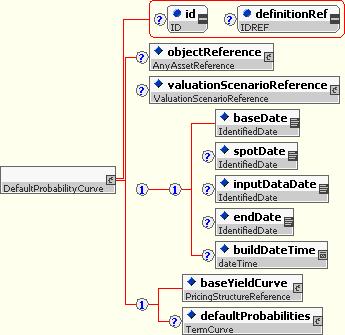

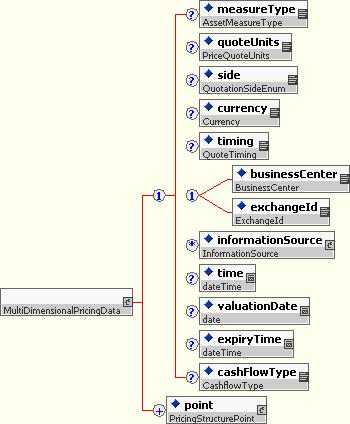

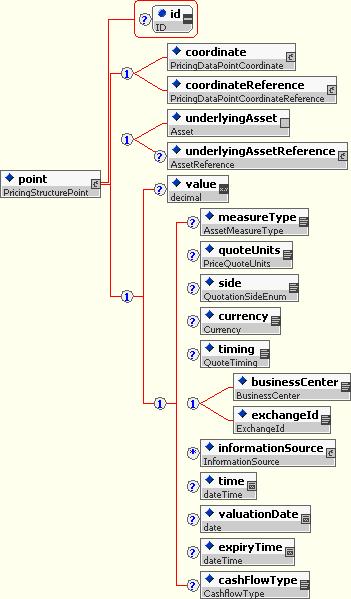

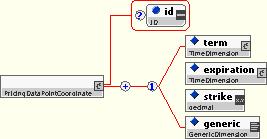

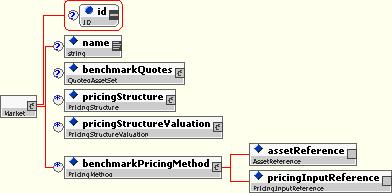

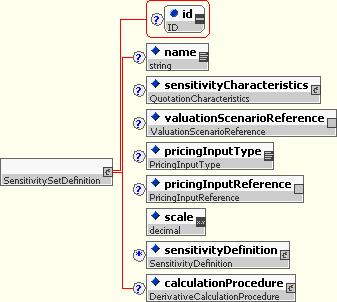

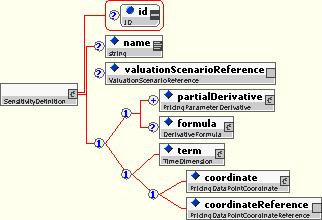

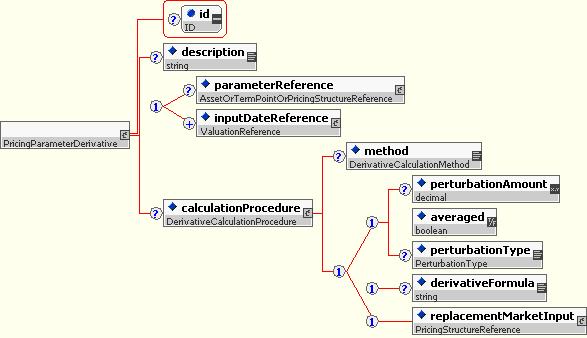

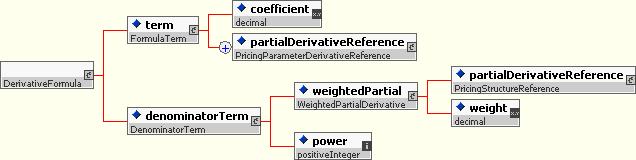

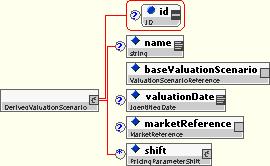

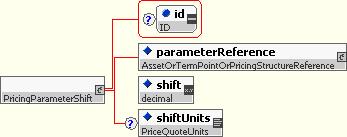

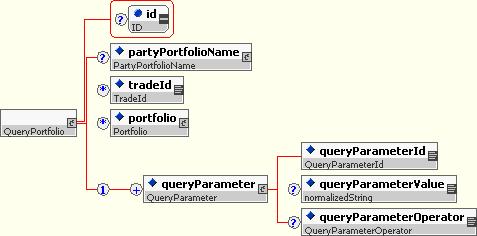

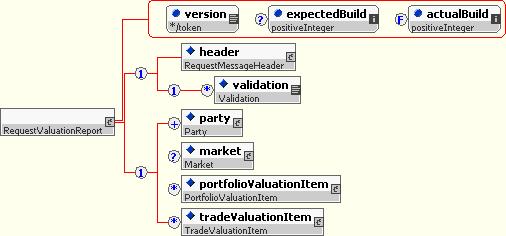

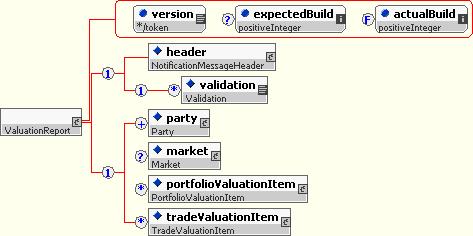

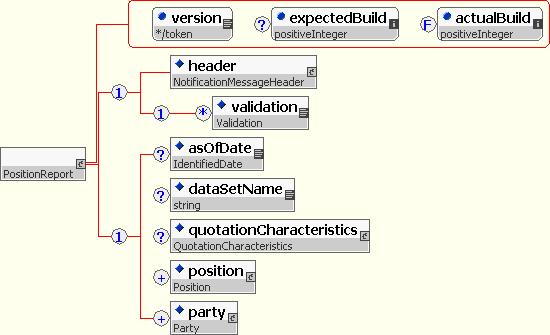

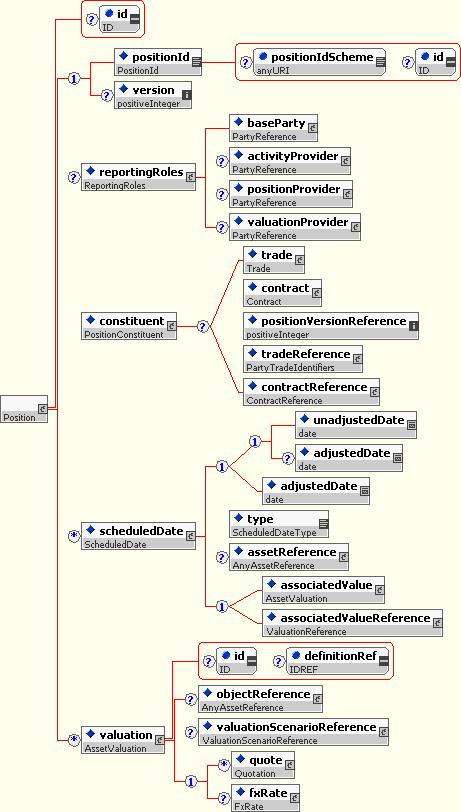

1.2.3 Diagram Notation

Most diagrams in this specification come from TIBCO's XML Turbo application which is used to batch generate the pictures in the documentation. The notation follows the pattern:

- No bubble indicates a mandatory element or attribute

- A '?' indicates an optional element or attribute

- A '*' indicates an occurrence of zero or many

- A '+' indicates an occurrence of one or many

- A '..' bubble with numbers above and below indicates specific range

- A '1' in a bubble indicates the presence of a nested sequence or choice group

- Diagonal lines indicate a choice group (< shape)

- Non-diagonal lines indicate a sequence ([ shape)

- A 'D' in a bubble indicates an attribute with a default value

This document was produced by the following working groups:

1.3.1 Architecture Working Group

- Andrew Jacobs (HandCoded Software), chair

- Anthony B. Coates (Miley Watts)

- Igor Dayen (Object Centric Solutions)

- Daniel Dui (University College London)

- Marc Gratacos (ISDA)

- Simon Heinrich (IONA Technologies)

- Lyteck Lynhiavu (ISDA)

- Andrew Parry (JP Morgan Chase Bank)

- Raj Patel (HSBC)

- Henri Pegeron (DTCC)

- Matthew Rawlings (JP Morgan Chase Bank)

- John Weir (Goldman Sachs)

- Irina Yermakova (ISDA)

1.3.2 Business Process Working Group

- Marc Gratacos (ISDA), chair

- John Booth (Northern Trust)

- Marie-Paule Dumont (SWIFT)

- Lucio Iida (Barclays Global Investors)

- Andrew Jacobs (HandCoded)

- Pierre Lamy (Goldman Sachs)

- Lyteck Lynhiavu (ISDA)

- Brian Lynn (Global Electronic Markets)

- Francoise Massin (SWIFT)

- Matthew Rawlings (JPMorgan)

- Steve Ross-Talbot (Hattrick Software)

- Christian Unger (BBH)

- Irina Yermakova (ISDA)

1.3.3 Validation Working Group

- Pam Field-Webber (IONA Technologies), chair

- Jim Brous (Metro Solutions)

- Ivan Djurkin (BGI)

- Daniel Dui (Barclays Capital and UCL)

- Marc Gratacos (ISDA)

- Simon Heinrich (IONA Technologies)

- Andrew Jacobs (HandCoded Software)

- Lyteck Lynhiavu (ISDA)

- Christian Nentwich (Message Automation)

- Henri Pegeron (DTCC)

- Irina Yermakova (ISDA)

1.3.4 IRD Products Working Group

- Harry McAllister (BNP Paribas), chair

- John Aldridge (JP Morgan Chase Bank)

- Marc Gratacos (ISDA)

- Robert Green (DTCC)

- Guy Gurden (Swapswire)

- Pierre Lamy (Goldman Sachs)

- Philippe Negri (Sungard)

- Jamie Orme (Goldman Sachs)

- Andrew Parry (JP Morgan Chase Bank)

- Marty Ross-Trevor (Bank of Tokyo-Mitsubishi)

- Marc Teichman (T-Zero)

- Jeff Valentino (Bank of America)

- Irina Yermakova (ISDA)

1.3.5 Credit Derivatives Working Group

- Ben Lis (T-Zero), chair

- Kathy Andrews (Bank of America)

- Milla Bouklieva (Goldman Sachs)

- Karel Engelen (ISDA)

- Piers Evans (SwapsWire)

- Marc Gratacos (ISDA)

- Robert Green (DTCC)

- Guy Gurden (SwapsWire)

- Tony Kao (Goldman Sachs)

- Lyteck Lynhiavu (ISDA)

- Pierre Lamy (Goldman Sachs)

- Anna Lukasiak (Goldman Sachs)

- Andrew Parry (JPMorgan Chase Bank)

- Henri Pegeron (DTCC)

- Mark Perry (Goldman Sachs)

- Marc Teichman (T-Zero)

- Irina Yermakova (ISDA)

- Shel Xu (Goldman Sachs)

1.3.6 FX Working Group

- Rick Schumacher (Wall Street Systems), chair

- Lee Buck (Morgan Stanley)

- Fred Burge (JP Morgan Chase)

- Marcello Davanzo (KPMG)

- Alexander Ernst (RiskTrak Financial)

- Gary Goldberg (FXPress)

- Rahul Gupta (FXAll)

- Lee Haines (Reuters)

- Richard Hall (Evolution)

- Antoine Hurstel (BNP Paribas)

- Bruce Kenney (Mizuho Capital Markets)

- Dan Kolner (UBS)

- Anna Lukasiak (Goldman Sachs)

- Tim Madeley (Cognotec)

- Francoise Massin (SWIFT)

- Donna McCollum (SunGard Trading Systems)

- Ned Micelli (Reuters)

- Justin Oglethorpe (Citigroup)

- Hugues Planzol (BNP Paribas)

- Frank Smith (Atriax)

- Gavin Smith (RCP Consultants)

- Bill Specht (Currenex)

- Tony Spraggs (Reuters)

- Viral Tolat (Integral)

- Jayesh Vira (SunGard Trading Systems)

1.3.7 Equity Derivatives Working Group

Voting Members

- Andrew Parry (JP Morgan Chase Bank), Chair

- Jasone Brasil (State Street)

- James Clark (Swapswire)

- Piers Evans (Swapswire)

- Robert Green (DTCC)

- Guy Gurden (Swapswire)

- Shabbir Irfani (Goldman Sachs)

- Rajan Khorana (Citadel Group)

- Robert Masri (DTCC)

- Coner Mongey

- Bin Shen (Goldman Sachs)

- Marc Teichman (T-Zero)

Non-Voting Members

- Takeo Asakura (Swapswire)

- Oluwasegun Bewaji (University of Essex)

- Jim Bonner (ML)

- Jim Brous (Metro Solutions)

- Karel Engelen (ISDA)

- Philip Franz (Bank of America)

- Steve Goswell (Barclays Global)

- Marc Gratacos (ISDA)

- Vinod Jain (Headstrong)

- Lucio Iida (Barclays Global)

- Ayesha Khanna (DTCC)

- Philip Leach (DTCC)

- Jianan Li (Citadel Group)

- Gaurav Makhija (Citadel Group)

- Mark Parris (UBS)

- Dharmender Rai (Lehman)

- Alicia Szybillo (DTCC)

- Sam Twum (Blue Tawny)

- Irina Yermakova (ISDA)

1.3.8 Pricing and Risk Working Group

- Brian Lynn (Global Electronic Markets), chair

- Michael Di Stefano (Integrasoft)

- Amod Dixit (Standard Chartered Bank)

- Marc Gratacos (ISDA)

- Mahmood Hanif (Bank of America)

- Eugene Kagansky (JPMorgan Chase)

- Pierre Lamy (Goldman Sachs)

- Philippe Negri (Sungard)

- Henrik Nilsson (TriOptima)

- Robert Stowsky (Brookpath Partners)

- Vlad Efroimson (Bank of America)

- Irina Yermakova (ISDA)

1.3.9 Loan Working Group

- Bhavik Katira (Chair)

- Ellen Hefferen (LSTA)

- Oleg Starovoitov (UBS)

- Robert Murray (Bank of America)

- Marc Gratacos (ISDA)

- Derek LaSalle (JPMorgan)

- Sreedhar Segu (DTCC)

- Lyteck Lynhiavu (ISDA)

- Karel Engelen (ISDA)

- Scott MacLaughlin (Goldman Sachs)

- Henri Pegeron (DTCC)

- Solomon Roytshteyn (Deloitte)

- Jeffrey Studer (JPMorgan)

- Irina Yermakova (ISDA)

- Derek Butler (FNF)

- Chris Childs (DTCC)

- Ken Katz (Misys)

- Hans Ellis (Swift)

- Sarah Wagner (JPMorgan FCS Corp)

The Financial Products Markup Language (FpML) is the industry standard enabling e-business activities in the field of financial derivatives and structured products. The development of the standard, controlled by ISDA (the International Swaps and Derivatives Association), will ultimately allow the electronic integration of a range of services, from electronic trading and confirmations to portfolio specification for risk analysis. All types of over-the-counter (OTC) derivatives will, over time, be incorporated into the standard.

FpML is an application of XML, an internet standard language for describing data shared between computer applications.

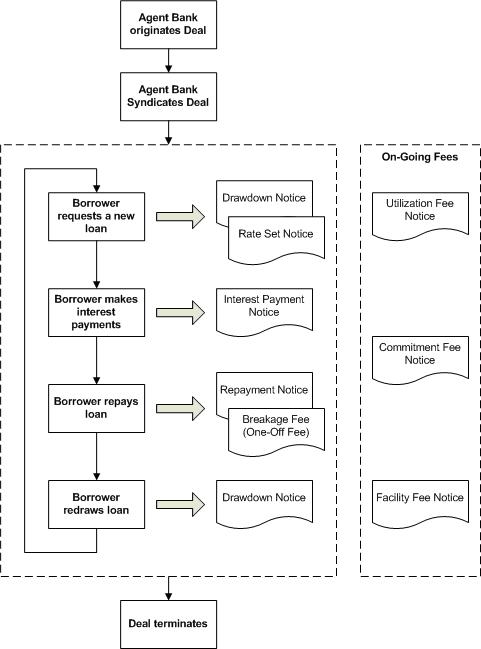

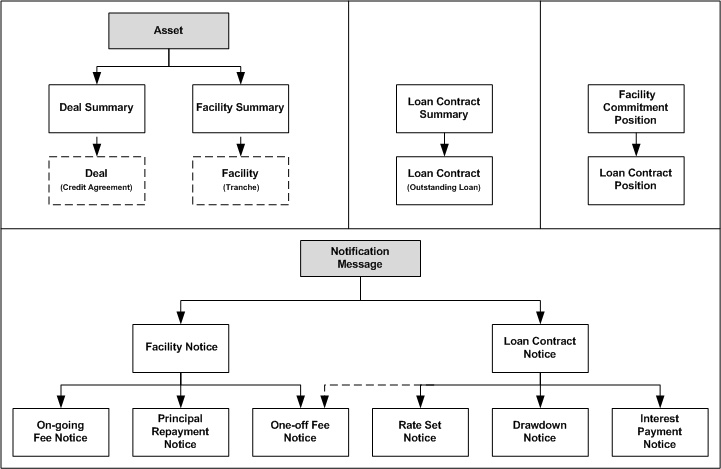

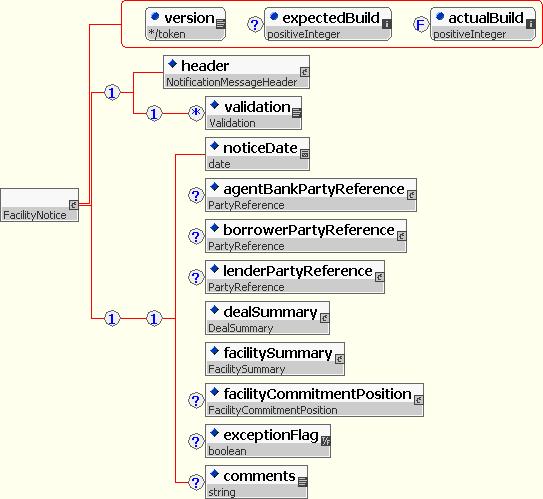

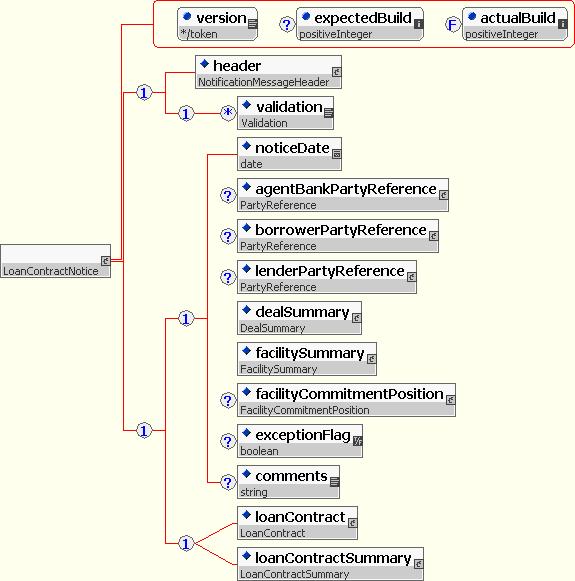

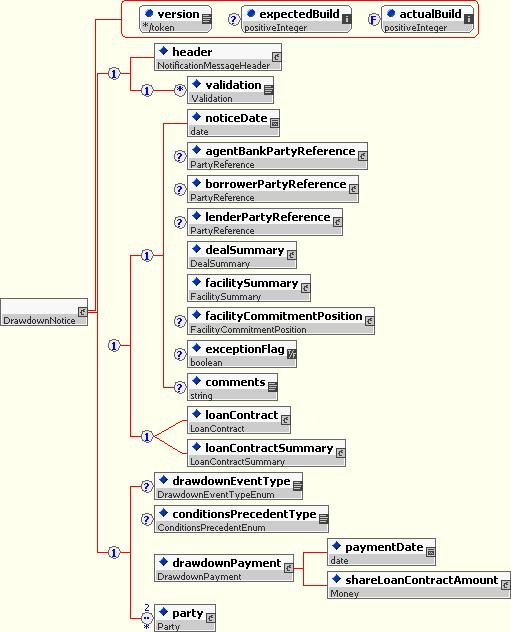

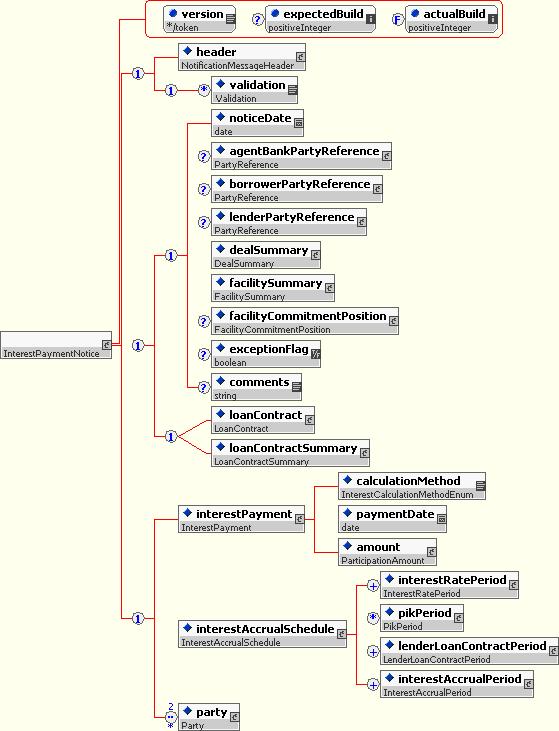

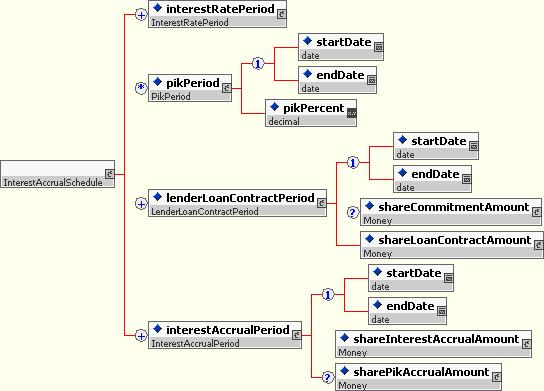

1.5.1 Loan Notices

The FpML Loan Working Group has defined support for a set of Loan Notices (Drawdown, Interest Payment, Repayment, One Off Fee, Ongoing Fee, Repayment Confirmation). The group has produced a schema representation aiming to cover the notifications in this business process, examples, and documentation. The FpML Standards Committee invites comments on these proposed materials including schemas, examples, and documentation.

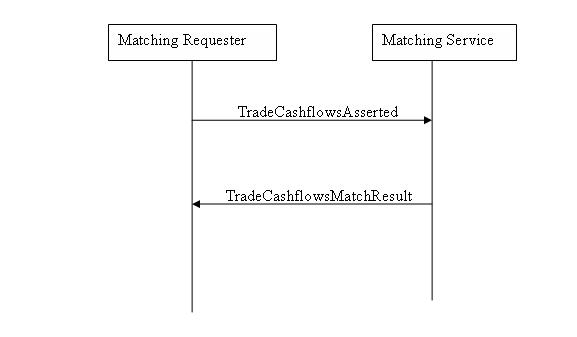

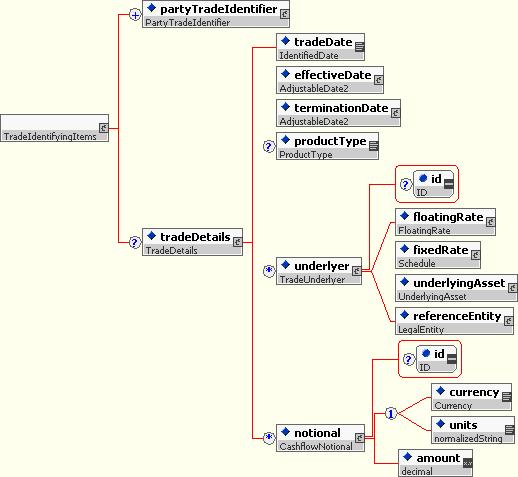

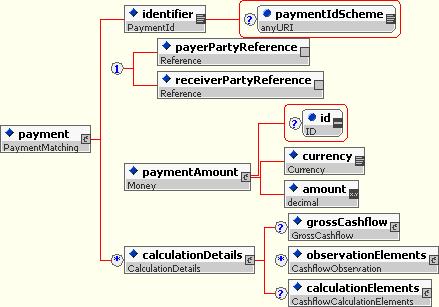

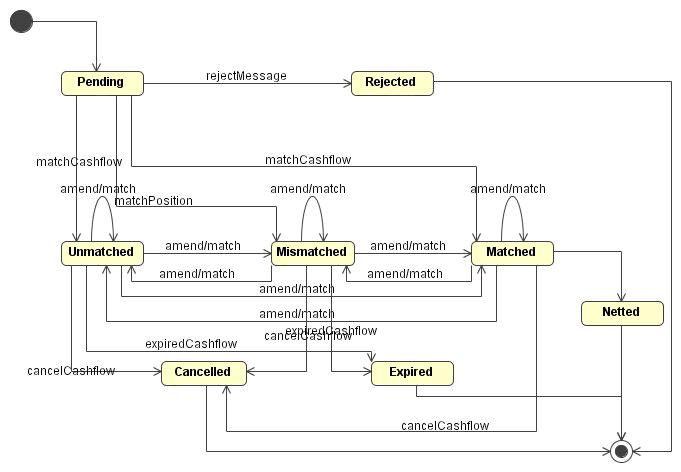

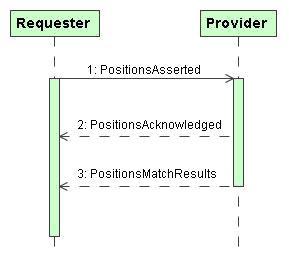

1.5.2 Cash Flow Matching and Portfolio Reconciliation

The FpML Business Process Working Group has defined support for Cash Flow Matching and Portfolio Reconciliation. The group has produced a schema representation aiming to cover the messages exchanged in this business process, examples, and documentation. The FpML Standards Committee invites comments on these proposed materials including schemas, examples, and documentation.

1.5.3 nthToDefault element within IndexReferenceInformation

The Credit Derivatives Working Group has decided not to include nth-to-default support within the current Credit Default Swap Index product representation (IndexReferenceInformation complex type). The FpML Standards Committee invites comments to know whether this would be a valuable feature to support.

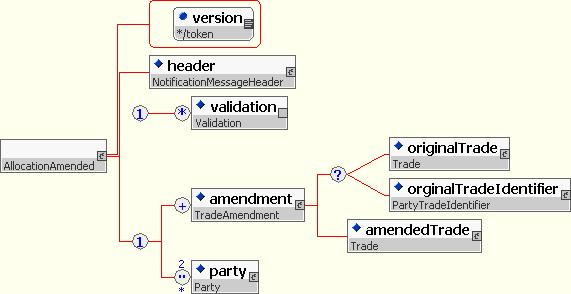

1.5.4 TradeAmended

As requested by some hedge funds, the new AllocationAmended message includes information about the original trade (allocation) that has been amended. This is not consistent with the existing TradeAmended message which only includes details of the amended trade. The FpML Standards Committee invites comments on this implementation approach.

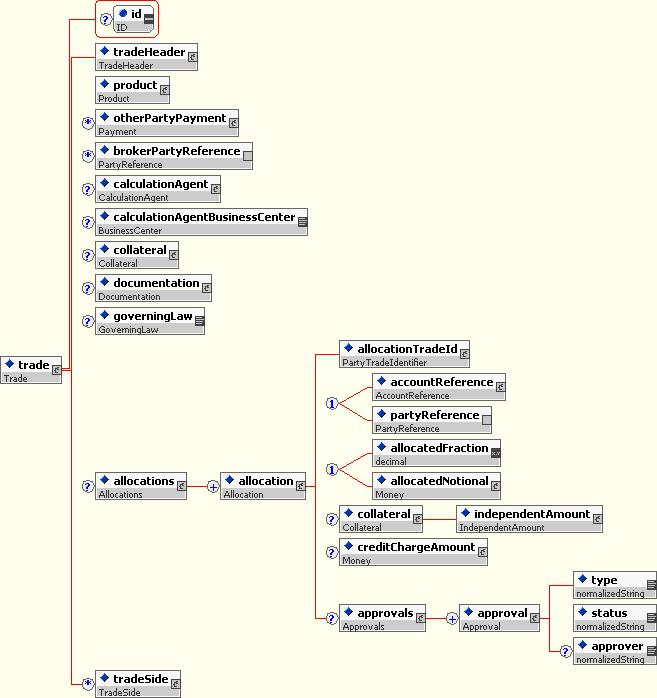

1.5.5 Allocations - Collateral Information

The "short-form" representation of allocations requires independent amount information. This required information may be an issue for listed instruments. The FpML Standards Committee invites comments on this implementation approach.

1.5.6 Providing Feedback

Comments on this document should be sent by filling in the form at the following link: http://www.fpml.org/issues .

1.6.1 Changes compared to FpML 4.4 Recommendation 2008-08-20 build 11

- Commercial Loan:

- The Standards Committee agreed to amend the Syndicated Loan model of the schema, to include one non-backward compatible change:

- Within On-going Fee Notice, amended the fee accrual period structure by making the accrual amount a mandatory element. Rationale for this Non-Backward Compatible change: The accrual amount itself should not be optional. An accrual period which does not state an accrual amount is clearly incomplete.

- The Standards Committee agreed to amend the Syndicated Loan model of the schema, to include one non-backward compatible change:

1.6.1.1 Incompatible changes compared to FpML 4.4 Recommendation 2008-08-20 build 11

- Within On-going Fee Notice, amended fee accrual period structure by making accrual amount a mandatory element. Rational for Non-Backward Compatible change: The accrual amount itself should not be optional. An accrual period which does not state an accrual amount is clearly incomplete.

1.6.2 Changes compared to FpML 4.4 Recommendation 2008-08-20 build 10

- Equity Derivatives:

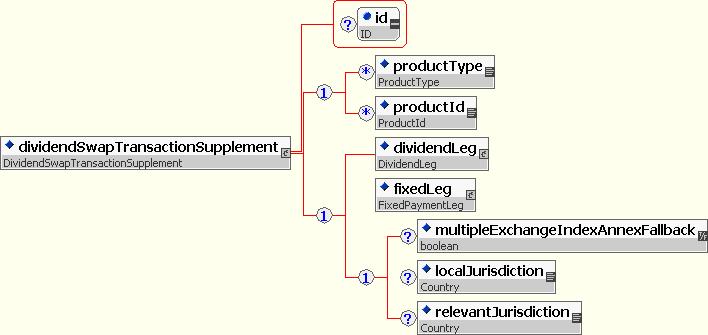

- Added Equity underlyer provisions to Variance Swap Transaction Supplement and Dividend Swap Transaction Supplement types. The following provisions have been added:

- Multiple Exchange Index Annex Fallback

- Local Jurisdiction

- Relevant Jurisdiction

- The rationale for this change: It impacted the ability to support the above products.

- Commercial Loan:

- The Standards Committee agreed to amend the Syndicated Loan model of the schema, to include one non-backward compatible change:

- Within On-going Fee Notice, amended the fee accrual period structure by making the accrual amount a mandatory element. Rationale for this Non-Backward Compatible change: The accrual amount itself should not be optional. An accrual period which does not state an accrual amount is clearly incomplete.

- The Standards Committee agreed to amend the Syndicated Loan model of the schema, to include one non-backward compatible change:

- Validation Rules:

- Syndicated Loans Validation Rules have been corrected.

- ID / IDREF References Rules have been corrected.

- The following issues have been resolved:

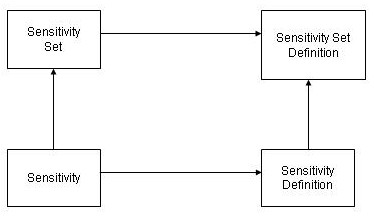

- http://www.fpml.org/issues/view.php?id=809 - A Bug Fixed - A "SensitivitySetDefinitionReference" type is added back to the schema (it was present in 4.1 but removed in 4.2) . It is used to reference a sensitivity set definition.

1.6.3 Changes compared to FpML 4.4 Trial Recommendation 2008-07-30

- Equity Derivatives:

- Added support for the following master confirmation type:

- ISDA2008EquityOptionJapan - The Equity Option Annex to the ISDA 2008 Japanese Master Equity Derivatives Confirmation Agreement applies.

- Added Equity underlyer provisions to Variance Swap Transaction Supplement and Dividend Swap Transaction Supplement types. The following provisions have been added:

- Multiple Exchange Index Annex Fallback

- Local Jurisdiction

- Relevant Jurisdiction

- Credit Derivatives:

- Amended support for portfolio compression by updating the contractual supplement scheme:

- Removed the following value: ISDA2003CreditFixedRecoverySwap - "Additional Provisions for Fixed Recovery Credit Derivative Transactions dated August 1, 2008."

- Added the following value: ISDA2003ContingentCreditSpreadTransaction - "Additional Provisions for Contingent Credit Spread Transactions dated August 15, 2008."

- Furthered support for European Loan CDS:

- Within "Obligations" structure, added three optional "Empty" elements "cashSettlementOnly", "deliveryOfCommitments" and "Continuity".

- Within "Obligations" structure, amended the annotation for the "designatedPriority" element to accommodate ELCDS (on the European confirmation, this field is called "Ranking"). "Applies to Loan CDS, to indicate what lien level is appropriate for a deliverable obligation. Applies to European Loan CDS, to indicate the Ranking of the obligation. Example: a 2nd lien Loan CDS would imply that the deliverable obligations are 1st or 2nd lien loans."

- Added a new example to show the ELCDS support.

- Commercial Loan:

- The Standards Committee agreed to amend the Syndicated Loan model of the schema, to include one non-backward compatible change:

- Within On-going Fee Notice, amended the fee accrual period structure by making the accrual amount a mandatory element. Rationale for this Non-Backward Compatible change: The accrual amount itself should not be optional. An accrual period which does not state an accrual amount is clearly incomplete.

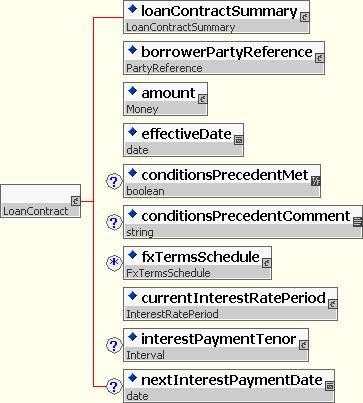

- Amended Loan model to be consistent with the deal and facility structures:

- Renamed LoanContractIdentifier type to LoanContractSummary type

- Within LoanContract, LoanContractNotice, LoanContractPosition, LoanContractRepayment, OneOffFeeNotice types, renamed element loanContractIdentifier to loanContractSummary

- Subsequently, updated all examples.

- The Standards Committee agreed to amend the Syndicated Loan model of the schema, to include one non-backward compatible change:

- Coding Schemes:

- Contractual Supplement scheme has been updated.

- Master Confirmation Type scheme has been updated.

- Validation Rules:

- Syndicated Loans Rules have been updated.

1.6.4 Changes compared to FpML 4.3

In addition to the changes describe above, the following additions have been implemented since FpML 4.3:

- Business Process:

- Added support for Events Cancellation Messages.

- Commercial Loan:

- Added support for Commercial Loan Notifications (between Agent Bank and Lenders).

- Credit Derivatives:

- Furthered support for European Loan CDS.

- Added support for portfolio compression.

- Added Support for new municipal CDS transaction types.

- Amended support for portfolio compression.

- Equity Derivatives:

- Added support for Variance Swap Transaction Supplement.

- Added support for Dispersion Variance Swap.

- Amended Variance Swap structure, the maximum allowable number of variance legs has been increased to unbounded, to allow the long form Variance Dispersion to be supported..

- Amended Directional Leg type to include the ability to have version aware identification of each leg.

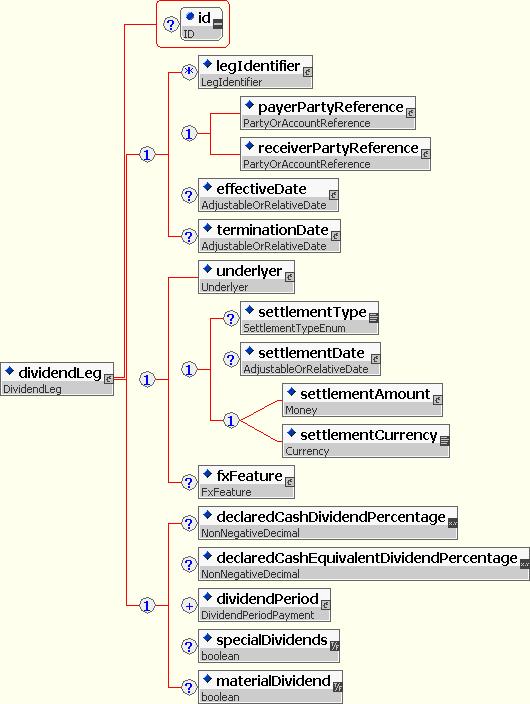

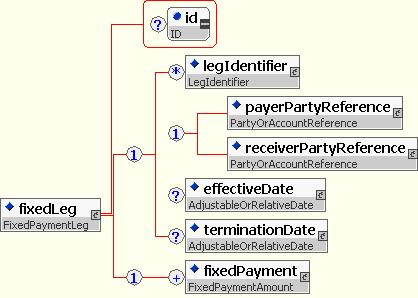

- Amended Dividend Leg structure in order support an additional values for the Japanese Index Dividend Swap Transaction Supplement .

- Remodeling work:

- Within "EquityDerivativeLongFormBase" type, the element "equityFeatures" is deprecated. Rational: This content is accessible in the complex type "EquityDerivativeBase" through the model group Feature.model.

- Added support for Identification of the exchanges where constituents are traded.

- Add Equity underlyer provisions to Variance Swap Transaction Supplement and Dividend Swap Transaction Supplement types:

- "Multiple Exchange Index Annex Fallback"

- "Local Jurisdiction"

- "Relevant Jurisdiction"

- Interest Rate Derivatives:

- Added support for Brazilian IR Swaps.

- Pricing and Risk:

- The cardinality of the element 'quote' was changed from 0 to many (FpML 4.2) to 1 to many (FpML 4.3). This change was breaking backward compability between minor versions. The cardinality of the 'quote' element has been restored to 0 to many as it is in FpML 4.2.

- Validation Rules:

- Added Business constraints for ID / IDREF relationships formalized as ecore references.

- Addition of validation rules for Loan notices.

- Addition of validation rules for FX products.

- Coding Schemes:

- Business Center scheme was updated.

- Inflation Index Source scheme was updated.

- Business Center scheme was updated.

- Broker Confirmation Type scheme was updated.

- Master Confirmation Type scheme was updated.

- Floating Rate Index scheme was updated to support 2006 ISDA Definitions.

- Contractual Supplement scheme was updated.

- Contractual Definitions scheme was updated.

- Position status scheme was created for portfolio reconciliation.

The scope of FpML 4.4 includes broadened BusinessProcess/Messaging coverage and additional product support, specifically:

1.7.1 Architecture Framework

The various Working Groups have developed FpML 4.4 within the FpML Architecture 2.1 Specification defined by the Architecture Working Group. This document defines that standards and principles on which the FpML grammatical definitions are based.

The FpML Architecture 2.1 builds upon the earlier FpML Architecture 2.0 and FpML Architecture 1.0 specifications and the conventions of FpML 1.02b before that. The refinement of the FpML architecture is an evolutionary process bought about by changes in the XML technology upon which it is based and the requirements of the standard as its scope expands.

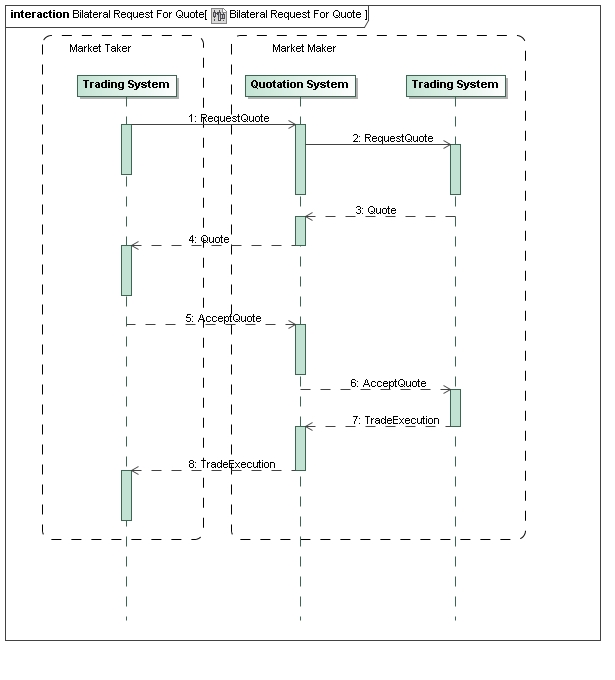

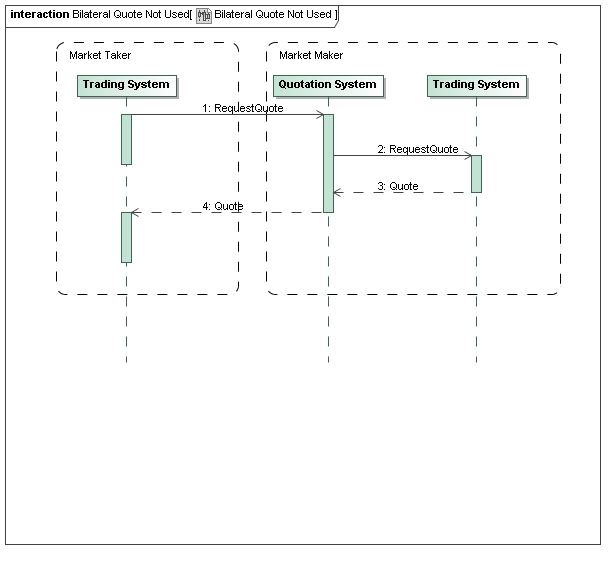

1.7.2 Business Process Scope

The FpML Business Process and Messaging Working Groups have extended the FpML 4.1 standard to cover Allocations, Accounts, Roles, and Cash Flow Matching.

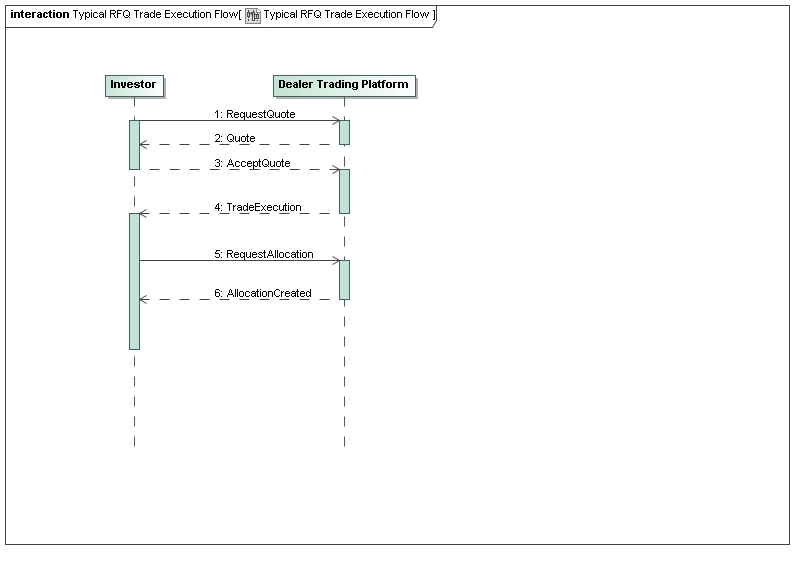

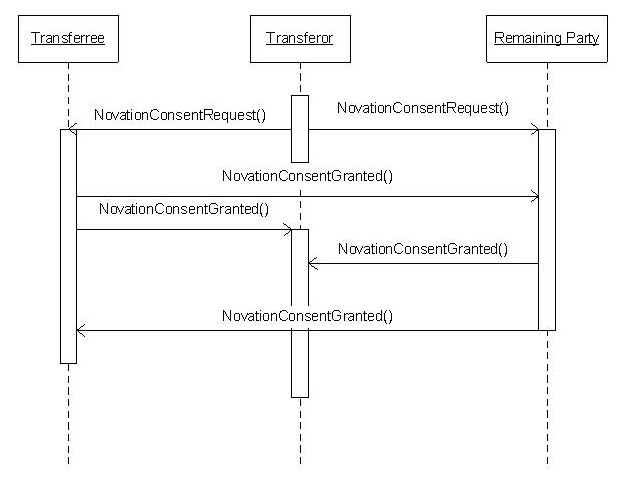

The FpML Messaging working group was formed to define a messaging framework and sample messages for selected business processes. The Business Process Working Group has continued the work and additional business processes have been added. The business processes currently supported include:

- Trade Affirmation

- Trade Confirmation

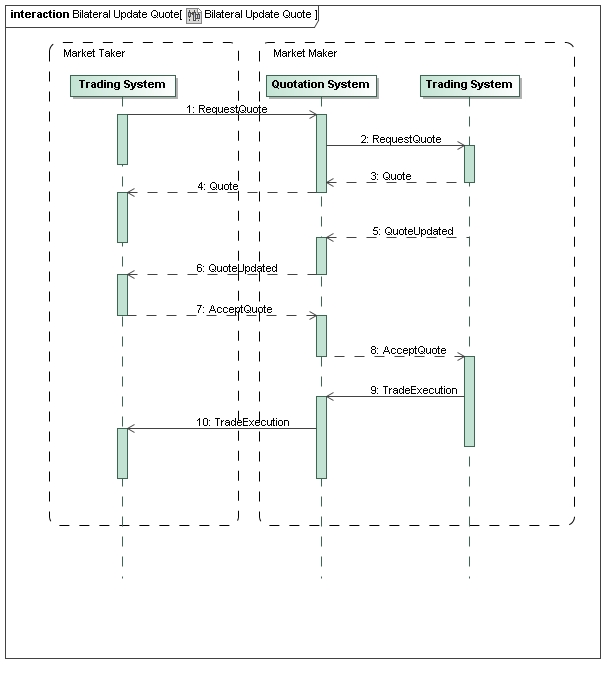

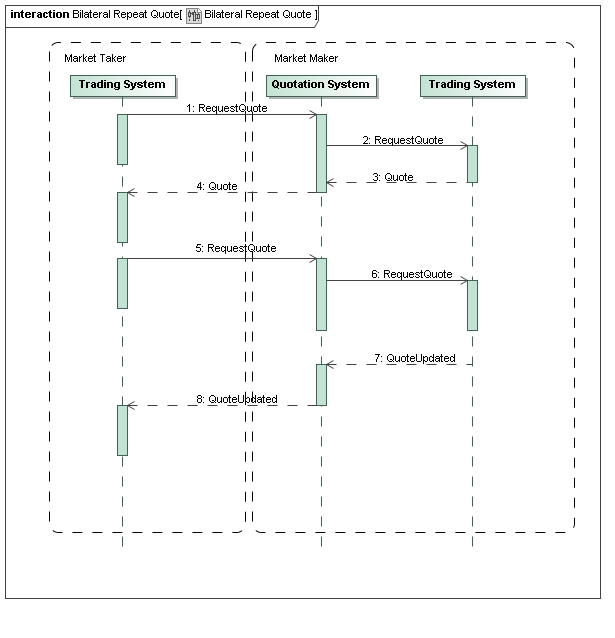

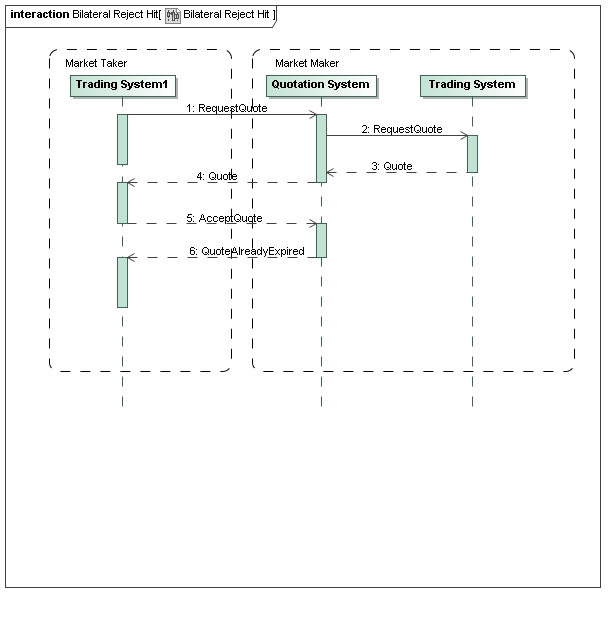

- Request for Quote

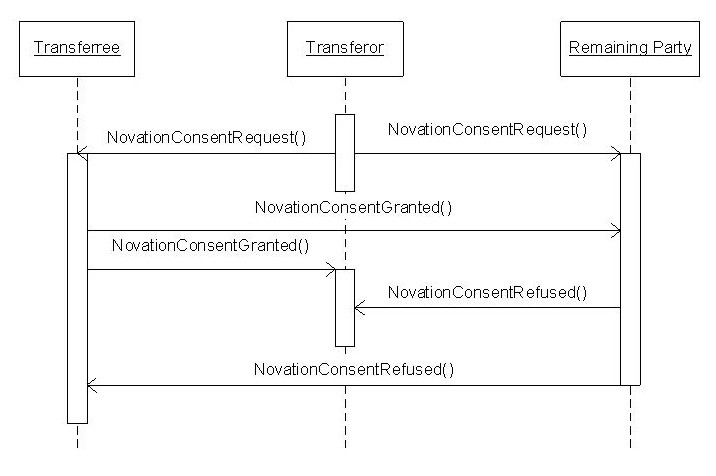

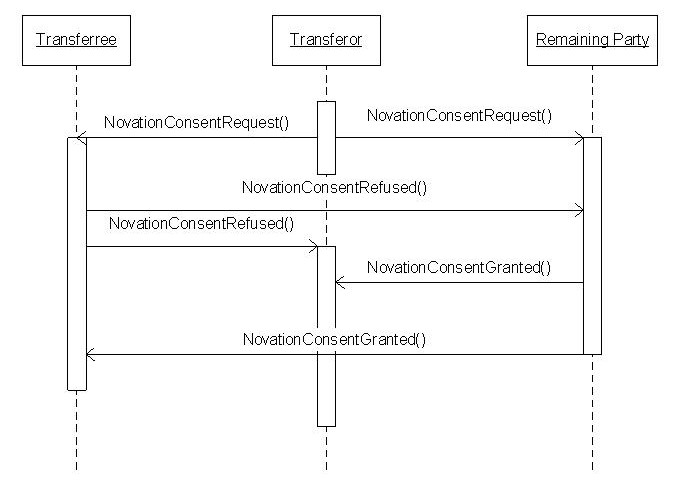

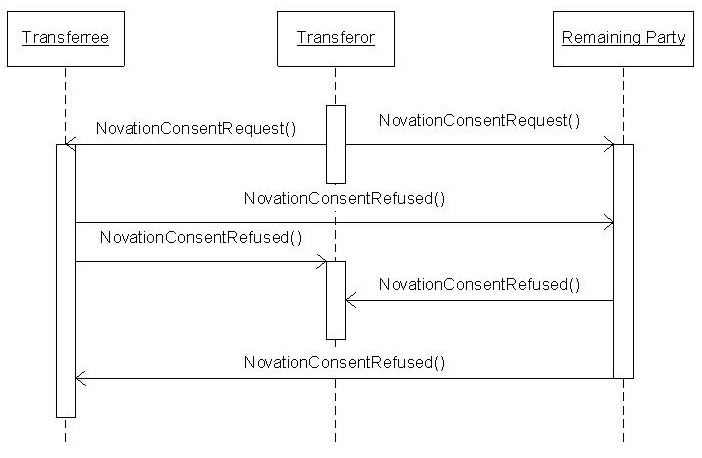

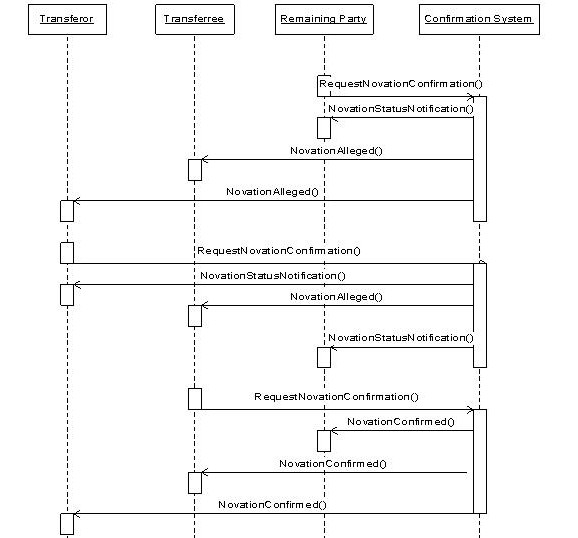

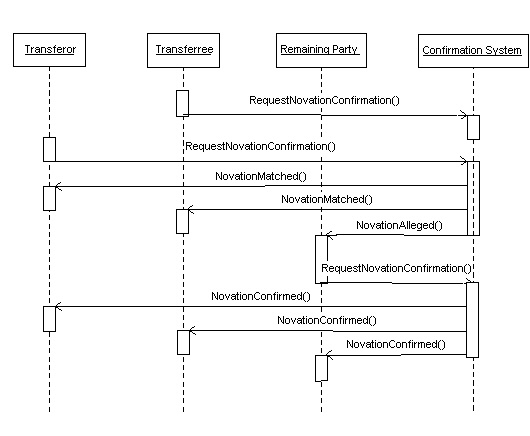

- Novations

- Terminations

- Increases

- Amendments

- Allocations

- Cash Flow Matching

- Contract notifications to faciliate communication between asset managers and custodians.

To support these business processes, a number of messages have been defined. Please see the "Business Process Architecture" section for more information.

1.7.3 Validation Scope

The Validation Working Group provides semantic, or business-level validation rules for FpML 4.4. These validation rules, which are aimed at normalizing the use of elements within FpML, are issued separately from the main working draft document at a URL defined in the validation section of this document.

The validation working group publishes with its releases:

- A set of rules described in English

- Positive and negative test case documents for each rule

- Non-normative reference implementations

The current specification includes a set of rules for Interest Rate Derivatives, Equity Derivatives, Credit Derivatives and for shared components. The rules for the different asset classes will be further enhanced in future versions.

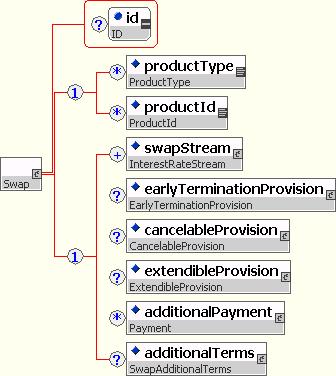

1.7.4 IRD Scope

In FpML 4.4 Recommendation the following Interest Rate Derivative products are covered:

- Single and Cross-Currency Interest Rate Swap

- Forward Rate Agreement

- Interest Rate Cap

- Interest Rate Floor

- Interest Rate Swaption (European, Bermuda and American Styles; Cash and Physical Settlement)

- Extendible and Cancelable Interest Rate Swap Provisions

- Mandatory and Optional Early Termination Provisions for Interest Rate Swaps

- FX Resetable Cross-Currency Swap

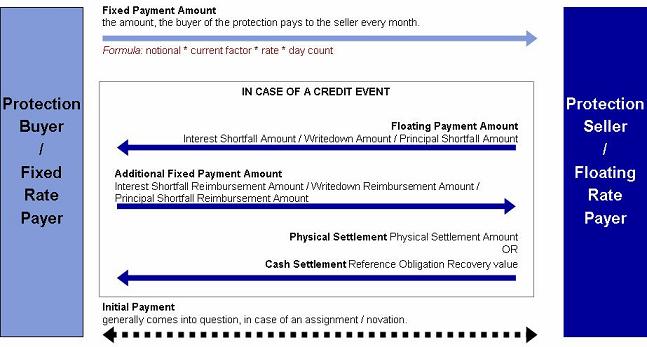

1.7.5 Credit Derivatives Scope

In FpML 4.4 Recommendation the following Credit Derivative products are covered:

- Credit Default Swap

- Credit Default Swap Index

- Tranche on Credit Default Swap Index

- Credit Default Swap Basket

- Credit Default Swap on a Mortgage

- Credit Default Swap on a Loan

- Option on Credit Default Swap

- Credit Event Notice

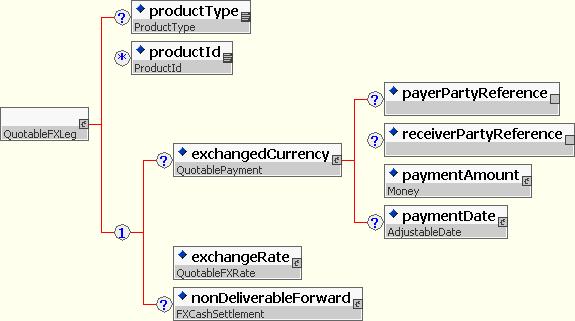

1.7.6 FX Scope

In FpML 4.4 Recommendation the following FX products are covered:

- FX Spot

- FX Forward (including non-deliverable forwards, or NDFs)

- FX Swap

- FX Options (European and American; barriers, digitals, binaries, average rates; cash and physical settlement)

- Option Strategies (multiple simple options)

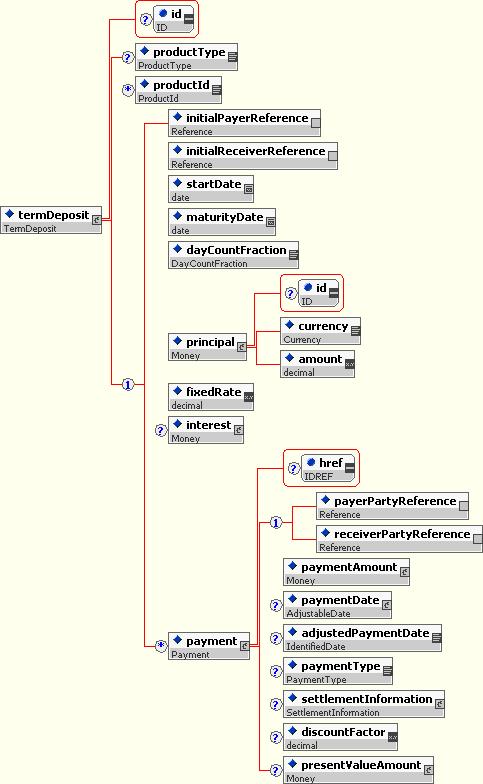

In addition, support for the following money market instrument is also provided:

- Term Deposits

1.7.7 Equity Derivative Options and Forwards Scope

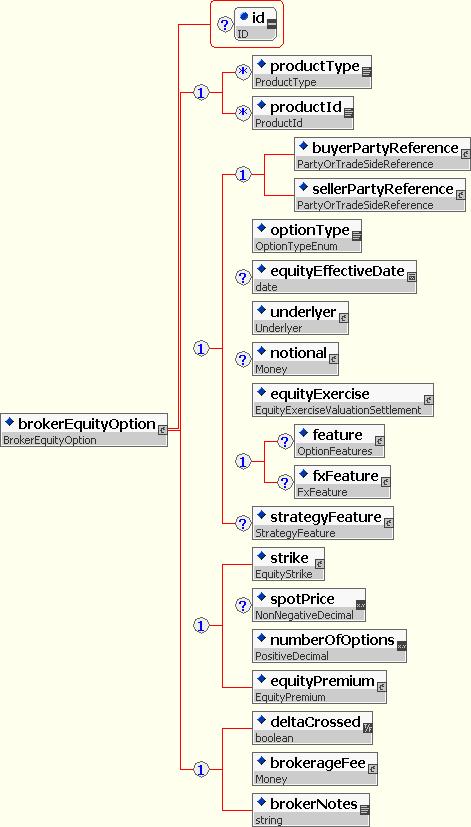

The EQD Products Working Group has extended the FpML standard to cover the following Equity Derivative products

- Broker Equity Options;

- Long Form Equity Forwards;

- Long Form Equity Options;

- Short Form Equity Options represented as Transaction Supplements under ISDA Master Agreements.

1.7.8 Return Swaps Scope

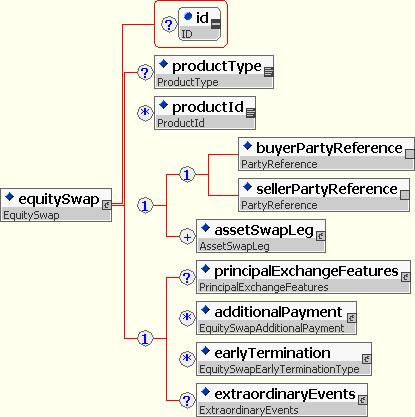

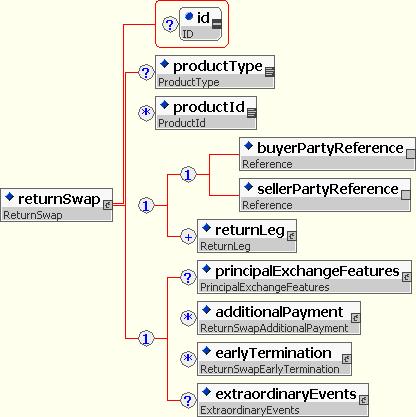

FpML provides generic Return Swaps support including "long form" Equity Swap representations, as well as Total Return Swaps. A separate product element called equitySwapTransactionSupplement supports "short form" Equity Swap Transaction Supplement.

Return-type Swaps have 1-to-many Legs, all of which must be derived from the ReturnSwapLeg type. Instances of Legs are returnLeg and interestLeg. Other Leg types may be derived from ReturnSwapLeg at will, to allow for private extensions to support whatever type of Generic Return Swap is desired.

The scope of this FpML representation for return swaps is to capture the following types of swaps that have equity-related underlyers:

- Single stock swaps as well as basket swaps (i.e. swaps with multiple underlyers);

- Swaps that have a different types of underlying assets (equity, index, mutual funds, exchange-traded funds, convertible bond, futures), or a combination of these;

- 2-legged swaps with a combination of an equity leg and a funding leg, as well as swaps that either have only one leg (e.g. fully funded or zero-strike swap) or multiple equity legs (e.g. outperformance swaps);

- Total Return Swaps, a type of swap in which one party (total return payer) transfers the total economic performance of a reference obligation to the other party (total return receiver).

- Swaps that have specific adjustment conditions, such as execution swaps or portfolio rebalancing swaps;

- Swaps that involve the exchange of principal cashflows;

- Swaps that have inital and final stubs;

- Swaps which can be represented as Transaction Supplements under ISDA Master Agreements;

- Variance Swaps (deprecated, a separate varianceSwap product element has been created - See Variance Product Architecture)

Extraordinary Events terms have been incorporated, to take into consideration the release of the 2002 ISDA Definitions for Equity Derivatives.

Trigger swaps, in which equity risk morphs into a fixed income risk once a certain market level is reached, may be supported in a subsequent release.

1.7.9 Correlation Derivatives Scope

The Equity Derivative Working Group extended FpML to cover:

- Correlation Swaps

1.7.10 Variance Derivatives Scope

The Equity Derivative Working Group extended FpML to cover:

- Variance Swaps, a type of volatility swap where the payout is linear to variance rather than volatility, therefore the payout will rise at a higher rate than volatility;

1.7.11 Dividend Derivatives Scope

The Equity Derivative Working Group extended FpML to cover:

- Dividend Swap Transaction Supplement

1.7.12 Commercial Loan Product Scope

The commercial loan business working group collectively decided to focus on designing one-way borrower-centric notifications for the phase 1 release of the standard. These notifications comprise most of the manual traffic that both agent banks and lenders must process on a daily basis.

The Commercial Loan Working Group extended FpML to cover:

-

Commercial Loan Notifications between Agent Bank and Lenders, including:

-

Facility Level Notifications

- Scheduled Principal Repayment Notice

- Unscheduled Mandatory and Voluntary Principal Repayment Notice

- On-Going Fee Notice

- One-Off Fee Notice

-

Loan Contract Level Notifications

- Drawdown Notice

- Rate Set Notice

- Interest Payment Notice

- One-Off Fee Notice

-

Facility Level Notifications

In order to fully describe the notifications, it was necessary to design the following supporting object types, all of which are embedded within various notification types:

-

"Short-form" Product Definitions. These are summary objects which, in the future, will form the foundation for defining the 'long-form' loan product:

- Deal Summary

- Facility Summary

-

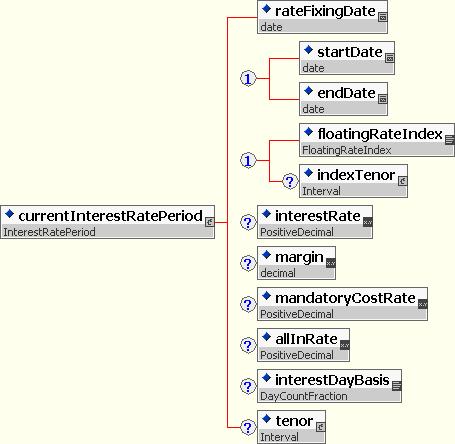

Loan Contract Definitions. These objects describe the value of outstanding loan contracts at a given point in time. The outstanding loan balance fluctuates over the life of a facility. There are two variations designed: the short-form summary and the long-form version of the loan contract:

- Loan Contract Summary

- Loan Contract

-

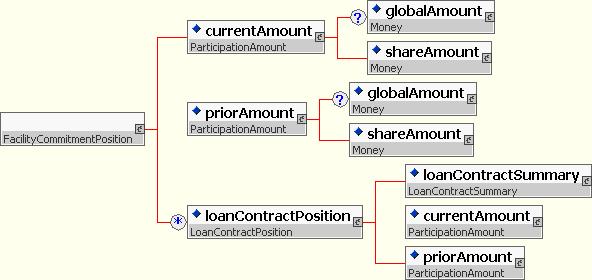

Lender Position Definitions. These objects describe the amount of a facility and loan contract that a single lender owns at a given point in time:

- Facility Commitment Position

- Loan Contract Position

1.7.13 Pricing and Risk Scope

The Pricing and Risk scope for FpML 4.4 Recommendation is:

Valuation and basic risk on the following products:

- Vanilla IR Swaps (single and dual currency fix/float swaps, non-CMS/CMT)

- Valuation reporting (trades only)

- Market Data (Yield Curves, FX spot rates)

- Market risk reporting (Delta Risk vs. Curve Inputs, FX exposures) for trades

- Credit Default Swaps

- Valuation reporting for trades

- Market Data (ir curves, credit spread, recovery rate, probability of default)

- Market risk reporting (risk with respect to. the above variables) for trades

- IR Caps/Floors/ EuropeanSwaptions, and corresponding risk types

- Valuation reporting for trades

- Market data (volatility surfaces)

- Market risk reporting

- Volatility/Vega Risk

- Convexity/Gamma Risk (applies to all products)

- Time Decay/Theta (applies to all products)

- Portfolio level valuation and risk

- Valuation

- Risk reporting

The Pricing and Risk Working Group has also provided some definitions that might be useful for other types of valuation and risk reporting.

1.8.1 Character Encoding

Producers of FpML documents intended for interchange with other parties must encode such documents using either UTF-8 or UTF-16. Consumers of FpML documents must be able to process documents encoded using UTF-8, as well as documents encoded using UTF-16. For more information, see

1.8.2 Character Repertoire

Unrestricted FpML elements may use any valid XML characters. For more information, see

http://www.w3.org/TR/REC-xml#charsets

Certain elements and attributes (such as scheme URIs) are defined with more restrictive types, such as xsd:normalizedString, xsd:token, or xsd:anyURI. For these types, please see the relevant data type definition in the XML Schema datatypes specification:

1.9.1 Schema and Example Validation

The schema files and examples in this document have been validated with XercesJ (v.2.2.1 and v.2.6.2) and HandCoded's Toolkit for FpML Processing (version Java 1.1 Alpha 2).