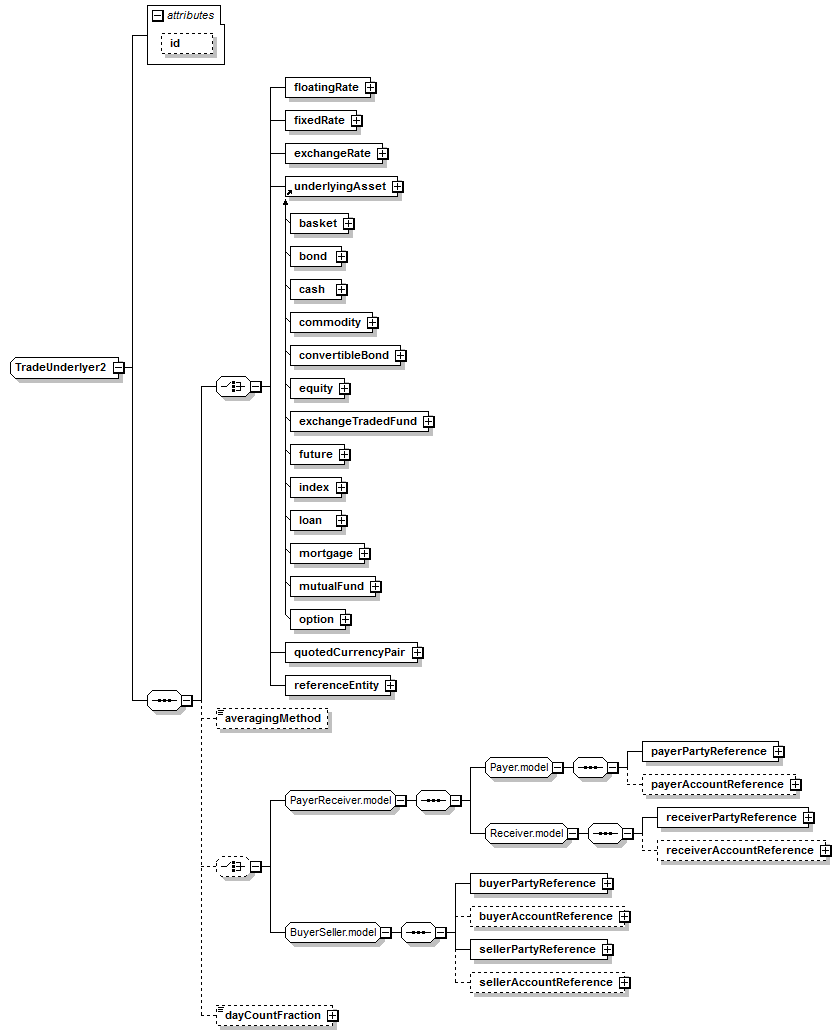

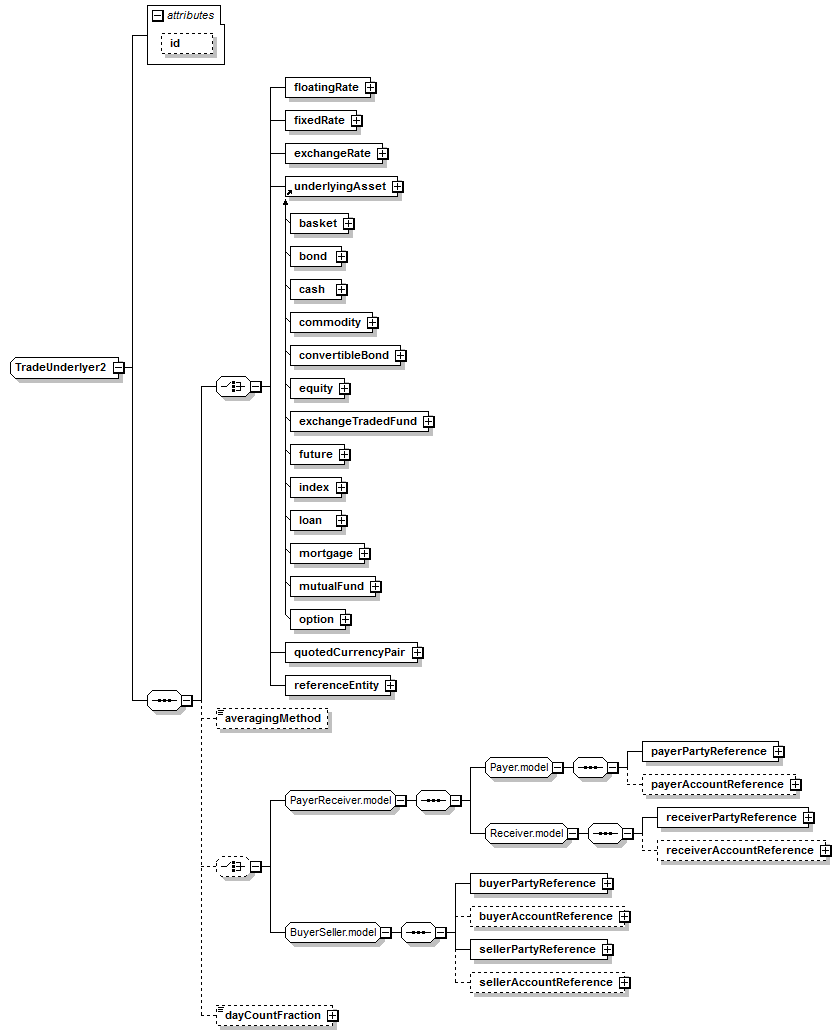

complexType "TradeUnderlyer2"

Namespace: |

|

Content: |

|

Defined: |

|

Includes: |

|

Used: |

|

XML Representation Summary |

<... |

|

|

|

> |

|

|

</...> |

Content Model Elements (16):

-

All Direct / Indirect Based Elements (1):

-

Annotation

The underlying asset/index/reference price etc. whose rate/price may be observed to compute the value of the cashflow. It can be an index, fixed rate, listed security, quoted currency pair, or a reference entity (for credit derivatives). For use with Generic products in Transparency reporting. Generic products define a product that represents an OTC derivative transaction whose economics are not fully described using an FpML schema. In other views, generic products are present for convenience to support internal messaging and workflows that are cross-product. Generic products are not full trade representations as such they are not intended to be used for confirming trades.

XML Source (w/o annotations (11); see within schema source)

<xsd:sequence>

<xsd:choice>

</xsd:choice>

<xsd:choice minOccurs="0">

</xsd:choice>

</xsd:sequence>

<xsd:attribute name="id" type="xsd:ID"/>

</xsd:complexType>

|

Attribute Detail (all declarations; defined within this component only; 1/1)

id

id-

Type: |

xsd:ID, predefined |

Use: |

optional |

XML Source (see within schema source)

<xsd:attribute name="id" type="xsd:ID"/>

|

Content Element Detail (all declarations; defined within this component only; 8/16)

-

The parties may specify a Method of Averaging where more than one pricing Dates is being specified as being applicable. This defines the averaging method applicable to this asset (used for Commodities).

Simple Content

Enumeration: |

"Unweighted" |

- |

The arithmetic mean of the relevant rates for each reset date. |

"Weighted" |

- |

The arithmetic mean of the relevant rates in effect for each day in a calculation period calculated by multiplying each relevant rate by the number of days such relevant rate is in effect, determining the sum of such products and dividing such sum by the number of days in the calculation period. |

|

minLength: |

0

|

XML Source (w/o annotations (1); see within schema source)

-

Specifies a day count fraction or fractions that apply to this underlyer; this is provided to meet regulatory reporting requirements, but is not sufficient to to fully represent the economics of the trade..

Simple Content

maxLength: |

255

|

minLength: |

0

|

XML Source (w/o annotations (1); see within schema source)

-

The rate of exchange between two currencies.

XML Source (w/o annotations (1); see within schema source)

-

The fixed rate or fixed rate schedule expressed as explicit fixed rates and dates. In the case of a schedule, the step dates may be subject to adjustment in accordance with any adjustments specified in calculationPeriodDatesAdjustments.

XML Source (w/o annotations (1); see within schema source)

-

XML Source (w/o annotations (1); see within schema source)

-

Describes the composition of a rate that has been quoted. This includes the two currencies and the quotation relationship between the two currencies.

XML Source (w/o annotations (1); see within schema source)

-

The corporate or sovereign entity on which you are buying or selling protection and any successor that assumes all or substantially all of its contractual and other obligations. It is vital to use the correct legal name of the entity and to be careful not to choose a subsidiary if you really want to trade protection on a parent company. Please note, Reference Entities cannot be senior or subordinated. It is the obligations of the Reference Entities that can be senior or subordinated. ISDA 2003 Term: Reference Entity

XML Source (w/o annotations (1); see within schema source)

-

Type: |

|

Abstract: |

(may not be used directly in instance XML documents) |

Subst.Gr: |

|

Define the underlying asset, either a listed security or other instrument.

XML Source (w/o annotations (1); see within schema source)